The recent volatility in the stock market has come as shock to many investors, however, looking at historical data, we shouldn't really be all that surprised.

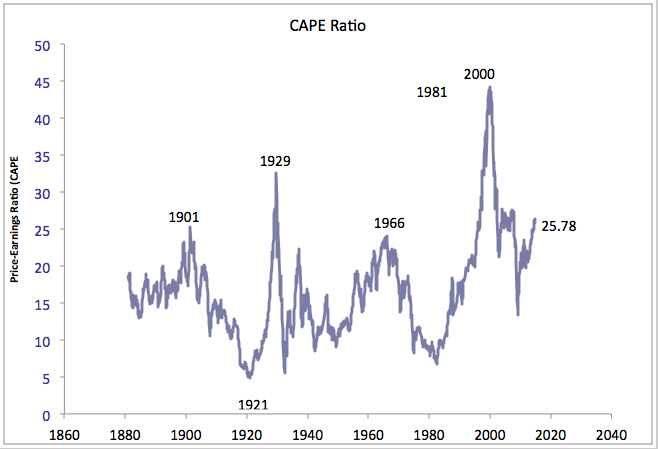

Back in 2000, Yale Professor Robert Shiller, co-creator of the widely quoted Case-Shiller U.S. Home Price Index, wrote a book called Irrational Exuberance. In the book, he used a data set consisting of monthly stock prices, dividends and earnings to ascertain whether or not the stock market is overvalued compared to historical levels. The data which goes back all the way to 1874 and which is available here, is used to calculate the Cyclically Adjusted Price Earnings Ratio (CAPE or PE 10 Ratio). There are currently just over 1720 data points in the set. Dr. Shiller uses monthly dividend and earnings data that are computed from the S&P four-quarter totals for each quarter since 1926 which are then linearly extrapolated to month figures. Stock price data is the monthly average of closing prices. CAPE is defined as the stock price divided by the moving average of ten years of earnings corrected for inflation using the Consumer Price Index. Higher than average CAPE values have a tendency to mean that average long-term annual returns will be lower and lower than average CAPE values have a tendency to mean that average long-term annual returns will be lower than average.

Here is a graph showing the entirety of the dataset:

Since 1881, the CAPE ratio has averaged 16.57. At the beginning of October 2014, the CAPE ratio sat at 25.78, nearly 55.6 percent above the 133 year average. The bump in 2000 is a result of the technology stock frenzy when traditional valuations went out the door in the "new electronic economy". We all know how that story ended, don't we?

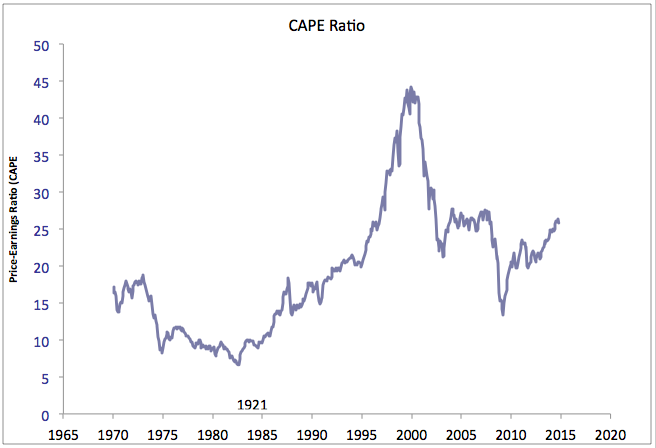

Let's take a closer look at the CAPE ratio in the "modern era" from 1970 to the present (and yes, I know that I'm randomly picking a year):

Over the 45 year timeframe, the average CAPE ratio was 19.37. The current CAPE ratio of 25.78 is still 33.1 percent above the 45 year average.

A brief look at Dr. Shiller's Cyclically Adjusted Price Earnings Ratio data would certainly suggest that the September 2014 stock market was overbought when compared to historical levels. With this in mind, the current correction should not have been a shock to investors who were piling into the stock market in a rabid search for a decent return on their savings, thanks in large part to Mr. Bernanke and Ms. Yellen and t

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment