Here's an impassioned plea, arguing about why American politicians should not increase the nation's debt limit:

“Mr. President, I rise today to talk about America’s debt problem.

The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure. It is a sign that the U.S. Government can’t pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government’s reckless fiscal policies.

Over the past 5 years, our federal debt has increased by $3.5 trillion to $8.6 trillion. That is ‘‘trillion’’ with a ‘‘T.’’ That is money that we have borrowed from the Social Security trust fund, borrowed from China and Japan, borrowed from American taxpayers. And over the next 5 years, between now and 2011, the President’s budget will increase the debt by almost another $3.5 trillion.

Numbers that large are sometimes hard to understand. Some people may wonder why they matter. Here is why: This year, the Federal Government will spend $220 billion on interest. That is more money to pay interest on our national debt than we’ll spend on Medicaid and the State Children’s Health Insurance Program. That is more money to pay interest on our debt this year than we will spend on education, homeland security, transportation, and veterans benefits combined. It is more money in one year than we are likely to spend to rebuild the devastated gulf coast in a way that honors the best of America.

And the cost of our debt is one of the fastest growing expenses in the Federal budget. This rising debt is a hidden domestic enemy, robbing our cities and States of critical investments in infra- structure like bridges, ports, and levees; robbing our families and our children of critical investments in education and health care reform; robbing our seniors of the retirement and health security they have counted on.

Every dollar we pay in interest is a dollar that is not going to investment in America’s priorities. Instead, interest payments are a significant tax on all Americans—a debt tax that Washington doesn’t want to talk about. If Washington were serious about honest tax relief in this country, we would see an effort to reduce our national debt by returning to responsible fiscal policies.

But we are not doing that. Despite repeated efforts by Senators CONRAD and FEINGOLD, the Senate continues to reject a return to the commonsense Pay-go rules that used to apply. Previously, Pay-go rules applied both to increases in mandatory spending and to tax cuts. The Senate had to abide by the commonsense budgeting principle of balancing expenses and revenues. Unfortunately, the principle was abandoned, and now the demands of budget discipline apply only to spending.

As a result, tax breaks have not been paid for by reductions in Federal spending, and thus the only way to pay for them has been to increase our deficit to historically high levels and borrow more and more money. Now we have to pay for those tax breaks plus the cost of borrowing for them. Instead of reducing the deficit, as some people claimed, the fiscal policies of this administration and its allies in Congress will add more than $600 million in debt for each of the next 5 years. That is why I will once again cosponsor the Pay-go amendment and continue to hope that my colleagues will return to a smart rule that has worked in the past and can work again.

Our debt also matters internationally. My friend, the ranking member of the Senate Budget Committee, likes to remind us that it took 42 Presidents 224 years to run up only $1 trillion of foreign-held debt. This administration did more than that in just 5 years. Now, there is nothing wrong with borrowing from foreign countries. But we must remember that the more we depend on foreign nations to lend us money, the more our economic security is tied to the whims of foreign leaders whose interests might not be aligned with ours.

Increasing America’s debt weakens us domestically and internationally. Leadership means that ‘‘the buck stops here.’’ Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better.

I therefore intend to oppose the effort to increase America’s debt limit.” (my bold)

It is really, really hard to argue with the logic presented, isn't it? This speech was given on the floor of the Senate way back on March 16, 2006 during the Bush II Administration.

As he said he would, the then Senator from Illinois and the current President of the United States voted “nay” to House Joint Resolution 47 which would have seen the debt limit increased to $8.965 trillion, an amount that almost seems laughably small by today’s standards, as shown here:

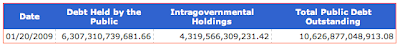

Here is a look at the debt level when the Senator from Illinois took over the White House:

Here is a look at the federal debt level today:

That's an increase of $6.12 trillion in debt or 68.3 percent of the entire debt ceiling limit that President Obama found so offensive back in March 2006. It is also nearly twice the projected increase of $3.5 trillion in debt that was proposed in President Bush's budget for the years between 2006 and 2011 that was of such great concern to the then Senator.

Consistency? Not so much. It does seem rather interesting that the current President is now expecting co-operation from the same august Congressional body that he was a part of in 2006 that didn't co-operate with the Bush II Administration when they needed to raise the debt ceiling, isn't it?

I guess that was the other "Barack Obama". Apparently, a politician's opinion on any given issue must be flexible, dependant on the political reality of that particular point in time.

Consistency – one of the rarest commodities in Washington.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment