Our friends at the Congressional Budget Office (CBO) released a report in February entitled "Changes in the Distribution of Worker’s Hourly Wages Between 1979 and 2009" which shows how the rate of hourly wages have changed over the past 30 years, how the wages at the top and bottom of the wage distribution (which is defined as dispersion) have changed and by how much. In addition, the CBO has studied these wage changes by gender.

Our friends at the Congressional Budget Office (CBO) released a report in February entitled "Changes in the Distribution of Worker’s Hourly Wages Between 1979 and 2009" which shows how the rate of hourly wages have changed over the past 30 years, how the wages at the top and bottom of the wage distribution (which is defined as dispersion) have changed and by how much. In addition, the CBO has studied these wage changes by gender.First, let’s look at how the CBO defines hourly compensation. Hourly compensation is defined as the sum of hourly wages, non-wage benefits provided voluntarily by employers such as employer-based health insurance and pensions and legally required benefits such as Medicare and Social Security. In 2007, non-wage benefits represented 27 percent of total hourly compensation with 8 percentage points for health insurance, 6 percentage points for paid leave, 3 percentage points for retirement benefits and 9 percentage points for legally required benefits. The cost of health insurance benefits rose from 5 percent to 8 percent of compensation in the years between 1987 and 2007.

The study looks at wage dispersion using 3 points of the United States wage distribution; the 10th percentile (10 percent of all wages fall below this point), the 50th percentile (or median which is the middle of the wage distribution) and the 90th percentile which is the top 10 percent of wages (90 percent of wages fall below this level). Wage dispersion over time is measured by how much the 90th percentile wage exceeds the 50th percentile or median and by how much the 10th percentile wage is less than the 50th percentile or median. As the spread between these values change over time, wage dispersion changes.

On to the details. In 2009, the median wage for men was $18.50 per hour or about $37,000 annually. The 90th percentile wage was $43.00 per hour or about $86,000 annually and the 10th percentile wage was $8.90 per hour or about $17,800 annually. Between 1979 and 2009, the median wage rose 8 percent after adjusting for inflation, the 90th percentile wage rose by 40 percent and the 10th percentile wage rose by 5 percent. Here is a graph showing the changes in 2009 dollars:

What I find particularly interesting is how slowly wages have risen in real terms (after inflation) over the 30 year period. For median wage earners, their annual real increase in hourly pay averages out to 0.27 percent (not compounded) annually over the thirty year period, a rather insignificant raise, don’t you think? When median wage is put into context with real output per worker over the same time period, there is a huge disparity; over the 30 year period, real output per worker rose by 59 percent

Using the data for women is somewhat complicated by the fact that the participation rate of women in the labour force rose sharply from 59 to 69 percent of the total labour force over the thirty year period. Women’s educational levels, choice of occupation and hours of work changed much more than those of men, making comparisons more difficult.

That said, among working women, the median wage in 2009 was $15.10 per hour or $30,200 annually ($6,800 less than men), the 90th percentile wage was $33.50 per hour or $67,000 annually ($19,000 less than men) and the 10th percentile wage was $8.00 per hour or $16,000 annually ($1,800 less than men). Over the 30 year period of the study, women’s median wage rate rose 37 percent after inflation (compared to 8 percent for men), the 90th percentile wage rose by 70 percent (compared to 40 percent for men) and the 10th percentile wage rose by only 8 percent (compared to 5 percent for men). Overall, the median wage rate of women in 2009 was 82 percent of the median wage of men; the gap between men’s and women’s wages narrowed substantially over the 30 year period for women at the median and at the 90th percentile. Here is a graph showing the changes in wages in 2009 dollars:

Back to the concept of dispersion. First we’ll look at the changes between the median wage and the 90th percentile or high income wage over the period studied then look at the changes between the median wage and the 10th percentile or low income wage over the same period.

1.) Changes in the difference between the median and high income (or 90th percentile) wages: Over the 30 year period, there was an increase in the difference between the median wage and the 90th percentile wage for both genders, meaning that higher income earners saw their wages increase at a faster rate than those who earned at the median. For men, the difference (or dispersion) between the median and the 90th percentile rose from an 80 percent difference in 1979 to a difference of 129 percent in 2009. For women, the difference (or dispersion) between the median and the 90th percentile rose from 79 percent in 1979 to 122 percent in 2009, roughly the same as that for men. Most of this increase in dispersion is attributed to growth in the number of college graduates compared to the number of high school graduates over the 30 year period; it was during that time that the differences between what a college graduate would earn compared to a high school graduate changed markedly.

2.) Changes in the difference between the median and low income (or 10th percentile) wages: Over the 30 year period, there was an increase in the difference between the median wage and the 10th percentile wage although not to the degree seen between the median and the high income earners. For men, in 1979, the 10th percentile wage was 50 percent lower than the median, this rose to 56 percent by 1986 but then rose and levelled off at the previous 50 percent level. For women, in 1979, the 10th percentile wage was 33 percent lower than the median, this rose to a 47 percent difference in 1986 where it has remained.

Here is a graph showing the changes in dispersion (differences in percentage) over time for both scenarios:

Why have wage increases for high income earners outstripped those at the lower income level?

1.) Growth in demand for workers skilled in technological innovations that require non-routine complex analysis, evaluation and decision-making. These requirements are often associated with advanced education. Here are two graphs showing how the median hourly wage is impacted by educational level over time for both men and women:

2.) Changes in patterns of international trade due to globalization. The increase in imports over exports has changed the type of workers required by businesses operating in the United States. Many of the goods and services that would formerly have been produced domestically are now imported, resulting in a decline in the demand for U.S. labour that would have been in demand in the past. As well, advances in long-distance communication has lessened the disadvantage to having workers in other countries. Despite these observations, changes to wage patterns in the United States cannot conclusively be attributed to globalization.

3.) Growth in the supply of highly educated workers slowed over the study timeframe. The increase in well-educated immigrants over the study affected the high wage earners by preventing wages from rising as much as they might have. As well, an influx of foreigners with little education kept wages at the lower levels from rising. Overall, the share of foreign workers rose from 6.5 percent of the work force in 1980 to 15.5 percent in 2009.

4.) The influx of highly educated women also impacted the high wage earners by preventing wages from rising as much as they might have because there were fewer constraints on the supply of skilled employees. Women’s share of the workforce rose from 38 percent of the workforce to 44 percent over the 30 year period.

5.) The decline in unionization from 20.1 percent of workers in 1983 to 12.3 percent in 2009 had an impact on wages in manufacturing most specifically. The power of unions to lift wages of low and middle skilled labourers has declined markedly and it is believed that up to one-third of the increase in dispersion between the median and the high wage earners is due to the decline in unionization. In fact, a January 2011 data release from the Bureau of Labor Statistics shows that union membership declined to 11.9 percent in 2010, its lowest level since comparable data were first collected in 1983. Overall, in 1983 there were 17.7 million union workers; that has declined to 14.7 million in 2010.

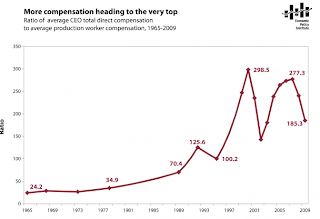

To sum up this posting, I am going to back up and change the subject slightly. In an earlier paragraph, I noted how little median wages had changed over the 30 year period. For men, the median wage rose only 8 percent after inflation and for women, the median wage rose by 37 percent. Now let’s look at what happened to the wages of those who lead the companies that we work for over the same time frame as a multiple of what an average production employee earns.

In 1979, an average CEO made 34.9 times the compensation of their average production worker. That ramped up rapidly to 298.5 times in 2001 and, in the tough year that was 2009, fell to 185.3 times. Here’s a graph from the Economic Policy Institute’s State of Working America website showing just how the disparity has grown over the past 4 decades:

This rather makes both an 8 and 37 percent increase in the real median wage of a working stiff over a 30 year timeframe look rather paltry, doesn’t it?

In researching this posting, I found it rather interesting to see just, on the whole, how little wages have changed over 30 years. Changes in the wage structure in the United States have made it exceedingly difficult for the "little guy/gal" to get ahead and may explain, at least in part, why the country is experiencing both a foreclosure and a debt nightmare. Certainly, many people over the past decade have spent far more than they could afford on housing (and toys), but wage stagnation especially at the median and below, explains at least part of the problem. It’s pretty hard to get ahead when increases in the cost of living are, in general, vastly outstripping what enters your bank account every two weeks.

Click HERE to read more of Glen Asher’s columns.

Article viewed at: Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment