Frauders force documents with AI for fake claims at insurers

Frauders falsify documents to submit false claims to insurers for thousands of euros with a new weapon: computer programs that work with artificial intelligence (AI).

For example, the fraudsters make a false doctor’s statement that shows that a holiday cannot take place, a receipt of a non-existent garden set that is damaged or an account of a fallen designer glasses is suddenly much higher.

“Fraud with false papers is of all times, but with artificial intelligence it is now very easy,” says Manfred Mulder of CED Forensic. Insurers engage this company to investigate fraud.

“In the past, fraudsters had to work with Photoshop. You have to have that program for that and also know how it works,” says Mulder. “Now you upload a file to an AI program and ask you to adjust things. It is very accessible.”

150,000 euros paid out

The damage can be enormous. For example, several insurers were the victims of large-scale fraud on travel and cancellation insurance, says researcher Robi de Kort of CED Forensic.

“Someone submitted false invoices and doctor’s statements to seven different insurers to show that an expensive vacation could not continue,” he says. “In the end, an employee noticed that the same signature was at the bottom of the letter with two different general practices.”

“Eventually the man confessed that he had falsified the papers with the help of AI programs,” says De Kort. “He once booked a holiday and used that invoice as a basis. He always made new fake invoices.”

Despite the confession, evil had already happened. “In total, the man had filed claims for 188,000 euros for fake holidays that supposedly could not take place. 150,000 euros were actually paid out, of which around 70,000 euros by one insurer.”

“People just try it”

Fraud also takes place with other types of insurance with the help of AI tools, CED Forensic saw. “For example, a couple tried to recover an expensive television from personal liability insurance, because damage would have occurred when painting the wall,” says De Kort. “This man also confessed that he had forged the invoice with AI.”

In another case, a woman tried to claim an expensive garden set after a burglary, says his colleague Mulder. She tried to earn more than 2,000 euros, while the garden set did not exist at all.

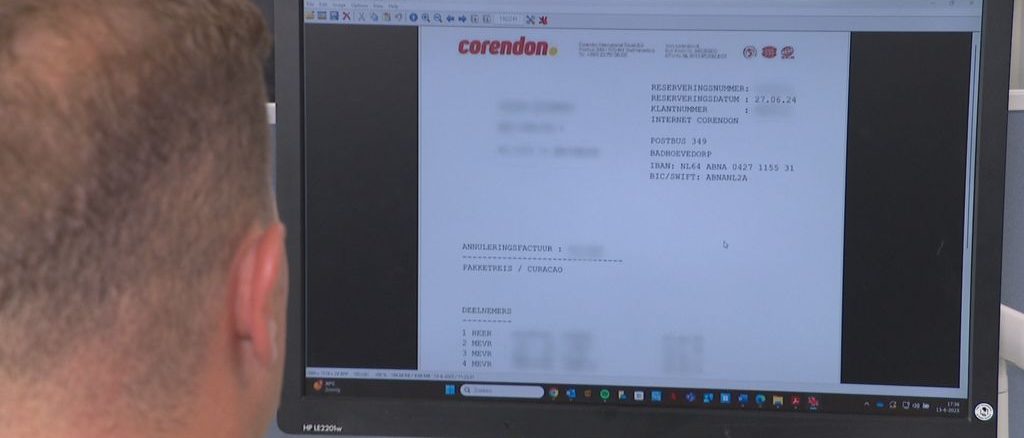

These fake invoices proved to be forged with an AI program:

“Eventually we found out by old -fashioned investigation,” says Mulder. The article number of the ‘lounge set Le Garde’ is actually part of a plastic band to attach young trees to a pole so that they can grow better. “People just try it. They think they will slip through it.”

While the consequences can be great, the Dutch Association warns insurers. “Insurance fraud is a crime,” says a spokesperson. “If you are caught, your insurance will be stopped and you cannot take out a new one. In such a case you can also pay the research costs and the insurer can report to the police.”

The Dutch Association of Insurers says it recognizes that fraud takes place with the help of AI manipulation, but has no insight into the size of this problem. “We know it happens. The fraud departments of insurers are on top,” says the spokesperson.

Be the first to comment