In the mainstream media, those who contribute to the financial pages are starting to publish stories expressing concerns about the relatively lofty valuations in the stock market. One measure that gets very little attention is the ratio of the market value of United States companies to the U.S. gross national product (GNP), a measure that is also known as the Buffett Indicator. Ted Berg, an analyst at the Treasury's Office of Financial Research cites the current level of this ratio as cause for concern in a recent publication entitled Quicksilver Markets.

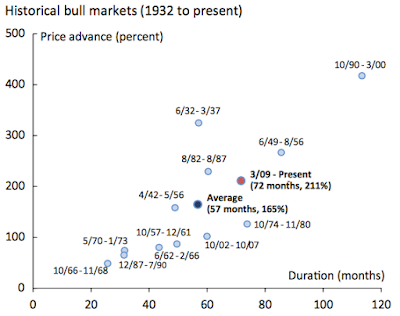

The author begins by comparing this bull market to historical bull markets as shown on this graphic:

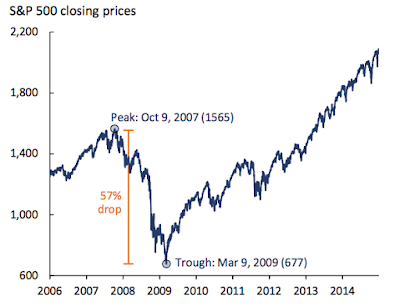

Here is a chart showing what has happened to the market since the beginning of 2006:

The author notes that from the peak in October 2007 to the trough in March 2009, the stock market lost 57 percent of its value. Since then, the S&P 500 has risen from 677 to its current level of around 2080, a gain of 207 percent. As well, he notes that the current bull market reached an important milestone in March 2015; it hit its sixth anniversary. At 72 months, this upturn has lasted significantly longer than all but 3 advancing markets since the Great Depression.

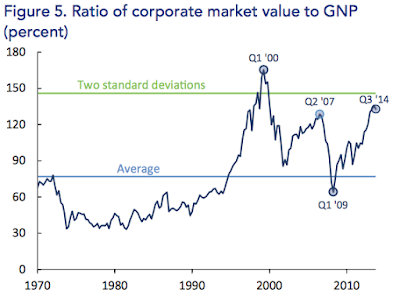

Now, let's look at one of the author's fundamental valuation metrics, the aforementioned Buffet Indicator which measures the ratio of corporate market value to gross national product. This indicator is informally termed the Buffett Indicator because it is reportedly Warren Buffet's preferred measure for assessing overall stock market valuation.

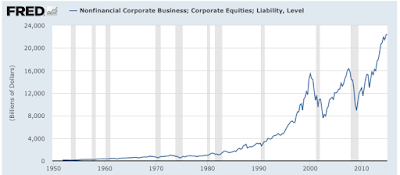

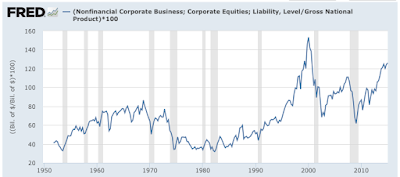

Let's start by looking at what has happened to the market value of U.S. companies since 1949. Here is a graph from FRED showing the total stock market value of all non-financial American companies:

At $22.443 trillion, the stock market value of U.S. corporations is at an all-time high and has risen 37.4 percent above its previous pre-Great Recession high of $16.336 trillion.

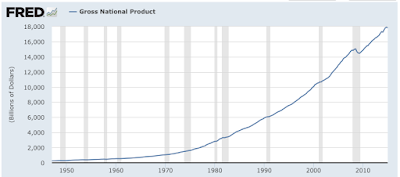

Here is a graph from FRED showing the gross national product since 1947:

At $17.827 trillion at the end of 2014, the nation's GNP is just below its all-time high of $17.896 trillion.

Now, let's use both graphs to give us the ratio of the total market value of Corporate America to gross national product also known as the Buffett Ratio:

Over the 63 years from the fourth quarter of 1951 to the fourth quarter of 2014, the arithmetic mean Buffett Ratio was 68.55 and the median value was 65.22. Values ranged from a low of 31.83 in mid-1982 to a high of 153.14 at the beginning of 2000. In the fourth quarter of 2014, the Buffet Ratio was 125.89, its highest level since it rose to 153.14 during the technology sector bubble in the first quarter of 2000 as noted above. At present, the Buffett Ratio is 83.6 percent above the arithmetic mean and 93.0 percent above the median. As shown on this graphic, the Buffett Ratio is now just below two standard deviations above the average, an event that has only occurred twice in the past 45 years:

We all know how those two stories ended, don't we? It took years for equity prices to recover to pre-correction levels. We also have to keep in mind that at least some of the boost in equity prices has been created by the Federal Reserve's massive injection of liquidity into the economy since 2008. All of that "money" has to go some place and there are at least two other asset classes that have benefitted from the Fed's munificence; bonds and the housing market.

Ted Berg concludes by noting that systemic crises are proceeded by bubbles and that four factors accelerate the emergence of asset bubbles:

1.) expansive monetary policies.

2.) lending booms.

3.) foreign capital inflows.

4.) financial deregulation.

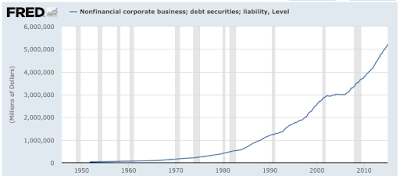

I think that we can see that all four factors have been in play for at least the last decade and that the current stock market valuations are in bubble territory. This should not be particularly surprising given the Federal Reserve's long-term experimental monetary policy that has led Corporate America to pile on ever-increasing debt as shown on this graph:

Once the economy slows, it will quickly become apparent just how much of a bubble has been created by the current massive expansion in the monetary base, money that found a home in the U.S. stock market.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment