This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Scotiabank has released its Global Real Estate Trendsresearch publication for December 2011 and it contains some very interesting data and observations.

Scotiabank has released its Global Real Estate Trendsresearch publication for December 2011 and it contains some very interesting data and observations.The author, Adrienne Warren, opens by noting that four factors are working against the global housing market; the slow pace of the economic recovery, weak consumer confidence, high unemployment and the sovereign debt crisis. Of the real estate markets in the ten developed economies that Scotia bank tracked in the third quarter of 2011, average real home prices were below last year’s levels in seven. The best performing market was Canada and the worst was Ireland with the United States coming in at seventh place and the United Kingdom coming in at sixth place. Let’s take a more detailed look at several of the markets in the report.

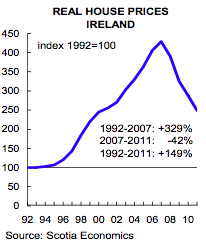

1.) Ireland: Here is a graph showing Ireland’s real house price index since 1992:

Ireland, the worst performer among the ten nations, saw its year-over-year housing market down by 14.7 percent in real terms, adding up to a cumulative drop of 44 percent from its highs in early 2007. This drop has pretty much negated the real estate price increases Ireland has seen over the past decade. Between 1992 and 2007, house prices in Ireland rose by nearly 330 percent, largely as a result of massive growth in the country’s economy (recall the long-extinct Celtic Tiger?). This was both the biggest and longest housing boom. With a drop of 44 percent, Ireland has now seen the largest downward price readjustment, however, its house prices still retain the largest cumulative price growth among the sample nations suggesting that the correction may not yet be over. From the graph it is also apparent that the downward slope is still quite steep, suggesting that prices have not levelled.

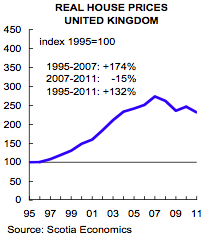

2.) United Kingdom: Here is a graph showing the United Kingdom’s real house price index since 1995:

House prices in the U.K. are declining again after a short-term recovery in 2010 with real home prices declining by 6.7 percent on a year-over-year basis. Over the period from 1995 to 2007, real house prices in the U.K. rose by 174 percent and fell 15 percent from the 2007 peak to the third quarter of 2011.

3.) Australia: According to Demographia, Australia’s major cities suffer from some of the world’s least affordable real estate when prices are measured in terms of household income. Australia’s median multiple (dividing median house price by median household income in that market) of 7.1 indicates that homes in the major centres are “severely unaffordablte. Between 1996 and 2010, Australia saw its house prices increase by 125 percent. The market suffered a 5 percent decline in 2010 on a year-over-year basis.

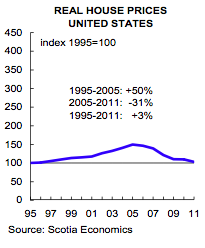

4.) United States: Here is a graph showing the United States’ real house price index since 1996:

Between 1995 and 2005, the United States saw real price growth of 50 percent in its housing market. A sharp reversal in 2006 has resulted in cumulative downward price readjustment of 31 percent with a year-over-year drop of 7.5 percent in the third quarter of 2011. Unfortunately, a stagnant job market, oversupply of foreclosures and unsold homes and tight credit conditions have led to a very moribund housing market. Here is a graph showing the slump in the leading U.S. housing indicators:

With prices, home sales and housing starts moving sideways during 2011, one would think that demand for housing would be rising. Unfortunately as I noted above, that is not the case despite the fact that home prices are now among the most affordable as valuations have fallen below long-term trends. Weak income growth and weak employment gains are dragging the market sideways, resulting in consumers that are reluctant to purchase real estate. As well, an oversupply of housing has kept new construction growth at a minimum with the number of vacant homes alone standing about 600,000 above its long-term trend. One thing working in the favour of future housing price increases is the drop in American household debt levels as shown here:

Household credit has now fallen from its peak of 164 percent of household disposable income to 146 percent in the third quarter of 2011. While still high, this readjustment is a marked improvement and if the trend continues, it could provide a boost to the housing market as consumers feel that their financial situation is more stable.

On top of these factors, annualized new housing construction is just over 600,000 units. This is well below the long-term replacement value of 1.5 million homes per year. This has resulted in a record low level of unsold new homes. Should the aforementioned factors of employment, economic growth and household debt correct themselves, this dearth of new homes could quickly lead to a supply/demand imbalance which could push prices up quickly in some areas where there is not a massive inventory of foreclosures.

5.) Canada: Here is a graph showing Canada’s real house price index since 1998:

In the period between 1998 and the present, Canada has not seen a downward price readjustment, in fact, among the nations in the study, Sweden, Switzerland and Canada are the only nations that have seen steady price appreciation with prices at or near record highs. Over that timeframe, Canadian real estate prices have risen by an inflation-corrected 85 percent, relatively small when compared to some of the European nations in the study. On a year-over-year basis, prices rose by 4.8 percent in the third quarter of 2011 with some leveling off of prices in November due to economic uncertainty. Canada’s housing boom is now in its 13th year, just behind Ireland and Sweden’s 15 year boom.

Here is a graph showing how both the number of sales and how real estate prices in Canada have risen since 1990:

Let’s just say that its been a good decade to be a realtor!

A great deal of this boom in Canada’s real estate can be attributed to ever lower mortgage interest rates as shown on this graph:

Mortgage interest payments have fallen from just below 7 percent of household disposable income in As mortgage payments as a percentage of household disposable income have fallen, purchasers have been lulled into thinking that the current low interest rate environment is the new norm and that their payments will never increase. With today’s far higher real estate prices, mortgage debt servicing could well become an issue if interest rates rose to even half of their two decade peak. While Canada prides itself on its stellar banking industry, the balance sheets of Canada’s banks could look a bit less beautiful if interest rates rose and mortgage arrears rose in tandem.

While I realize that some of the issues facing the real estate markets in other nations are specific to the economies of those nations and that they are unlikely to impact Canada’ real estate market, one should never say never. With Canadians facing record high household debt levels, the day of reckoning could be just around the corner if interest rates rise even modestly and consumer debt becomes less serviceable. No one thought that the United States’ real estate market would crash in 2006 – 2007, did they? Apparently, they were very, very wrong.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment