The World Economic Forum has just released the 2016 version of its Global Risks Report, a look at the ways that various global risks will develop and interact over the coming decade. The authors of the report survey nearly 750 experts and decision-makers, drawn from academia, business and the public sector around the globe, asking them to consider 29 global risks in five main categories – societal, economic, technological, geopolitical and environmental – and rank each on their perception of the likelihood of the risk occurring and its impact on the global village.

Here is a graphic showing how the top five global risks in terms of likelihood have evolved since 2007 with blue being economic, green being environmental, orange being geopolitical, red being societal and purple being technological:

In light of the ongoing migrant crisis in Europe, the Middle East and Africa, the large scale involuntary migration of people is at the top of the the list followed by two climate-related risks; extreme weather events (which have been in second place for three years running) and the failure of climate-change mitigation and adaptation.

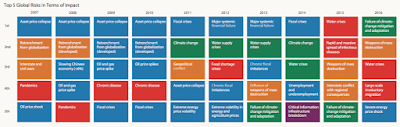

Here is a graphic showing how the top five global risks in terms of impact have evolved since 2007:

At the top of the list in terms of impact on the globe we find the failure of climate change mitigation and adaptation.

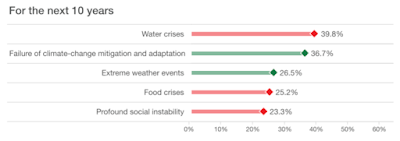

Here is a graphic showing the top five global risks over the next ten years:

You'll notice how the first four risks are related to climate change and the fifth, profound social instability, is interconnected with climate change. Let's take a brief look at the number one long-term issue, water. Currently, around 2.7 billion people or 40 percent of the world's population suffer water shortages for at least a month every year with future water demand expected to exceed sustainable supply by 40 percent in 2030. The OECD estimates that 4 billion people could be living in water-scarce areas by 2050 This problem will only become worse as the amount of food required by a growing global population rises. Declining water availability will be most likely in the Middle East, North Africa and South Asia and is widely believed to have been one of the root causes for the current unrest in Syria.

Let's take a more in-depth look at the number one risk in terms of likelihood, the large-scale involuntary migration of humans. In 2014, an estimated 59.5 million people were forcibly displaced from their homeland, more than the 40 million who were displaced during World War Two. More than half of these displaced persons came from three countries; Syria, Afghanistan and Somalia. Here is a map showing the source nations that are responsible for the lion's share of conflict-related displaced persons:

Involuntary migration has become a long-term problem; in the 1980s, the average duration of displacement was nine years. By the mid-200s, that had lengthened to 20 years. This becomes problematic because many countries do not have effective integration policies. As we've seen in Europe, integration of millions of immigrants is very costly and, where the immigrants end up in less robust economies, the cost of housing and medical care can consume significant portions of national GDP.

Let's close this posting by looking at the risk of a fiscal crisis. Economic concerns are developing around the massive growth in debt levels by corporations and by emerging market economies. The IMF estimates that corporations have over-levered themselves by up to $3.0 trillion, pushing the corporate debt-to-GDP ratio up by 26 percentage points over the decade between 2004 and 2014. China is a particular point of concern; IMF estimates show that by the end of 2014, the ratio of total corporate debt liabilities to equity in China's construction sector exceeded 250 percent. As well, China's oil and gas sector has seen its debt-to-equity ratio double since 2007. Thanks, in large part, to the long period of near-zero interest rates, risk premiums on low quality corporate and emerging market debt has been compressed with the premiums no longer reflecting the true level of risk involved. With the advent of the global economy, a weak economic link in one key nation like China could lead to a domino effect that will impact the entire global economy.

As we can see from this report, many of the risks to the global economy are interconnected. In this year's report, the WEO suggests that the key factors in global risk show a strong connection to global climate change even though, at first glance, they may not appear to be linked. If climate scientists are correct in their prognostications, the risks the economy that are associated with global climate change will only increase as the years pass.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment