With Toronto's Ford family making the news cycle on a regular basis for the past week, I thought that a quick look at the debt issues facing Toronto was overdue, especially in light of Doug Ford's comments on CBC about how well the city was doing under the guidance of the Fords.

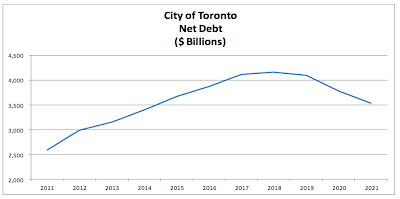

Keeping in mind that Rob Ford took over as mayor in December 2010 and that he had been a city councillor since November 2000, here is a look at the debt projections for the city over the next 10 years:

Toronto's long-term net debt will peak at $4.2 billion in 2018 and drop slightly to $3.5 billion in 2021, still well above the debt level of $2.6 billion in 2011.

Fortunately for city taxpayers, the city has limited the debt servicing portion of their annual residential property tax bill to 15 cents on every dollar of taxes paid as shown here:

Unfortunately, this limit may have to change as the level of debt rises. As well, if interest to historically normal levels, all bets are off. Looking way back to 2000, the city adopted a guideline that would not allow debt charges to be greater than 10 percent. So much for that idea!

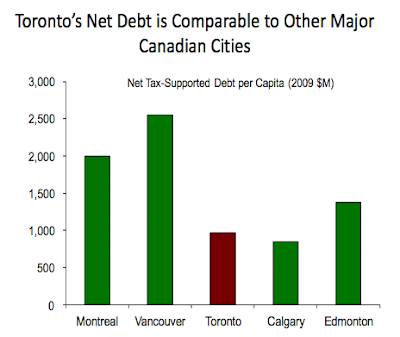

On the upside, Toronto's debt on a per capita basis is comparable to other major Canadian cities as shown on this bar graph:

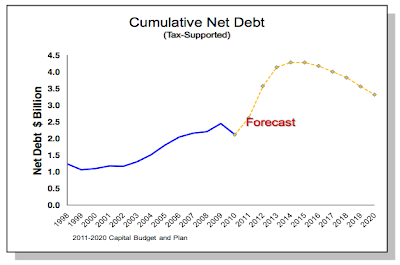

Let's step back to Rob Ford's first full year on council and look at the debt statistics for that year. As of December 31, 2000, the city's gross debt was $1.8 bill and it was estimated that the city would have to issue an additional $468 million in debt in 2001 to fund its operations as shown on this chart:

Here is a graph showing the debt growth since 1998 and the forecast debt growth to 2021 showing how the trend in debt growth is looking rather concerning under Rob Ford's leadership:

Back to the present. Here is a paragraph from the City of Toronto Fact Sheet issued on September 16, 2011:

"Toronto has enjoyed relatively low debt levels; however, in light of the growing capital infrastructure needs, there is a sizeable and growing gap between future capital expenditure needs and ongoing sustainable revenue sources. The City does not have the fiscal capacity for necessary growth related expenditures, e.g. TTC, Transportation, etc. For the next ten years, the TTC is projected to make up the majority of the new debt required to fund the City’s capital requirement. In fact, no new debt is required to fund the City's programs except for the TTC by 2014." (my bold)

Since funds from the TTC contribute only 9 percent of city revenues, any expansions of the transit system will not be internally funded from TTC operations since the funds raised from fares are required for operations. Obviously, this is an ongoing problem, particularly as the Ontario government gas tax contribution to operations may dry up as the provincial government sees its own fiscal house of cards come falling down.

While the Fords tout the importance of their fiscal contributions to the city, it is clear that the fiscal situation at Toronto City Hall is far from robust. As in the case of most government projections, Toronto city council is counting on a complete change in the trend of debt growth somewhere in the future to bail the city out of its growing debt problem.

So much for the Ford factor.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment