A rather interesting bit of research by Marco Lagi and Yaneer Bar-Yam at the New England Complex Systems Institute examines Europe's debt crisis in some detail and makes suggestions regarding the timeframe of potential defaults by some of its worst debt offenders. Please keep in mind that the research is dated September 2012 and that some factors have changed since the research was completed, however, it is still relevant, particularly given the recent crisis in Cyprus.

Let's open by looking at why, even though they have sovereign immunity and no enforcing body to exact repayments, do nations ever choose to pay back their debts. National governments assume the following costs associated with defaulting:

1.) A loss of reputation.

2.) Trade sanctions.

3.) Harsh future credit terms.

4.) Exclusion from the world's credit markets.

5.) Reduced future economic growth.

Obviously, as interest rates for sovereign debt rise, the risk of default rises. As well, the more likely that investors suspect that a bond default will take place, the higher interest rates will be. Interest rates on sovereign debt are set by the willingness of those who loan the funds either by negotiation or by open market auction. As interest rates rise, the ability of nations to borrow money drops because the risk of default is considered to be too high. When markets are in equilibrium, economic conditions are used by those participating in the market to determine both interest rates and the risk of default. If there is a departure from equilibrium, increasing interest rates may contribute to, rather than be caused by, default risk.

In the study, the authors are able to show that over a 10 year period from 2001 to 2012 that the annually averaged long-term interest rates on the debt of several European nations are quantitatively related to the ratio of debt-to-GDP. For example, in the particular case of Greece, the market seems to expect that Greece will default on its debt once its debt-to-GDP ratio reaches the two hundred percent level.

The authors have built an equilibrium model of sovereign debt default risk that is able to quantify the consistency between interest rates and economic indicators and the ultimate risk of default using the ratio of debt-to-GDP. Each country in the analysis has a specific debt default threshold; for the countries in the study, the default threshold debt ratio varied between 90 and 200 percent of GDP. The trajectory of the debt can be used to estimate the timing of debt default which becomes a certainty as the debt threshold is passed. The timing of default can be shortened by sudden upwards increases in bond interest rates; to alleviate this time shortening, governments may find it necessary to enact more aggressive austerity measures.

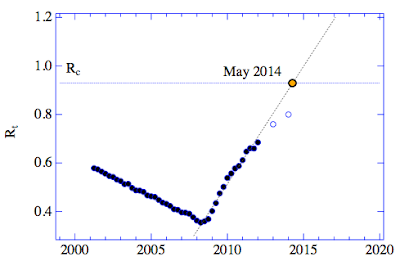

Now, let's look at some specific example plots of three key European debtor nations showing the debt-to-GDP ratio as a function of time for each. Keep in mind that Rt stands for the debt ratio and Rc stands for the critical threshold debt-to-GDP level.

1.) Ireland – date of default is April 2014:

2.) Spain – date of default is May 2014:

3.) Italy – date of default is June 2016:

In each case, the hollow circles on the plot show the projected debt-to-GDP ratio if all proposed austerity measures are met, a highly unlikely prospect. If these measures are not met, the curve becomes steeper and the time to default shortens since the debt-to-GDP level rises at a faster rate.

As you can see, according to this analysis, the Cyprus issue is but the tip of the European debt crisis iceberg. It would appear that the world's economy is living on borrowed time and that while Europe’s problems are not always headline news, the spectre of a key default is lurking in the background.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment