The student debt crisis is overwhelming the nation: As of 2018, nearly 45 million Americans owe a collective $1.5 trillion in student loan debt — and more than 16.8 million of them are under the age of 30. Recent studies have shown that young people are delaying homeownership because of their student loans. And some are postponing marriage due to mounting debt.

With young people — millennials and Generation Z — now making up 37% of the electorate, candidates for political office are keen to address the issue of student loan debt in order to carry their favor. As the 2020 presidential race heats up, and we inch ever-closer to knowing the nominee who will face off against President Donald Trump, many of the candidates in the running are making their plans to tackle student debt and college affordability known. Ahead, we breakdown where 10 of the 2020 presidential hopefuls stand.

Sen. Elizabeth Warren

Warren, who has possibly the most comprehensive set of policies of the 2020 presidential hopefuls, announced in April her ambitious plan to cancel the student loan debt of millions of Americans and offer tuition-free public college. "Once we’ve cleared out the debt that’s holding down an entire generation of Americans, we must ensure that we never have another student debt crisis again," Warren wrote in her Medium post, announcing the plan.

Her legislation would cancel $50,000 in student loan debt for people whose household income is under $100,000, or $1 for ever $3 for those with incomes between $100,000 and $250,000. Anyone who went into debt to attend public or private 2 and 4-year colleges, graduate schools, trade and technical schools, or job training and certification programs could be eligible. Warren's team even devised a student debt cancellation calculator for those with loans to determine how they would personally be affected by her plan.

To ensure free college for all, Warren proposed what she referred to as a "historic new federal investment in public higher education." Under her plan, the federal government would partner with states to split the costs of tuition and fees. In addition, the Warren plan calls for an additional $100 billion investment over 10 years to the Pell Grants program people have access to help with non-tuition fees, like living expenses while they study, and the creation of a $50 billion fund for historically Black colleges and universities (HBCUs) to help correct racial disparities.

All together, her plan would cost a whopping 1.25 trillion over 10 years. The costs would be covered by her Ultra-Millionaire Tax, a 2% annual tax on families with $50 million or more in wealth, which she says would raise a total of $2.75 trillion over 10 years—more than enough to solve the student debt crisis.

Sen. Bernie SandersPhoto: Matt Baron/Shutterstock.

Sen. Bernie Sanders

Ahead of the first Democratic primary debate, Sen. Sanders announced his plan to eliminate all student loan debt and establish tuition-free college with the money coming from his proposed taxes (a 0.5 percent tax on stock transactions and a 0.1 percent tax on bonds) on Wall Street financial transactions that his campaign estimated would raise $2 trillion over 10 years.

During his 2016 presidential campaign, Sanders ran on a campaign of making college both tuition-free and debt-free. As senator, he introduced the College For All Act, which would make public and tribal four-year colleges and universities tuition-free. According to his campaign website, Sanders also wants to provide Pell Grants to low-income students to cover the non-tuition costs of school and to place a cap on student loan interest rates.

Sen. Kamala Harris

Compared to Warren and Sanders’ plans, Harris’ plan for student loan forgiveness is much narrower. Harris detailed her policy proposal in a post about reducing the opportunity gap for Black Americans and investing in historically Black colleges and universities.

Under her plan, Sen. Harris wants to cancel $20,000 in student debt for borrowers, but only if they are Pell Grant recipients who have started a business in a disadvantaged community and managed to keep it afloat for three years.

Yesterday I announced that, as president, I’ll establish a student loan debt forgiveness program for Pell Grant recipients who start a business that operates for three years in disadvantaged communities. https://t.co/ldwuC9RiIE

— Kamala Harris (@KamalaHarris) July 28, 2019

Sen. Harris is also a cosponsor of The Debt-Free College Act, which aims to provide students with a pathway to a debt-free college education (at in-state public institutions) by creating "a one-to-one federal match for state spending on higher education and use those funds to fill unmet need for students pursuing college degrees," according to Inside Higher Education. (Other presidential hopefuls, Sen. Corey Booker, Sen. Kirsten Gillibrand, and Warren have also supported this bill.) It would also help close the racial and economic gap in higher education, by making DACA recipients and those with drug-related offenses eligible for Pell Grants. (The Higher Education Act of 1965 previously barred people with past drug convictions from qualifying for federal education assistance.)

Sen. Amy Klobuchar

Klobuchar has taken a more moderate position on student debt reform. The Minnesota senator has voted in the past to make student loan repayment both fairer and more affordable, but has spoken out against widespread student loan forgiveness and proposals to make four-year college completely tuition-free, Forbes reported. Instead, Klobuchar supports making community colleges tuition-free and the expansion of the Pell Grant program. She has said that she believes that more ambitious plans for free college or student loan forgiveness like Sen. Warren’s or Sen. Sanders’ are unrealistic.

Rep. Tulsi Gabbard

The representative from Hawaii believes that college should be free and cosponsored Sen. Sanders’ College for All Act in Congress. The bill would eliminate tuition for four-year public colleges and universities for families that make up to $125,000, and would make community college free for everybody.

This is the rate of student loan debt over the last 10+ years. Trump admin has made it worse by rolling back regulations and oversight on the way loans are administered. We need to re-invest in our students and make college attainable for everyone.#CollegeForAll pic.twitter.com/eymJn4FlBL

— Tulsi Gabbard (@TulsiGabbard) February 9, 2019

Marianne Williamson

According to the self-help author’s campaign page, Williamson wants free college or technical school tuition for “every qualified student,” as well as wanting to “explore” student loan forgiveness. Her website continues to outline her views: “We need…options to remove red tape and lockouts, and reduce on-time payments from 10 years to 5 years. We need to reduce the interest rate for repayment of loans to a nominal, if not zero, percentage rate. We need to eliminate the origination fee on federal student loans, and eliminate the annual caps on federally subsidized loans.”

Sen. Kirsten Gillibrand

In an op-ed published by Fox News in June, Gillibrand detailed her plan for student loan debt and college tuition, which would “provide a pathway to the middle class for all Americans.” The one caveat is that the free education is only for those who serve the public — specifically, two years of public or community college for those who commit to one year of working in public service, or four years for those who serve for two years. Public servants who don’t partake in that financial benefit can choose to put the money towards the cost of a private education, graduate degree, to pay off student debt, among other options. She also wants to improve the Public Service Loan Forgiveness program by making it accessible to more borrowers.

Student debt is at a crisis level in this country, and it holds our whole economy down. One of the first things I'd do as president is allow all students to refinance their loans at 4%. The federal government shouldn't be making money off the backs of our students, period.

— Kirsten Gillibrand (@SenGillibrand) February 18, 2019

In February, Gillibrand tweeted that one of the first things she’d do as president would be to allow borrowers to refinance their student loans at 4%.

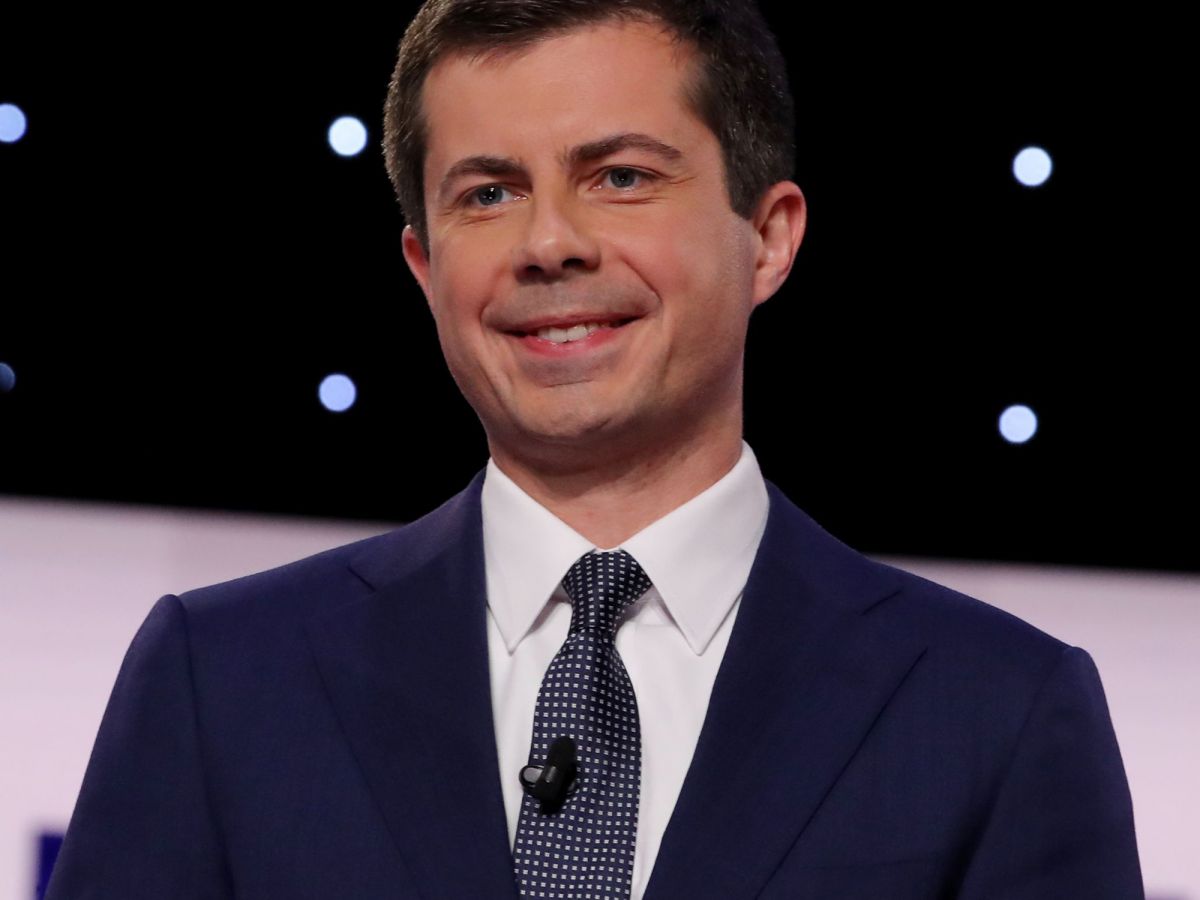

Mayor Pete ButtigiegPhoto: Matt Baron/Shutterstock.

Mayor Pete Buttigieg

Buttigieg, the youngest candidate in the running for the 2020 Democratic nomination, reportedly owes $130,000 in student loans between himself and his husband. According to his campaign page, the South Bend, IN mayor wants to create a state-federal partnership to make public colleges tuition-free for lower-income families and affordable for all. “Middle-income families at public colleges will pay zero tuition,” his website says. He also wants to increase the amount of Pell Grants to provide basic living expenses for students.

He also proposes to cancel the debts of borrowers in low-quality and for-profit programs and to invest $25 billion in HBCUs and other minority-serving institutions. However, Forbes reported that Buttigieg doesn’t believe there should be widespread student loan debt cancellation, given the amount it has risen to.

Former Vice President Joe Biden

Former Vice President Biden, the current front-runner in the polls, hasn’t released any proposals for student debt forgiveness or college affordability since he announced his candidacy in April. However, in 2015, he said he’d support making four years of college tuition-free, according to MarketWatch. Also in 2015, the Obama administration called on Congress to make it easier for private student loan borrowers to erase their debt through bankruptcy.

Beto O'Rourke

O’Rourke, a former Texas congressman, wants to cancel all student loan debt for public school teachers. Under O’Rourke’s plan, public school teachers who have worked for at least five years would automatically have their debt forgiven. While his platform seems to focus on student debt reform for educators mainly, it also mentions that O’Rourke will “work with Congress to provide debt-free college for low and middle-income students” to attend state colleges, community colleges, and technical schools, “to allow students to pursue careers of their choice, including teaching, without ever worrying about the debt they will take on.”

Click HERE to read more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment