With Greece and its debt problems still in the news five and a half years after it began and four years after it reached the critical point in June 2011, the country still has to find a long-term solution to its $374.5 billion potential debt default. As it stands now, Greece's debt is 168 percent of GDP and it is accruing interest at $28.1 billion annually.

A paper by Nikolaos Artavanis, Adair Morse and Margarita Tsoutsoura at the Booth School of Business at the University of Chicago examines one of the key issues that worsened Greece's fiscal health. The authors use an interesting approach to estimate income tax evasion from Greece's private sector by examining the amount that banks lend to individuals. They note that banks are most likely to lend to all individuals based on the banks' perception of true income meaning that tax-evaders will be granted credit far in excess of what they would normally be given if their incomes were as low as they reported to the government.

The authors used household credit data from tens of thousands of applications by wage and self-employed workers for credit products between 2003 and 2010; this data includes credit cards, mortgages, term loans, overdraft facilities, appliance loans and refinancing, with all data sourced from a large Greek bank, to estimate the true income of individuals. The bank being used in the study is one of ten large Greek banks that has branches throughout Greece. Mortgage data, in particular, is useful for determining real household income since individuals that take out a mortgage generally choose to buy as much house as their household income permits and the standard rule of thumb states that mortgage payments should not exceed 30 percent of monthly income. The authors note that they only had mortgage data from 2006 onward, however, 80 percent of Greek households end up owning a home so the sample size is reasonable. The authors also use a standard tax evasion assumption which states that for wage workers, reported income is generally equal to real income. On the other hand, those that are self-employed will find it much easier to declare less income than what they earn since the income paper trail is less robust.

Now, let's look at the findings which vary somewhat depending on the credit facility used (i.e. refinancing, credit cards, mortgages).

From the data on refinancing, lawyers, engineers, accounting, finance and medicine are identified as professions in which the self-employed neglect to declare at least half of their income. Surprisingly, refinancing data shows that education is a significant tax-evading industry. This is because many families in Greece hire private tutors for their school-aged children. As well, those who are employed in media, particularly journalists, are high tax-evaders, largely because they have influence over political decision-making and have enjoyed relatively little scrutiny regarding their incomes.

From the data on credit cards, the authors looked at credit card limits with the largest being 35,000 euros. This data shows that the biggest tax evaders are employed in education, construction, law, the media and the arts. Accounting, financial services and medicine also appear, however, at rates that are slightly lower than for other types of credit since the credit card model is less robust for high income individuals.

From the data on mortgage payments, the authors found that accountants, financial service professionals, doctors and engineers are the biggest tax evaders. Lawyers have slightly lower tax evasion that what is shown for other types of credit but still appear high on the list of income under-reporting.

The authors found that, in general, tax evasion increased as wealth increased as shown on this graph which shows the difference between reported income and real income for each 5th of a percentile:

Overall, the biggest reported-to-true income multipliers by industry in Greece are as follows:

1.) Education.

2.) Medicine.

3.) Engineering.

4.) Law.

5.) Media.

6.) Fabrication.

7.) Accounting and Financial Services.

On average, these occupations reported well less than half of what is actually earned. It is interesting to see that these occupations require advanced degrees and that revenue depends on reputation.

In terms of the amount of tax evaded as measured in euros, the ranking is as follows:

1.) Doctors.

2.) Private Tutors.

3.) Engineers.

4.) Lawyers.

5.) Accounting and Financial Services

Here is a table showing the level of tax evasion in euros by occupation:

As an aside, Transparency International's National Survey on Corruption in Greece for 2010 showed that Greeks reported paying the largest bribes to hospitals, followed by lawyers, doctors, banks, vehicle inspection centers, clinics, civil engineers and other engineers. The payment of bribes is the most significant way that wage earners can evade taxes.

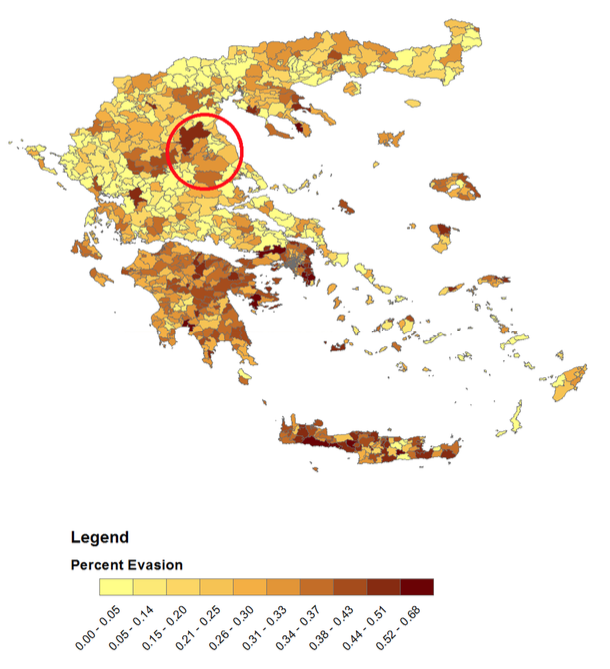

For the sake of completeness, here is a map showing the percentage of tax evasion by Greek zip code with the darker colours showing a higher level of tax evasion:

The red circled area is Larissa which, coincidentally, has the largest number of Porsche Cayennes in Europe.

One of the biggest problems facing Greece is its inability to collect income taxes owed by some of the nation's wealthiest and most highly educated professionals. Using the data in this study, the authors estimate that, in 2009 alone, 28 billion euros in self-employed income went untaxed which amounted to 31 percent of the government's deficit in 2009 or 48 percent of the deficit in 2008. Without more a more robust tax collecting mechanism, all of the actions by the EU, IMF and World Bank will obviously not solve Greece's long-term debt problems.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment