With the recent budget impasse in Washington, it seemed like a prudent exercise to look at the fiscal regime in the American capital given the partial shutdown and federal budget issues that seem to appear on a fairly regular basis. As I have done in the past, let’s look at how often Washington has suspended and raised the debt limit as well as invoking the use of “extraordinary measures” to ensure that the services provided by the federal government to taxpayers remain intact.

The modern debt limit was created in 1939 as the Public Debt Act of 1939 and was replaced with the Public Debt Act of 1941 (aka H.R. 2959 – 77th Congress) that set the stage for the financing of modern government debt financing. Here is the title page for the Act:

Until the 1941 act was passed, the federal government treated all interest and capital gains on its debt obligations as tax exempt. The 1941 act changed this by making the difference between the purchase and redemption price for savings bonds taxable. At the time that the Public Debt Act of 1941 was passed, the aggregate limit on all federal debt obligations was placed at $65 billion. Keeping in mind that the United States was about to enter the Second World War, this limit was raised as follows:

1942 – $126 billion

1943 – $210 billion

1944 – $260 billion

1945 – $300 billion

In 1946, the Public Debt Act was once again amended, lowering the debt limit to $275 billion.

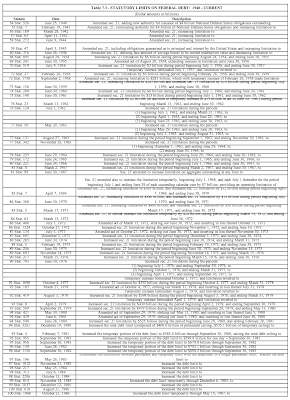

Here is a lengthy table showing the entire history of changes to the debt limit:

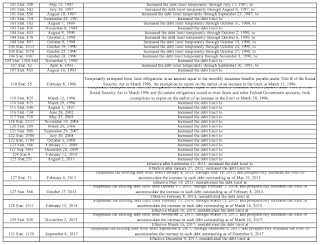

Since the concept of a debt ceiling was launched in 1941, Congress has either changed, amended or suspended the statutory debt limit 121 times (up to and including 2017).

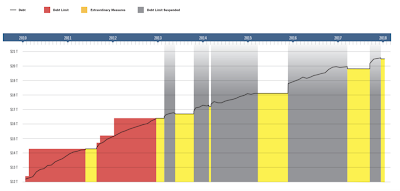

Here is a line graph showing the evolution of the debt ceiling since 1941 and how it is projected to grow out to 2023:

It is also important to note how the debt ceiling growth rate accelerated substantially just after the beginning of the new millennium as the War on Terror began and during the Great Recession when Washington spent trillions of taxpayers’ dollars bailing out Wall Street and the banking sector as a whole.

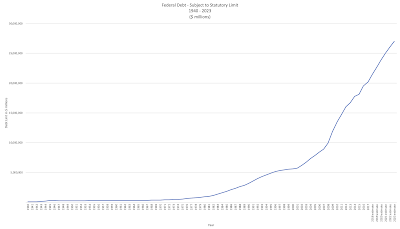

Here is a detailed look at the period between 2010 and the beginning of 2018 showing how often Congress has had to rewrite its own debt laws:

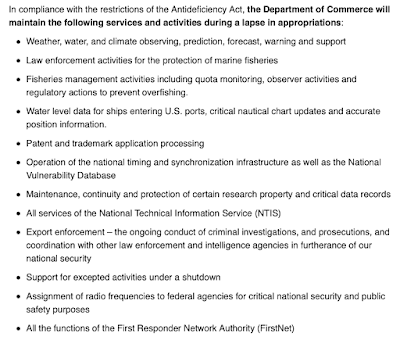

At some point, Congress may find it difficult to kick the debt can further down the road, particularly in a scenario where Washington will find itself bailing out the economy as it did during the Great Recession. If we want a sense of what could lie ahead should Washington continue its overspending ways, here is a screen capture from the United States Department of Commerce showing the federal government services that will remain active during the most recent lapse of Congressional appropriations:

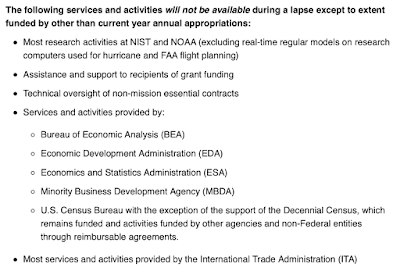

Here is a list of the services that will not be available during the funding lapse:

Obviously, the longer that the federal government is underfunded, the more services that will have to be reduced since the government cannot run on ether.

The current level of political polarization in Washington has very effectively accomplished one thing; it has made American voters forget all about the fiscal mismanagement that has taken place, an issue that will eventually cost American taxpayers hundreds of billions of dollars in annual interest payments on the debt that Washington has accumulated over the past two decades in particular.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment