This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Maritime Electric appears to be profiteering from electricity monopoly and preferential treatment from government with two stories – one for PUC and another for shareholders

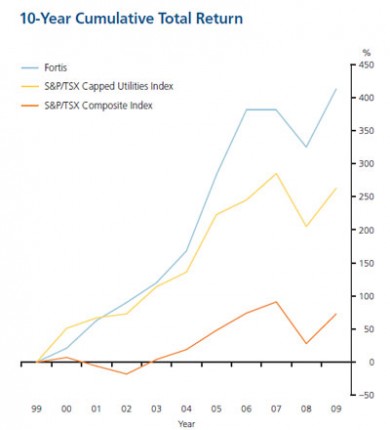

Fortis Inc, 10 Year Cumulative Returns may indicate profiteering on it’s monopoly markets (Source – Fortis 2009 Annual Report)

Premier Robert Ghiz told the PEI Legislature that he has arranged a 14% reduction in electricity rates with Maritime Electric. The rates will be held at that level for 2 years.

The numbers don’t add up. For the past two years Maritime Electric has been collecting higher electricity bills that have increased their shareholder returns to double the approved rate. ME has increased their dividends by 50%. The interest “savings” projected by the government are only $15 per customer not 14%.

Our inexperience Premier has met some very sharp business people in the likes of Maritime Electric and Fortis. He has bought into a “funny money” deal that has Maritime Electric and their parent Fortis laughing all the way to the bank.

Ex-NB Shawn Graham’s “funny money”deal to sell NB Power and lower rates cost him the election. PEI’s taxpayers may revolt against this one as well. Most of the online commentary is negative on the scheme.

Here are some of the financial holes in this Swiss cheese sandwich.

The Loan

The reduction is contingent on PEI loaning $35 million to Maritime Electric at preferential rates. The loan will be paid back over 25 years. Everyone agrees taxpayers or Maritime Electric rate customers, who are one and the same, will be paying this loan back.

There are many questions about this arrangement and Maritime Electric’s monopoly power on PEI.

When Maritime Electric has made various rate applications at the PEI PUC it has argued necessity. However, it appears ME has been profiteering. Best returns for a utility in Canada

In their 2009 Annual Report, Maritime Electric’s parent Fortis Inc. is bragging about exceeding a 400% cumulative rate of return, whereas the Utility Index has been only250% and the TSE has has a return less than 90% over the decade. Considering the rate increases ME has said it needed to survive, it’s easy to see that Islanders are building shareholder value at the expense of their own wallets.

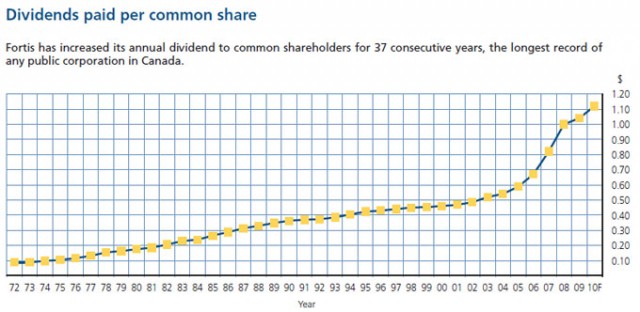

Dividends take a spike up after Ghiz election

“Fortis has increased its annual dividend to common shareholders for 37 consecutive years, the longest record of any public corporation in Canada.” (Annual Report 2009)

Between 1990 and 2006, Maritime Electric paid an annual dividend of $0.40 to $0.60 in the orderly fashion the market expects of utilities.

All of a sudden in 2007, coincidentally the year Robert Ghiz was elected Premier of PEI and the electricity rates started their 50% increase on PEI, Maritime Electric started increasing dividends to shareholders.

By 2009 Fortis were touting about paying dividends of $1.04.

Rate of return numbers contradict rate hearings

Maritime Electric is guaranteed an 10% return to shareholders in rate setting hearings. (This was previously reported as 8% but somehow all the numbers on the Annual Report are higher.)

Unlike the rate agreement set with Premier Catherine Callbeck, Islanders are paying cost plus to Maritime Electric.

While 10% is an arguable rate of return, Maritime Electric claims their actual rate of return is 18%.

“Over the past 10 years, Fortis delivered an average annualized total return to shareholders of approximately 18 per cent, the highest in our sector.” (Annual Report 2009, page 4)

Well, well, the truth comes out. Maritime Electric is earning another 8% for it’s shareholders. That is the basis on which the the PUC granted their rates.

Numbers don’t add up on loan

The “Big Lie” being sold to Islanders is that PEI can borrow money at a lower rate because we are bigger than Fortis.

ME’s cost of borrowing $35 million at 7% would be a $1 million annual saving over the Provinces stated rate of 4%. That is an interest saving of $15 a year for each Maritime Electric customer.

That simply does not c0mpute. How does a $1 million saving amount to a rate reduction of $2.4 million for ME customers?

PEI is a sovereign Province but our annual budget is less than 50% of Fortis which reports annual revenues of $3.6 billion versus PEI’s $1.3 billion.

Utilities in North America are considered slow gold mines. They have locked in customers and only have to convince political regulators to allow them cost plus rate structures. The joke is: how do you increase profits in a utility? Redecorate head office since the cost will be passed on to customers at a profit.

Fortis bonds are rated AA except for the default in Belize.

According to their Annual Report, Fortis is paying interest rates between 6% and 9%. They also fund money through debentures are similar rates.

If Premier Ghiz had any management skills and fortitude he would climb out of bed with Maritime Electric and start looking out for Island taxpayers.

By Stephen Pate, NJN Network

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment