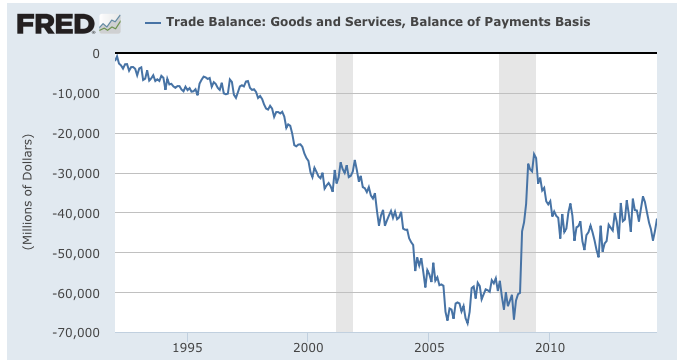

Since the United States trade balance turned negative in the early 1990s, the situation has improved very little, except during the period since the middle of the Great Recession as shown here:

During and since the Great Recession, the saving grace for the balance in trade has been the lack of demand for foreign-made goods as consumers have retrenched.

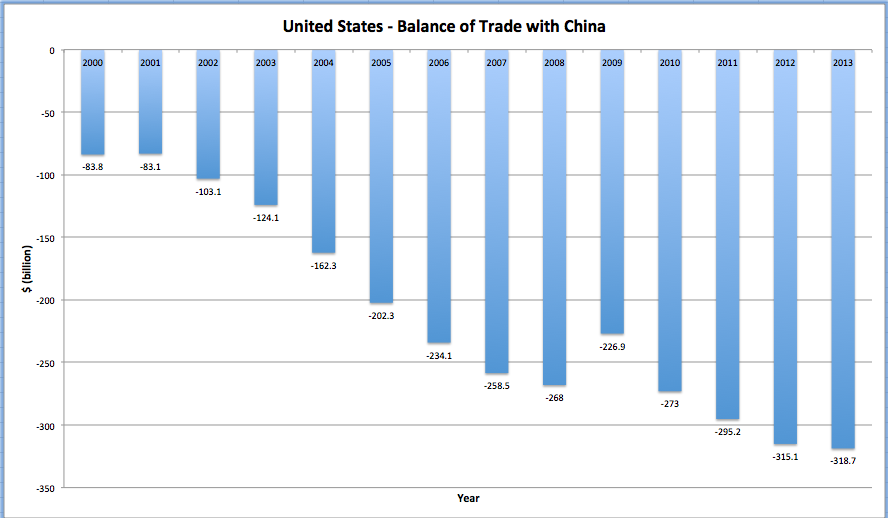

If you look back to the period between 1998 and 2006, you'll notice that the balance of trade began a steady march into negative territory. Here's the reason why:

The negative balance of trade with China rose from $83.8 billion in 2000 to $268 billion by 2008, an increase of 220 percent. While the trade deficit with China declined slightly in 2009, it began to rise again in 2010 and was $318.7 billion in 2013.

This change in trade with China is largely a result of the implementation of the World Trade Organization's entry of China into their fold in 2000. The Clinton Administration passed a bill in October 2000 that granted China permanent Normal Trade Relations status which gave Chinese companies lower tariffs on goods that they exported the the United States. This meant that China ended up with a competitive advantage because China's cost of labor is so much lower than the United States. On top of that, China's practice of manipulating its currency to keep its value low against the United States dollar has had a marked impact on the trade balance which has harmed the U.S. manufacturing sector by lowering the cost of U.S. imports and raising the cost of U.S. exports.

How does China manipulate its currency and what impact would ending this practice have on the United States economy? China has massive total foreign reserves, hitting $3.66 trillion at the end of September 2013. Total foreign exchange reserves equalled a massive 45 percent of China's GDP at the end of 2011. Here is a graph showing the annual growth in China's total reserves which are, by a wide margin, the largest in the world:

The growth in China's foreign currency assets gives us an indication of the degree of China's currency manipulation.

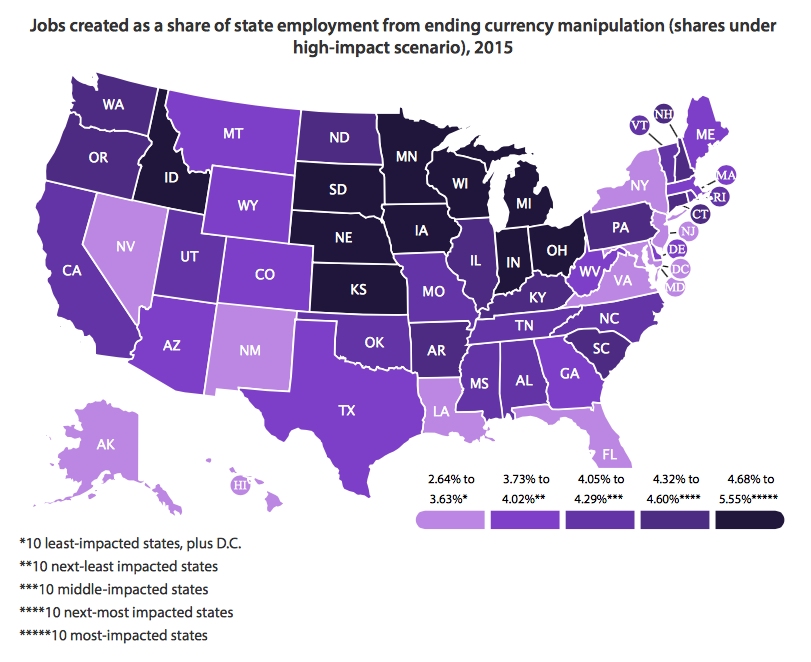

The authors of the EPI report indicate that by ending currency manipulation by China, the following would happen:

1.) The trade deficit would be reduced by $200 billion in three years under a low impact scenario and by $500 billion under a high impact scenario. This would increase annual American GDP growth by between $288 and $720 billion.

2.) The U.S. economy would create between 2.3 and 5.8 million jobs.

3.) Approximately 40 percent of the job gains would be in manufacturing which would gain between 891,500 and 2,337,300 jobs. Agriculture would gain 246,800 to 486,100 jobs. Administrative and support industries would also gain between 166,700 and 413,900 jobs.

4.) Increased tax revenues and reduced social safety net expenditures would reduce federal budget deficits by between $107 and $266 billion in 2015.

Here is a map that shows the jobs created as a share of state employment from ending currency manipulation:

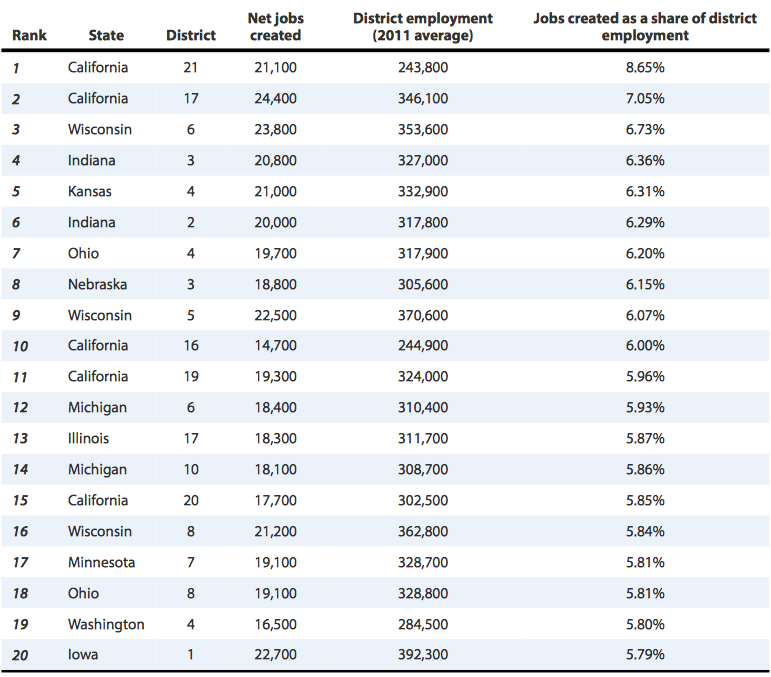

Here is a chart showing the 20 Congressional Districts that would benefit the most from the new net jobs created by ending currency manipulation in the high impact scenario:

It is quite clear has caused at least part of the post-Great Recession modest economic growth problems. Without taking clear steps to end currency manipulation, the United States economy can look forward to long-term low growth rates and stubbornly high unemployment, particularly in the manufacturing sector.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment