This article was last updated on May 20, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Recently, there have been many news reports on China and whether or not the country is deliberately manipulating the value of its currency, the yuan, by undervaluing it. Many economists feel that China is undervaluing its currency by 25 to 40 percent, making their exports cheaper and making imports from their trading partners more expensive. In light of all of the news, I thought I’d take a two part look at China’s economy, in particular, the country’s foreign reserves in comparison to its debt in the first instalment and its gold reserves in the second.

China has the world’s largest foreign exchange reserves even when excluding its physical gold. According to the People’s Bank of China (PBOC), the country’s foreign reserves totalled $2.454 trillion dollars in June 2010. China’s foreign reserves grew at a rate of 15.1% year over year and have risen from $165.6 billion in 2000. They currently hold yen, United States dollars, euros and other currencies in reserve. China’s currency reserves are now approaching 4 percent of the world’s annual GDP. Here’s a screen cap from the PBOC website showing the growth in the country’s reserves in 2010:

For those of you who aren’t aware of the PBOC, it is the central bank of the People’s Republic of China and has more assets than any other financial institution in world history. As a note of curiosity, while the rest of the world divides its interest rates by quarters (0.25%), interest rates set by the PBOC are always divisible by 9.

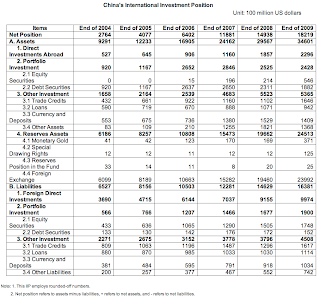

Not only does China have massive foreign currency reserves, according to SAFE’s report for the year 2009, they have direct investments abroad (operation of China-owned enterprises outside China) totalling $229.6 billion, portfolio investments (bonds, money market investments, treasury bills) totalling $242.8 billion and other investments (trade credits, loans, currency etc.) totalling $536.5 billion.

From the SAFE website, here’s a screen capture showing their foreign international investments including their foreign reserves in currencies, gold, trade credits and loans to the end of 2009:

According to the State Administration of Foreign Exchange (SAFE), China has stated that they will not use their vast foreign reserves as a "nuclear weapon" against the United States by dumping their holdings of United States Treasuries, largely estimated to be roughly two-thirds of their holdings. It would not likely be in China’s best interest to dump United States paper because a decline in the U.S. dollar (or any of the other currencies that they hold) would have a negative impact on the size of their reserves. China has repeatedly expressed concerns about the serviceability of massive government debt being taken on by both European nations and the United States. One interesting direction from China is their urging of other nations to end stimulus spending; advice which is being ignored by both the United States and Japan who have recently announced plans for additional stimulus. China’s huge holdings in currencies do provide a trap of sorts for China. They cannot sell their holdings without a massive capital loss as the value of the currency declines and if they cease to accumulate more currency reserves, their actions could be leave the world’s currency markets with a bearish perspective on that particular currency. I like to think of their reserves of paper as a variety on the age old Chinese finger puzzle.

SAFE states that China’s external debt at the end of 2009 stood at $428.65 billion excluding debt held by Hong Kong, Macao and Taiwan Province. The majority of China’s external debt was comprised of international commercial loans (74.4 percent) and the balance was from foreign government loans and loans generated by international financial organizations (25.6 percent). The majority of the debt was denominated in United States dollars. The total interest payments on the medium and long term debt in 2009 was $3.629 billion. China calculates its external debt-to-GDP ratio at 8.73 percent and its ratio of short-term debt to foreign exchange reserves was 10.81 percent. In comparison, the external debt of the United States stood at $13.984 trillion on June 30th, 2010 according to the United States Treasury Department. With the United States’ GDP estimated to be $14.14 trillion in 2009 by the CIA world fact book, we can see that the debt-to-GDP ratio of the country is rapidly approaching the magic 100 percent mark. The interest on the United States debt for fiscal 2010 reached $413.9 billion. Japan’s gross public debt is estimated to be $10.14 trillion by the end of 2010, a whopping 197 percent of GDP, the second worst level in the world after Zimbabwe.

There is some discussion that China vastly underestimates its true debt-to-GDP ratio. Professor Victor Shih, a specialist in Chinese politics at Northwestern University, estimates that 8000 local investment entities have borrowed close to $1.6 trillion, roughly one-third of China’s GDP. The Chinese government has ordered banks to lend to investment companies set up by local and central governments, allowing them to borrow enormous sums of money. As well, there are other debts that the central government guarantees such as Ministry of Railway bonds. Since local governments are the most likely to default on their loans, the Chinese government may find itself taking over billions of dollars worth of bad debt.

Regardless of whether or not local entity debt is included in China’s calculations of its debt to GDP ratio, it would appear that their economy is, at least presently, in far better shape when it comes to central government debt accumulation than the United States, the United Kingdom and Japan.

In the second part of this posting, I will examine China’s growing investment in gold.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment