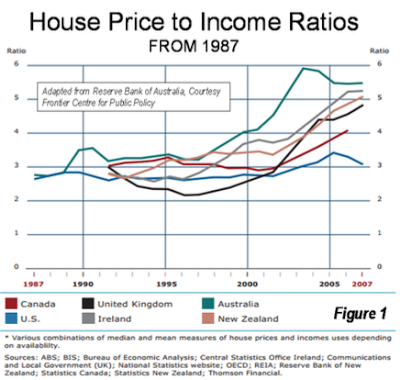

For thirteen years, Demographia has looked at a multi-nation sample, comparing real estate affordability when measured using their unique metric. This year, they look at residential housing affordability in Australia, Canada, China (Hong Kong), Ireland, Japan, New Zealand, Singapore, the United Kingdom and the United States and compare the affordability in both major metropolitan areas with populations greater than one million people and smaller urban areas.

Let’s open by looking at how Demographia defines housing affordability. Rather than simply looking at median house prices in a given market to determine affordability, the authors of the report use a metric that they call the “median multiple” which is defined as follows:

Median Multiple = Median Price of a Home in a Market

Median Household Income in that Market

Demographia then divides the median multiple metric into affordability brackets as shown here, noting that a median multiple of around 3.0 is historically significant as a break-over point between affordability and non-affordability as shown here:

Here are Demographia’s house affordability ratings using the median multiple:

Median Multiple of 3.0 or less – Affordable

Median Multiple of 3.1 to 4.0 – Moderately Unaffordable

Median Multiple of 4.1 to 5.0 – Seriously Unaffordable

Median Multiple of 5.1 or more – Severely Unaffordable

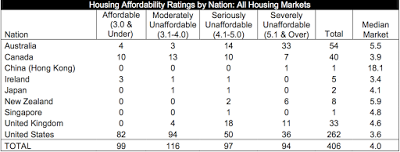

Let’s start by looking at the housing market affordabilities for all 406 housing markets in the 9 nations in the study, showing how many markets in each nation fall into each affordability bracket:

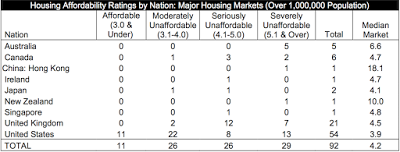

Here is a table showing the affordability ratings for the 92 major housing markets (population greater than one million) in each of the nine nations, which shows us that, in general, the major markets are far less affordable than their smaller counterparts.

Here is a table showing the ten least affordable major housing markets in the study:

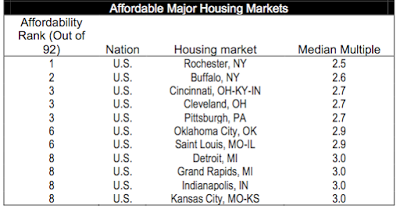

In contrast, here are the ten most affordable major housing markets, all of which are located within the United States:

Now, as I have done in other years, let’s focus on the affordability of housing in the United States, looking at both the most affordable and least affordable markets and how the affordability has changed from the previous year. Let’s start with this graph which shows the affordability of middle-income housing in the ten largest real estate markets in the United States between 1995 and 2016:

As we can see, Los Angeles and Chicago have seen significant decreases in affordability since the housing market bubble burst in 2007 – 2008. As well, all of the ten largest major markets in the United States are now considered to be unaffordable by a household with all of them having a median multiple greater than 3.1.

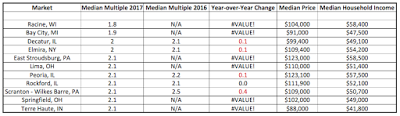

Here is a table showing the ten most affordable real estate markets in the United States using the entire sample of both large and smaller markets:

As you can see, the affordability in America’s most affordable real estate markets has changed little between 2016 and 2017 where the data is available for both years.

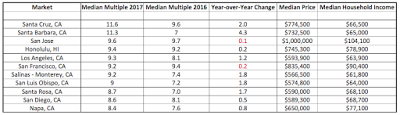

Here is a table showing the ten least affordable real estate markets in the United States using the entire sample of both large and smaller markets:

As in previous years, the majority of America’s least affordable housing markets are located in a single state with nine out of ten of the nation’s least affordable housing markets being located in California. As well, there are an additional six California markets that are considered severely unaffordable for a total of 15. As well, as you can see, affordability has declined in all but two of the ten least affordable markets with significant affordability declines in Santa Cruz, Santa Barbara, Salinas – Monterey, San Luis Obispo and Santa Rosa. It’s also an interesting exercise to compare median household incomes in both groups; the median household income in the East Stroudsburg, PA market is $58,500; this compares to $66,500 in Santa Cruz, CA, a difference of $8000 or 13.7 percent annually. Median real estate prices are a whole different story; the median price of a home in East Stroudsburg is $58,500 compared to $774,500 in Santa Cruz, a difference of $716,000 or 1224 percent! That’s as clear an explanation of the variation in housing affordability as one can imagine.

It is quite clear that the United States real estate market has been split into two parts; the former industrial heartland where housing is incredibly cheap, even by historical standards, and the market in California where real estate valuations are becoming increasingly unsustainable. With the Federal Reserve rattling the “interest rate cage” on a regular basis, even a small increase in mortgage rates could prove to be problematic for America’s most overvalued real estate “owners”.

Click HERE to read more.

Vote for Shikha Dhingra For Mrs South Asia Canada 2017 by liking her Facebook page.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment