Many of us have suspected that the middle class has been left out of the economic benefits that have allegedly accrued over the past decade particularly when it comes to wage growth when compared to those that dwell at the top of society's heap. A study by Lawrence Mishel and Heidi Shierholz of the Economic Policy Institute examines what has happened to wages and benefits over the past decade and how workers' real wage gains have evolved particularly since the "end" of the Great Recession.

The authors looked at wages from two perspectives:

1.) Using establishment data supplied by surveys that are employer-based.

2.) Using household data supplied by surveys that are household-based.

Let's open by looking at a graph that compares real average hourly compensation growth and productivity growth between 2000 and 2013:

As you can quickly see, since 2004, real growth in hourly compensation has been stagnant no matter what measure is used. In the period between 2000 and 2007, productivity grew by 16 percent whereas compensation grew by between 5.5 percent and 7.2 percent depending on the measure used. Since the Great Recession in the years between 2007 and 2012, productivity grew by 7.7 percent whereas real growth in compensation in the private sector "grew" by between 0 percent and -0.6 percent depending on the measure used.

Now, let's look at the impact of educational attainment on real wage growth. For those of us that are baby boomers, the mantra of the necessity of getting a college or university education to succeed in life was drilled into us from the early years. While a post-secondary education does provide a wage premium, that premium has stalled at between 40 and 50 percent since the late 1990s as shown on this graph:

Both college-educated genders have seen the premium stall at about 45 to 46 percent for women and 48 to 49 percent for men since before the Great Recession. White collar managers and professionals have seen real wage increases of 4.7 percent between 2001 and 2012. By comparison, blue collar construction and natural resource workers have seen real wage increases of 5.9 percent and installation and maintenance workers have seen real wage increases of 5.3 percent over the same time frame. Over the past year, all workers have seen real wage increases of only 0.3 percent with white collar managers and professionals seeing real wage increases of 0.3 percent and blue collar construction and natural resource workers seeing real wage increases of 0.1 percent. The minute difference in real wage growth between the two groups is rather stunning even in light of the wage premium. It certainly makes one question the wisdom of accruing tens or hundreds of thousands in debt for a wage gain that is not growing.

So, in all of this, who is benefitting the most from real wage increases (as though you can't guess). Here's the answer:

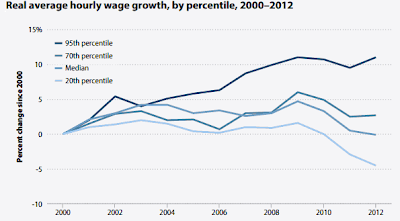

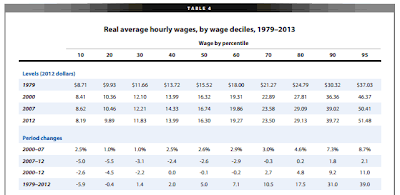

Since the Great Recession, all income groups under the 70th percentile (i.e the lower and middle classes) have seen a decline in real wage growth and, in the case of wage earners in the bottom 20 percent as shown in the lightest blue line, they have seen their wages shrink by 5.5 percent in real terms between 2007 and 2012. The only wage group that saw increasing real growth in wages was the top five percent (the 95th percentile as shown in the darkest blue line). This group has seen their real wages rise by 11 percent between 2007 and 2012 as shown on this chart:

Over the past year (2012 to 2013), wage earners in the 50th percentile and greater (excluding those in the 10th percentile) have seen real but very modest wage gains ranging from 0.6 percent to 2.0 percent. Those on the losing end who fall in the 20th to 40th percentile saw real wage contractions ranging from -0.2 percent to -0.7 percent over the year.

As you can imagine, a great deal of real wage growth in recent years can be attributed to very low inflation rates rather than significant increases in nominal wages. With very low inflation, even a modest raise of three or four percent still provides the recipient with a one to two percent real wage increase. Even modest raises like that do not appear to be prevalent in today's job marketplace. As one would suspect, in this environment of "you're damn lucky to have a job", employers are less than motivated to actually increase wages by a significant amount.

So much for shared prosperity. It's no wonder that so many Americans are feeling poorer as the years pass. The fact that productivity keeps growing while wages remain stagnant makes one wonder how much longer corporations will be able to squeeze more and more blood out of a stone without giving something back. And, until consumers feel that they have sufficient credit or income to spend, the economy is likely to continue to expand at a rather tepid rate as has been typical since the end of the latest recession.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment