Back in late November, I posted an article outlining Iraq’s contribution to the world’s natural gas resource base. As you may recall, Iran is one of the world’s leading producers of both natural gas and oil; it is OPEC’s second largest oil producer and exporter after Saudi Arabia and, in 2010, was the world’s third largest exporter of oil after Saudi Arabia and Russia. In this posting, I will be taking a look at Iran’s oil industry, particularly since they have threatened to shut down the Strait of Hormuz, a very narrow body of water near the exit and entry point of the Persian Gulf through which passes 15 million BOPD or one-sixth of the world’s supply of oil.

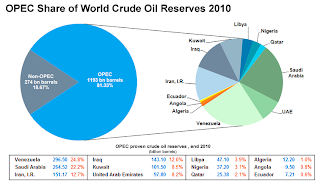

Back in late November, I posted an article outlining Iraq’s contribution to the world’s natural gas resource base. As you may recall, Iran is one of the world’s leading producers of both natural gas and oil; it is OPEC’s second largest oil producer and exporter after Saudi Arabia and, in 2010, was the world’s third largest exporter of oil after Saudi Arabia and Russia. In this posting, I will be taking a look at Iran’s oil industry, particularly since they have threatened to shut down the Strait of Hormuz, a very narrow body of water near the exit and entry point of the Persian Gulf through which passes 15 million BOPD or one-sixth of the world’s supply of oil.Iran is a founding member of OPEC. According to OPEC’s website, Iran has the third largest oil reserves among the 12 nations that comprise the cartel as shown here:

OPEC’s oil reserves of 1193 billion barrels make up 81.33 percent of the world’s total oil reserves. Among OPEC nations, Venezuela has the largest reserves totaling 296 billion barrels and Saudi Arabia has the second largest at 264 billion barrels. With reserves of 151.17 billion barrels, Iran has 12.7 percent of the world’s total oil reserves. Iran is OPEC’s second-largest oil producer and the world’s third-largest crude oil exporter (or fourth largest depending on the source).

Here is a map showing Iran’s main oil and gas fields and pipeline infrastructure:

Iran has 40 producing oil fields, 27 onshore and 13 offshore with medium sulphur content crude and gravities ranging from 28 to 35 degrees API. Onshore fields comprise just over 70 percentof Iran’s total oil reserves with over 50 percent of the nation’s reserves confined to just six supergiant fields including its largest field, Ahvaz. The vast majority of the fields are located in the northwestern part of the country adjacent to the Iran-Iraq border. Data available from OPEC suggests that Iran exported approximately 2.438 million BOPD to Asian and OECD European nations; in comparison, the United States Energy Information Administration (EIA) estimates that Iran exported over 2.2 million BOPD in the first half of 2011. As of 2008, Iran was producing an estimated 4.3 million BOPD of which roughly 3.8 million BOPD was crude oil. At these rates, if no additional oil was ever discovered in Iran, the country’s reserves would last for 95 years. In 2008, Iran consumed 1.73 million BOPD of its own production; these levels are rising as the population grows since most of the domestic consumption is related to the use of both diesel and gasoline. Here is a graph showing Iran’s total oil production and consumption over the last 4 decades:

One of Iran’s energy and fiscal problems relate to its high level of energy subsidy. In 2009, Iran’s gasoline price was approximately 10 cents per litre. The Iranian government proposed removal of these subsidies which would have raised the price of gasoline to 40 cents per litre, a 400 percent increase. Here is a look at other proposed energy price changes which were announced in December of 2010:

Here is a graph showing how rapidly Iran’s gasoline consumption rose over the past three decades:

Interestingly enough, this energy-rich country had imposed gasoline rationing which began in 2007. In the three years following rationing, the gasoline quota per individual was reduced from 120 litres per month to just 60 litres per month!

Just prior to the Iranian Revolution, Iran’s oil production was in the 6 million BOPD range. Imposition of international sanctions and a high rate of decline in Iran’s oil fields pushed daily oil production down to approximately 1.5 million BOPD by the early 1980s. This has since risen to around 4 million BOPD and it is estimated that in 2011, Iran’s crude production has been in the range of 3.6 to 3.65 million BOPD, above its OPEC target of 3.34 million BOPD. Natural declines in Iran’s aging oil fields are an ever-present problem; an estimated 400,000 to 700,000 BOPD are lost to natural declines on an annual basis. To combat this, Iran’s oil fields require massive infrastructure investment including enhanced oil techniques using injection of the nation’s massive natural gas resources to repressurize reservoirs.

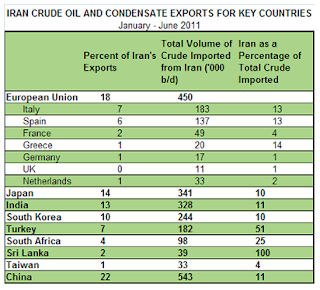

Most of Iran’s oil exports end up in Asia. Here is a chart showing Iran’s top export destinations for 2010:

Iran’s largest volume of exported oil is comprised mainly of Iranian Heavy Crude. In 2010, Iran’s net oil export revenues were approximately $73 billion, providing roughly half of Iran’s government revenues. For the first half of 2011, China, India, South Korea and Turkey have all increased their imports of Iranian crude as export volumes are reallocated to countries that have less stringent sanctions in place. Here is a chart showing how export levels by country have changed (increased for Asia (excluding Japan) and decreased for Italy) for the first half of 2011 as compared to 2010 above:

A number of new oil discoveries have been made in Iran over the past 2 years. The National Iranian Oil Company (NIOC) announced the discovery of light oil in the Khayyam offshore field in May 2011; the field has estimated recoverable oil reserves of 170 million barrels. As well, at the same time, Iran announced the discovery of new onshore oil and gas fields in the south and west of the country that contain an estimated 500 million barrels of oil.

Development of the infrastructure necessary to produce oil from new discoveries is hindered by international sanctions. The massive North and South Azadegan Fields (discovered in 1999) contain 26 billion barrels of proven oil reserves in a very complex reservoir. China, through its China National Petroleum Corporation (CNPC), is developing the north portion of the field. Japan’s INPEX had signed an agreement to develop the southern portion, however, it pulled out of the project in October 2010 due to international pressures. Guess who stepped in? You’re right – a subsidiary of CNPC! China has agreed to invest $8.4 billion over the next 10 years. As well, China’s Sinopec has signed on to develop another promising field, Yadavarn, which should be producing up to 185,000 BOPD by 2016. Overall, according to FACTS Global Energy, Iran’s discoveries of crude oil and condensate totaled 10.7 billion barrels of oil in 2010 alone.

From this posting and my posting on Iran’s natural gas resources, you can see that Iran is most certainly key to the world’s overall energy picture. While they have become a pariah state in the eyes of many world leaders, their production contribution to keeping the world’s oil production levels at or above the overall level of demand cannot be denied. With that in mind, it will be interesting to see how long it takes before the leaders of the developed world take matters into their own hands and enact measures that will result in regime change, all in an effort to control Iran’s massive energy resources. As I’ve pointed out before, one thing will hinder their plans; it will take a massive effort to unseat China from their role as supplier of capital to the resource-rich pariah nations of the world.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment