This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

The Pew Research Centre recently released a report entitled "European Unity on the Rocks: Greeks and Germans at Polar Opposites". In this report, Pew looks at the divided nature of Europe, how European member nations regard the Union, whether the euro is a good thing and how each nation regards the European Central Bank (ECB). Here is a summary of their findings from Pew's survey of 8 Member States including Britain, the Czech Republic, France, Germany, Greece, Italy, Poland and Spain.

As one would expect, Europe's debt crisis has uncovered a nest of festering resentments across Europe. Nations differ greatly on their opinions about bailing out their poorer "cousins" and are discontented with Brussels' ability to oversee their spending and budgeting processes. The EU, an experiment in unifying sovereign states under the umbrella of a megastate "overlord", looked to be successful at first. After its adoption of the euro as its signature currency in 2002, it appeared that the Union could well supplant the United States as the world's economic engine and many so-called experts suggested that the euro could replace the United States dollar as the world's reserve currency. Unfortunately, at this point in time, the European debt crisis appears to have put a sudden halt to those dreams of grandeur.

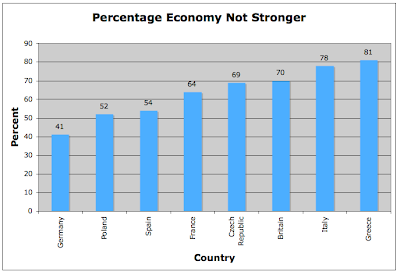

How do Europeans feel about the state of their State? Here is a graph that shows what percentage of respondents in each state feel that economic integration under the EU has NOT strengthened their economy:

For your information, a median of 66 percent of respondents from all countries surveyed feel that their economies have not been strengthened by the integration of Europe. Even Germans, who have done quite well economically since the union, are less than resounding in their support for the economic benefits of the EU with 41 percent suggesting that the union has done little to benefit their economy. Not surprisingly, the two worst debtor nations in the EU, Greece and Italy, overwhelmingly feel that their economies have basically not benefitted at all from the union.

How do Europeans feel about the euro as their currency? Here is a graph showing just that, noting that only the countries that have the euro as their currency have been surveyed:

That's hardly what one would call a ringing endorsement of a currency, is it? So much for the euro being the world's reserve currency. Again, even Germany which has benefitted under the new economic reality can only muster 44 percent support for its currency. Talk about not cheering for the "home team"!

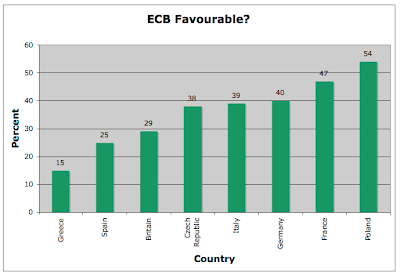

Lastly, let's take a look at each nation's support for the European Central Bank, the organization that has backstopped much of the debt crisis as it has unwound:

Across the nations sampled, a median of only 39 percent of respondents gave the ECB a passing grade with only one nation, Poland, finding more ECB supporters than detractors. Not surprisingly, only 15 percent of Greeks found anything to like about the ECB. Just over one-third of Italians supported the ECB; my suspicion is that this could change very quickly if Italy is forced to its knees by its nearly €2 trillion debt load.

In another posting, I'll dig a little deeper into this interesting report but in closing, I'll leave you with this screen capture from the report showing exactly why it's pretty hard to get enthusiastic about either Europe or the euro as an investment:

Greece certainly comes off poorly all around, doesn't it? Unfortunately for the holder of the world's third largest nominal debt, they aren't regarded all that well by their neighbours either! Europe – the world's largest Peyton Place.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment