While the global stock market, particularly the American stock market, seems to be on an endless upward trajectory, there is a little discussed aspect of the business sector that could bring the global economy to its knees as you will see in this posting.

Let’s open this posting with a definition:

“A derivative is a security whose price is dependent upon or derived from one or more underlying assets. The derivative itself is merely a contract between two or more parties. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Most derivatives are characterized by high leverage.”

Derivatives can be traded over-the-counter (OTC) or on an exhange with OTC derivatives comprising the majority of derivatives that currently exist. These OTC derivatives are unregulated and have a far greater risk for the counterparty (i.e. one of the two parties that participates in the derivative transaction) than exchange traded derivatives.

Derivatives started out as a means for international traders to ensure that the exchange rate for internationally traded goods were balanced. As is typical in the financial sector, the use of these contracts has mushroomed into the speculative world and are often characterized by very high levels of leverage and risk.

Here are some common types of derivatives:

1.) Futures Contracts – an agreement between two parties for the sale of an asset at an agreed upon price. Futures contracts can be used to hedge against risk and can also be used to speculate on the future price of a commodity/stock etcetera. Futures contracts are standardized so they can be traded on a futures exchange.

2.)Forward Contracts – a customized contract between two parties to buy or sell an asset at a specific price on a future date. Forward contracts can be used for both hedging and speculation. Since forward contracts are not standardized (i.e. commodity type, amount and delivery date can vary), they are traded as an over-the counter instrument. As noted above, forward contracts are riskier than futures contracts since defaults can occur when a counterparty fails. These contracts are often used by corporations to hedge currency and interest rate risks.

3.) Swaps – a contract between two parities agreeing to trade loan terms.

4.) Options – an agreement to buy or sell a security from one party to another at a predetermined future date. In contrast to a futures contract, the buyer or seller is not obligated to complete the transaction if they do not wish to do so. Options can be short, long, puts or calls.

5.) Credit Derivative – an agreement to sell a loan from one party to another at a discounted price.

6.) Mortgage-backed Securities – similar to other types of derivatives with mortgages as the underlying asset.

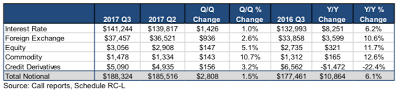

Let’s look at the world of derivatives from the viewpoint of the Office of the Comptroller of Currency. In its latest quarterly report, we find the following exposure to derivatives (in billions of dollars):

At a total of $188.3 trillion, the notional value of derivatives is roughly 9.7 times as large as the entire U.S. economy (using Q3 2017 GDP of $19.501 trillion) with interest rate derivatives making up 75 percent of the total. You can also see that the total notional value of derivatives in the banking sector has grown by 6.1 percent on a year-over-year basis with interest rate derivatives rising by $8.251 trillion over the year. If we exclude the 22.4 percent drop in the value of credit derivatives over the year, since Q3 2016, the notional value of derivatives has risen by $13.336 trillion or 68.4 percent of the U.S. economy.

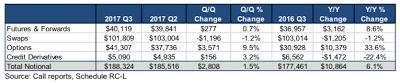

With the background on the types of derivatives, here is a breakdown in the value of four main types of derivative contracts outstanding in the third quarter of 2017 (in billions of dollars):

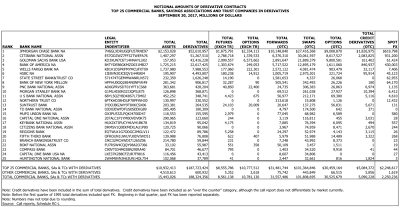

The four largest banks with the most derivative activity hold 90.2 percent of all banking sector derivatives, totalling $169.8 trillion dollars. The largest 25 banks in the United States hold basically 100 percent of all derivative contracts as shown on this table:

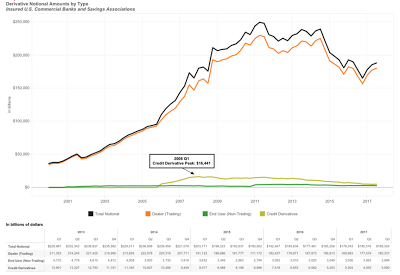

Here is a graph showing how the notional value of derivatives have changed since 2000:

While down from its peak of $249 trillion in the second quarter of 2011, the value of derivatives has mushroomed since the first quarter of 2000 when the notional amount of derivatives in U.S. commercial bank portfolios was a rather measly $37.6 trillion.

What is the potential downside of all of this “paper”? The 2017 edition of the Financial Stability Report from the Office of Financial Research outlines the vulnerability posed by derivatives, particularly in the case of a failing financial firm. The report notes that, historically, there have been problems resolving nonbank financial firms’ over-the-counter (OTC) derivatives positions through bankruptcy. Under current law, there is a significant risk that a run will take place on a bankrupt firm’s derivatives counterparties, a situation that occurred when Lehman Brothers Holdings Inc. filed for bankruptcy in September 2008. Counterparties terminated most of Lehman’s 6000 plus derivative contracts (which accounted for only 5 percent of the global derivative markets) resulting in losses on its derivatives portfolio, magnifying the impact of Lehman’s failure on the American banking system.

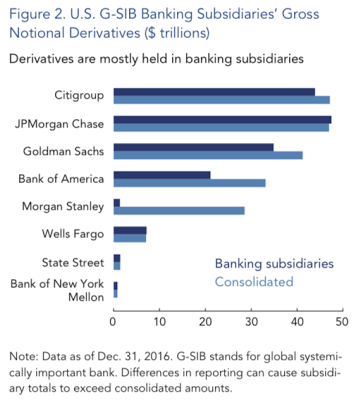

Here is a graphic showing the notional value of derivatives held by the United States global systemically important banks (G-SIB) and their banking subsidiaries to the end of 2016:

The authors of the report note that finding assignees for the over-the counter derivatives portfolios held by larger United States global systemically important banks could be difficult since there are very few potential buyers at that level. If a derivatives portfolio is “out of the money”, selling the failed bank’s portfolio might be impossible at any price, causing a cascade of issues for the banking sector.

As we can see from this posting, there is a very significant potential risk to the global economy related to the extremely large derivatives positions held by America’s largest banks. Should an unexpected shock like 2007 – 2008 roil the markets again, the systemically important banks in the United States and around the globe could find themselves holding paper that is nearly worthless. If one party (i.e. counterparty) to a derivative contract fails, the impact can cascade through the financial system, a repetition of what happened as the contagion spread during beginning of the Great Recession.

Apparently, when it comes to the U.S. banking sector, some lessons are never learned.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment