In recent weeks and months, page one news for most of the world’s major (and minor) newspapers and media outlets has been the debt crisis facing the Eurozone, most particularly Greece and, most recently, Italy. It has certainly been a roller coaster ride for the world’s bond and stock markets which fluctuate on a daily basis, solely based on that particular day’s perception of whether or not a given nation will default on its debt. In light of that, I thought that it would be prudent to take a look back at the largest sovereign debt default which took place back in 2001. Please excuse me in advance for the length of this posting, but I wanted to ensure that the entire story was told.

In recent weeks and months, page one news for most of the world’s major (and minor) newspapers and media outlets has been the debt crisis facing the Eurozone, most particularly Greece and, most recently, Italy. It has certainly been a roller coaster ride for the world’s bond and stock markets which fluctuate on a daily basis, solely based on that particular day’s perception of whether or not a given nation will default on its debt. In light of that, I thought that it would be prudent to take a look back at the largest sovereign debt default which took place back in 2001. Please excuse me in advance for the length of this posting, but I wanted to ensure that the entire story was told.After several years of recession which was accompanied by social unrest, Argentina’s government imploded and stopped payments on its debt. The default on $100 billion worth of debt that was owed to both domestic and foreign investors, was the largest sovereign default in history. The world’s experience with Argentina’s default serves as a laboratory for what might lie ahead for an ever-increasing number of debtor nations who simply will not be able to service their existing and future debt loads. The major difference between what happened in 2001 and what is happening today is scale; government debt for debtor nations today is far higher in both nominal and real terms than the issues that faced Argentina back in 2001. Let’s take a look at what happened and what is still happening as Argentina reinvents itself in the eyes of the investment community.

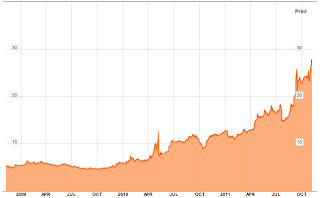

Back in 1989, Argentina fell into a period of hyperinflation with inflation peaking at 84 percent in 1991 that threatened to destabilize their economy. The IMF introduced a “Convertibility Plan” in April of 1991 to stabilize the economy through a measure that fixed the peso to U.S. Dollar exchange rate at one-to-one at the same time as Argentina’s central bank was restricted from printing endless supplies of paper which they had historically been prone to do (does this sound at all familiar, Mr. Bernanke?). For the next several years, the Argentine economy stabilized and actually grew at an average annual rate of 6 percent through 1997. Inflation dropped from its hyperinflationary peak in 1991 to a low of 0.1 percent in 1996. Unfortunately, external debt grew from $62.3 billion in 1991 to a peak of $146.3 billion in 2000, largely due to debt rollovers. The halcyon days of the early to mid-1990s ended with a sudden jolt in August/September 1998 when Russia defaulted on its own sovereign debt followed by the devaluation of Brazil’s real in January 1999. This triggered a severe recession in Argentina that did not correct itself, resulting in a loss of confidence in the quality of Argentina’s debt, a concern that eventually became self-fulfilling. It also became apparent that the “Convertibility Plan” had an unforeseen weak spot; because it fixed the USD to peso exchange rate, it prevented Argentina from devaluing the peso which compounded the drop in exports. Oops! By late 2000, Argentina was having an increasingly difficult time accessing capital resulting in a very sharp rise in the spread between United States Treasuries and Argentine bonds as shown on this graph:

Does the trend on this graph look familiar to anyone? Here’s a graph showing the yields on Italy’s 10 year bonds for the past 3 years:

Here’s the same 3 year graph showing the yield on Greece’s 10 year bonds:

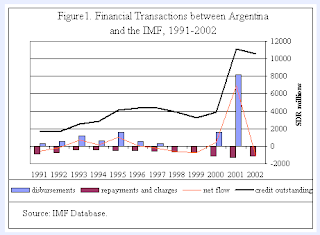

By the second quarter of 2001, capital was flying out of Argentina at light speed, necessitating even further IMF intervention as I will show later. Runs on the local banking system resulted in a partial freeze and finally, after (belatedly) deciding that Argentina was no longer in compliance with the conditions of the IMF-sponsored program, the IMF decided to withdraw its support and suspend disbursements. When Argentina defaulted, it owed private investors $81.8 billion, the Paris Club countries $6.2 billion and the IMF $9.8 billion.

It is interesting to note that Argentina’s debt problems escalated in an extremely short period of time. In late 2001 around the time of the default, Argentina’s debt-to-GDP ratio sat at 53.7 percent, what would appear to be a very comfortable level compared to today’s sovereign debt transgressors. Following default and devaluation of the Argentine peso, the country’s debt-to-GDP soared to 166.4 percent in 2002, still relatively reasonable when compared to many debtor nations today. What led to this crisis? According to a 2010 report by the Congressional Research Service’s J.F. Hornbeck entitled “Argentina’s Defaulted Sovereign Debt: Dealing with the Holdouts”;

“Argentina’s 2001 debt crisis resulted from many factors. For the most part, Argentina fell victim to its own economic policies,but these were compounded by questionable lending and policy advice by the International Monetary Fund (IMF), a global recession, and international credit markets determined to chase high-yielding debt with inadequate regard to risk. Together, these factors propelled Argentina toward a position of unsustainable debt that ended in an unprecedented default and restructuring scheme.” (my bold)

Well, look at that! The IMF compounded Argentina’s debt problem by offering questionable lending and policy advice. Apparently, global credit markets continued to loan money to Argentina even when the country’s debt rose to worrisome levels. Does this story sound familiar to anyone other than me? Accompanying the additional loan facility was assurances by both investment banks and credit agencies that overstated Argentina’s strengths. Once again, a familiar story. As if all of that was not bad enough, between 1991 and 2001, the IMF agreed to numerous lending arrangements to the Argentine government that were based on promised changes to Argentina’s policies that were either overly optimistic, unrealistic or a combination of the two. The IMF compounded the problem with lax supervision and ended up lending too much for too long into a situation that was quite clearly untenable. Here’s an interesting quote from the IMF’s Independent Evaluation Office (IEO) report on the role of the IMF in Argentina between 1991 and 2002:

“Argentina was plunged into a devastating economic crisis in December 2001/January 2002, when a partial deposit freeze, a partial default on public debt, and an abandonment of the fixed exchange rate led to a collapse in output, high levels of unemployment, and political and social turmoil. These events have raised questions regarding the country’s relationship with the IMF because they happened while its economic policies were under the close scrutiny of an IMF-supported program. Furthermore, the IMF had been almost continuously engaged in Argentina since 1991, when the “Convertibility Plan” fixed the Argentine peso at parity with the U.S. dollar in a currency board-like arrangement. While Argentina experienced strong growth and very low inflation for much of the 1990s, it fell into a deep recession in 1998 and, partly because of the strictures of the convertibility regime, became increasingly constrained in its ability to use standard macroeconomic policy tools to engineer a recovery. As the economy slowed and international investors became nervous, the country’s already high external debt service burden grew to a point where the debt became unsustainable….While ultimate accountability for a member country’s economic policy must rest with its national authorities, since the crisis, a number of observers have raised questions about the effectiveness and quality of financing and policy advice provided by the IMF. Some critics have argued that the IMF’s main fault lay in providing too much financing without requiring sufficient policy adjustment, while others have alleged that the policies recommended by the IMF actually contributed to the crisis. In either case, the eventual collapse of the convertibility regime and the associated adverse economic and social consequences for the country have, rightly or wrongly, had a reputational cost for the IMF.” (my bold)

I’d say rightly…so why is it that governments around the world continue to support the IMF and allow it to step in to “rescue” debtor nations?

Here’s a graph from the IEO report showing the massive ramping up of monies disbursed to Argentina in the year of default and the rapid growth in debt (credit outstanding):

As a result of the default, Argentina’s economy contracted by 20 percent from the onset of the recession in 1998 to the end of 2002. This led to massive unemployment and further social unrest as one can well imagine.

Let’s briefly address what has happened since Argentina’s default in 2001 – 2002. Following the default, there was a very lengthy and unsuccessful attempt to find a mutually acceptable solution between the creditors and the Argentine government. The most pressing issue was that Argentina was simply in no fiscal position to repay its $98 billion debt. By January 2005, Argentina had only reached agreement with 76 percent of its creditors and had accrued an additional $21.4 billion in past due interest on top of what it owed back in 2001. Of the $81.8 billion of debt held by the private sector, $62.2 billion worth was exchanged for $35.2 billion of new bonds, a 56 percent recovery rate (or a 44 percent haircut). The problem arose with the 24 percent of creditors who did not accept the offer along with the accrued past due interest as well as the arrears to the Paris Club and the poor, old IMF. To get out from under the heavy hand of the IMF, in 2006, Argentina paid back the full $9.8 billion owing. As of January 2010, Argentina still owed $29 billion of bond principal and past due interest to private investors and $6.2 billion to the Paris Club countries. One would have to think that this is a perfect example of attempting to get “blood from a stone”. Here is a chart showing the current status of Argentina’s sovereign debt:

Interestingly, nearly $500 million is owed to the United States which has frozen $105 million of Argentina’s Central Bank reserves at the Federal Reserve Bank of New York and another $2 billion of global bonds backing loans are on hold at the Depository Trust Company. This has meant that, under United States law, various U.S. agencies are prohibited from lending to Argentina because it is in arrears on its debt.

Argentina’s economy has done remarkably well since the default; GDP growth rose to 8.8 percent in 2003 and averaged 8.5 percent annually until 2008. Public debt-to-GDP has dropped from a peak of 166.4 percent in 2002 to a low of 48.8 percent in 2008 and the country has had a primary surplus of 2.8 percent or higher until recently. On top of all this feel good data, Argentina’s international reserves have risen from $10.4 billion in 2002 to $47.5 billion in 2009.

Now let’s summarize. Looking at the issues facing Argentina during the onset of its debt default crisis, one has to wonder what was going through the learned minds at the IMF with their 11th hour, hail Mary dumping of credit into Argentina when it was so apparent that failure was eminent, particularly given the fact that Argentina’s central bank loved to print its way out of trouble? It begs the question, “Will the bailout of the offending Eurozone nations turn out any differently or is the agony just being prolonged?” I’ve said it before and I’ll say it again; apparently, economics is NOT a science!

The more things change, the more they stay the same. Unfortunately, some lessons are learned in a very, very hard way, particularly by the world’s central bankers and the IMF. It will be interesting to see if history repeats itself on the east side of the Atlantic Ocean this time.

Article Viewed on Oye! Times @ www.oyetimes.com

To view all Glen Asher Blogs Click HERE

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment