In the 1960s, 1981 Economic Nobel Laureate James Tobindeveloped an interesting measure which gives us a sense of stock market valuations and whether the stock market is overvalued or fairly valued. The ratio was developed based on Dr. Tobin's hypothesis that companies should be worth what it costs to replace them, in other words, the total stock market valuation of a company should not exceed the value of its assets. The ratio, known as Tobin's Q, is the ratio of price to replacement cost; in its simplest terms, it measures a firm's assets to its market value as calculated using this formula:

Tobin's Q = Total Market Value of a Firm

Total Asset Value of a Firm

It can also be thought of as the ratio of the market value of a company's installed capital to the replacement cost of the installed capital.

Here is a very simplified example. If a company has $40 million of assets, 10 million shares outstanding and a share price of $3.00, Tobin's Q would be calculated as follows:

Tobin's Q = (10,000,000*$3.00)/$40,000,000 = 0.75

When Tobin's Q is between zero and 1, it costs more to replace a company's assets than the firm is worth (on the stock market). If Tobin's Q is above 1, the firm (on the stock market) is worth more than the value of its assets. Theoretically then, if Tobin's Q is greater than 1, a company is overvalued and if it is less than 1, it is undervalued. If we look at the aforementioned example company, leaving its assets at $40 million and its outstanding shares at 20 million and increase its share price to $5.00, Tobin's Q would be calculated as follows:

Tobin's Q = (10,000,000*$5.00)/$40,000,000 = 1.25

This means that the example company is overvalued when the stock price rises to $5.00 per share. according to Tobin's theory.

Tobin's Q can be taken to the extreme, covering the entire United States corporate universe by using the quarterly Federal Flow of Funds data from the Federal Reserve's Z.1 Financial Accounts of the United States which you can find here. If you go to table B.103, Tobin's Q can be calculated by dividing line 39 (market value) by line 36 (replacement cost). Tobin's Q generally hits highs during bull or bubble market phases and drops to lows during recessions and bear market phases.

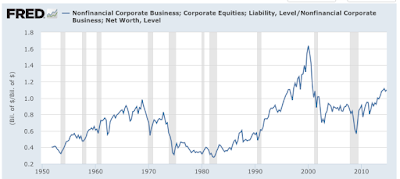

The Tobin Q ratio can be calculated using data on the FRED website by dividing Non-financial Corporate Business Corporate Equities Liability Level by Nonfinancial Corporate Business Net Worth Level which will result in this graph:

Unfortunately, as you can see, the data is current only to the last quarter of 2014 which isn't much help half way through 2015. For that reason, many analysts rely on other sources of data.

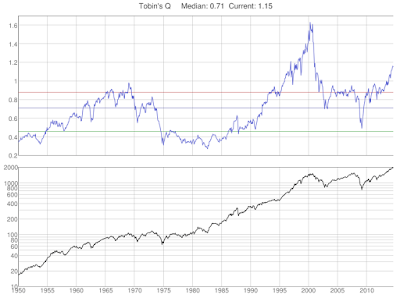

Now, let's look at a chart that shows the Q ratio for the entire economy to the present:

Looking all the way back to 1950, the median Q ratio is 0.71 and going back further to 1900, the arithmetic mean is 0.68. Right now, the Q ratio is 1.15, its highest level since the rise in the stock market during the tech sector bubble of the late 1990s and early 2000s when the Q ratio hit 1.64. It is also at its second highest level since 1950 and, if we go back in history to 1900, the Q ratio is above any peak since that time. It has also risen significantly from its low of 0.57 during the depths of the Great Recession.

If we look at the Q ratio and divide it by the average over the last century, at the tech sector peak, the market price was about 140 percent above the historic average of replacement cost. Right now, the latest data point is 69 percent above the mean, suggesting that the stock market is significantly overvalued. It is important to keep in mind that periods of stock market over- and under-valuation can persist for many years at a time (as happened during the tech sector bubble), however, the current high level of Tobin's Q suggests that the stock market is likely to change direction significantly over the medium- and long-term.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment