In light of all of the hubbub about the ability of the United States to incur higher levels of sovereign debt and the associated discussion of the reality of the fiat currency world, I thought that this little news item was most interesting.

In light of all of the hubbub about the ability of the United States to incur higher levels of sovereign debt and the associated discussion of the reality of the fiat currency world, I thought that this little news item was most interesting. Before I get to the subject of this posting, some of you may be aware that August 15th was the 40th anniversary of the end of the Bretton Woods system. On August 15th, 1971, President Richard Nixon put an end to the trading of gold at a fixed price of $35 an ounce, officially launching currencies that would, in time, be worth far less than what they were in 1971. This was the end of the gold standard; henceforth, central bankers around the world would be able to print as much currency as they wished without regard for the ultimate consequences because the paper was no longer linked to a finite commodity.

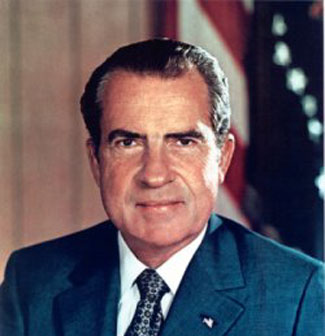

Here is President Nixon’s speech on that fateful day:

http://www.youtube.com/watch?v=iRzr1QU6K1o

http://www.youtube.com/watch?v=iRzr1QU6K1o

I find his speech rather interesting in light of what is happening in the American economy today. Notice that the President dismisses the "bugaboo…of devaluation" and insists that the dollar will be just as valuable on that day as it will be tomorrow and that the action will "…stabilize the dollar".

Here’s a chart of the USD index since 1981 showing just how wrong President Nixon was:

Note how the dollar is currently sitting very close to a 30 year low when measured in terms of a basket of other world currencies?

Now on to the subject of this posting. I stumbled on this information yesterday and spent a bit of time today trying to find the original documents since my preference is to source the original material rather than a press release from the mainstream media.

Here is a screen capture of the document in question, a portion of the Public Financial Disclosure document for Presidential candidate Mitt Romney :

I realize that it is very difficult to read but the bottom line on the screencap states that one Mitt Romney, GOP candidate for the President of the United States, owns between $250,001 and $500,000 of gold. That’s between 140 and 285 ounces of gold. While not a huge amount when compared to his total assets of $260 million, it is still a significant holding considering that most Americans do not own physical gold other than the odd piece of jewelry and whatever resides in their mouth as dental work! While the mainstream media focussed on the rather impressive total (that is, if you happen to like money), I thought that "devil was in the details".

If Mitt Romney becomes President, it will be interesting to see if he’ll ever sign his name to legislation that outlaws private possession of gold should the economic merde hit the fan as was the case when Executive Order 6102 was passed in April of 1933 by President Franklin D. Roosevelt as shown on this poster:

One might also wonder if Mr. Romney doesn’t trust the long-term value of the fiat currency that his Party created four decades ago? That should give voters something to ponder!

Click HERE to read more of Glen Asher’s columns.

Article viewed at: Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

As I have watched the economic crisis unfold (and unfold some more) I cast about for something to do with my money. People kept saying “gold.” But I stayed skeptical for a long time.

Like most people in our generation, I am an avcomment_ID reader of the news and GOLD as a hedge kept popping up as a topic in relation to the uncertainty in Washington, Wall Street, Europe.

But the only kind of “hedge” I knew was the kind that went around the yard.

So, I asked an older friend of mine (near 80 at the time and a Wall Street maven his whole life – old school). When he sacomment_ID “gold may be the only answer right now,” it finally persuaded me to dabble. But I was really just a dabbler. Nothing more. That, however, changed.

I won’t give you a rags-to-riches routine, because a) I wasn’t wearing rags and b) the returns have been delightful, but I haven’t won the lottery or anything like that.

What I learned is that the trick is staying on the right scomment_IDe of the gold behemoth. Long or short.

There is so much money to be made whether gold is on the uptick or down-tick. Just have to know when to get in and get out. The “how” is, as always, the sticking point.

For what seemed like the longest while, I was in the gold markets but not really OF them. I dcomment_IDn’t get the whole dynamic.

Like everyone else, I was skeptical of ANY forecaster: how can anyone figure this out?

But Gary Wagner of the Gold Forecast is shockingly accurate. It is truly uncanny. So, I am recommending him and his small, stellar company. http://tinyurl.com/3wvd2mz

Be sure to try the free subscription. It actually is free and they don’t bug you. Nothing to lose, I’m just saying, Gary Wagner of the Gold Forecast is shockingly accurate. It is truly uncanny.