This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

An article by M Ayhan Kose, Prakash Loungani and Marco Terrones, all of the IMF, on the VOX website examines why this global recovery is different and why, despite the fact that we are four years into the recovery, has it been so weak compared to past post-recession recovery periods.

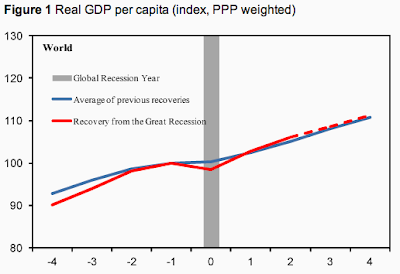

As shown on this graph, global real per capita GDP growth after the Great Recession (in red) has followed a path that is very similar to the average of previous recoveries (in blue):

On the graph, global real per capita GDP is normalized to a level of 100 in the year before the recession. On average, the world's economy has generally returned to its pre-recession level of output within a year of the end of the recession and this recession was no different on a global level.

Now, let's take a quick look at a graph showing GDP growth in the United States since 1990:

Notice that after the recession in the early 1990s and 2000s, that economic growth rates in excess of 5 percent were not uncommon. Such is not the case since 2008 as shown here:

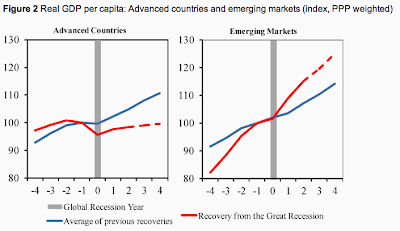

That noted, there is something different this time as shown on these graphs:

This time, the current recovery (in red) has been far different for advanced economies than it has been for emerging market economies with the economies of advanced nations being quite weak compared to both previous recoveries (in blue) and the recoveries of emerging nations.

Why the difference this time?

1.) Problems in the design of the single currency Eurozone.

2.) The severity of the financial crisis.

3.) The uncertainty of policies implemented by governments and central banks.

4.) The synchronized nature of the Great Recession across most major economies.

There are two additional factors at play that I will elaborate on.

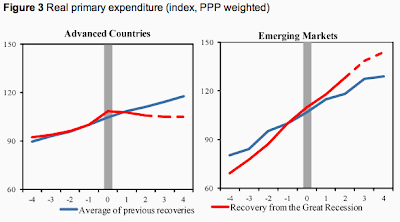

First, government expenditures, used to stimulate moribund economies, in the advanced and emerging economies are very different this time as shown on these these graphs:

In the past, in advanced economies, government expenditures expanded and real government expenditures increased as governments prodded their economies back to life. Not this time. For example, even though the United States government pumped trillions of dollars of fiscal stimulus into the economy, this was done very early in the recession and fell thereafter. In contrast, real expenditures in emerging market economies grew more rapidly than average. This is largely because emerging market economies had stronger fiscal positions than their advanced economy counterparts.

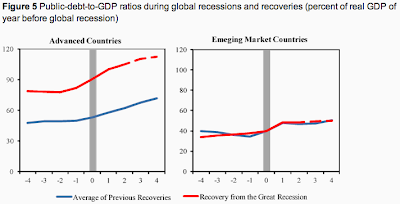

Second, the governments of advanced economies have a far higher level of debt prior to and during the recession than in past recoveries, particularly when compared to their emerging market counterparts. On top of that, the severity of the Great Recession meant that revenues collapsed, resulting in very high deficits and even higher debt levels. Here are graphs that show how public debt-to-GDP levels are different this time for both economies:

Note that the public debt levels of emerging market economies are basically the same as they have been throughout previous economic cycles in contrast to advanced economies.

This time, unlike past post-recession periods, the governments of most of the world's largest economies have been unable to spend their way out of trouble. It appears that the elevated level of public debt has finally caught up to us and that the world's economy has reached the point where it has to rely on central bank policies to bail it out. Unfortunately, now that we're at the zero bound on interest rates, central bankers are having to rely on unconventional (read experimental) measures that may have unintended consequences over the long-term.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment