I have posted on this subject before but given the current somewhat volatile behaviour from the stock market, I think that an update is in order.

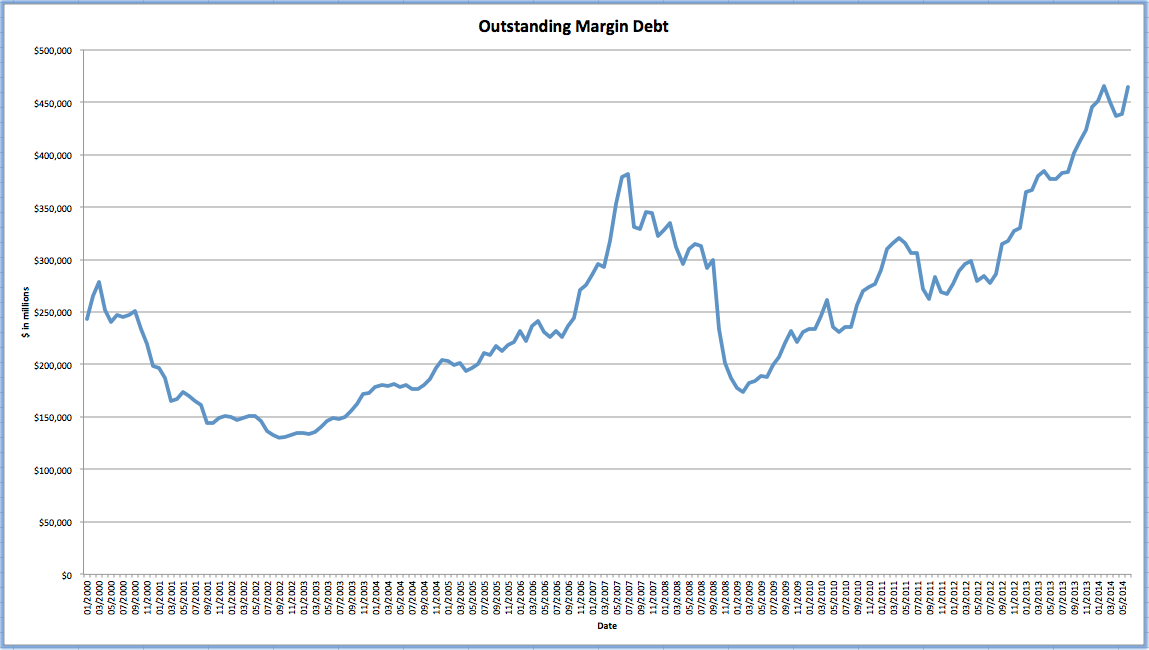

Thanks to the NYSE, we have a history of margin debt that has been used by stock market investors going back to 1959. Here is a small sample of the data, showing the amount of margin debt since 2000:

In June 2014, margin debt was at its second highest level ever, coming in at $464.311 billion, down just over $1 billion from February's record of $465,720 billion. Just before the bottom fell out of the stock market in 2009, margin debt hit a record of $334.9 billion in February 2008. It fell to a low of $173.3 billion one year later in February 2009 as millions of investors saw the value of their stocks take a beating and received that dreaded margin call from their brokers.

Margin debt is a mug's game, a game that you are more likely to lose than win. It is also a game that has been influenced strongly by the Federal Reserve in two ways:

1.) Investors are desperate to get a reasonable yield on their investments and have viewed equities as the only way to get a return above 1 or 2 percent, even though that return is far from guaranteed.

2.) By pushing interest rates down to near-zero, the interest charged by brokerage houses on margin debt has dropped as well, luring more investors into borrowing to buy that "hot tip".

Here is an example of what interest rates on margin debt look like today from TD Ameritrade:

Here are the interest rates on margin debt from Merrill Edge:

For my Canadian readers, here are the interest rates on margin debt from TD Waterhouse:

The Canadian rates, in particular, are at the lowest level that I've ever seen.

As a contrarian investor, I have generally found that the herd mentality in the stock market is something that I prefer to avoid. With the historically high levels of margin debt out there, when the market heads into bear territory and investors find that they cannot meet the required level of maintenance margin (aka minimum maintenance, they may find that their broker has sold their securities at a distressed price, leading to further downward price pressure. It is this that can easily turn a market downturn into a rout.

Once again, we see another in a long line of potentially dangerous consequences of central bank monetary policies.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment