This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…With Russia and Ukraine hitting the world's 24 hour news cycle over the past weeks and the threat of sanctions now hanging over Russia, there is an issue that will affect the geopolitical picture and how Russia is dealt with, particularly by Europe.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…With Russia and Ukraine hitting the world's 24 hour news cycle over the past weeks and the threat of sanctions now hanging over Russia, there is an issue that will affect the geopolitical picture and how Russia is dealt with, particularly by Europe.

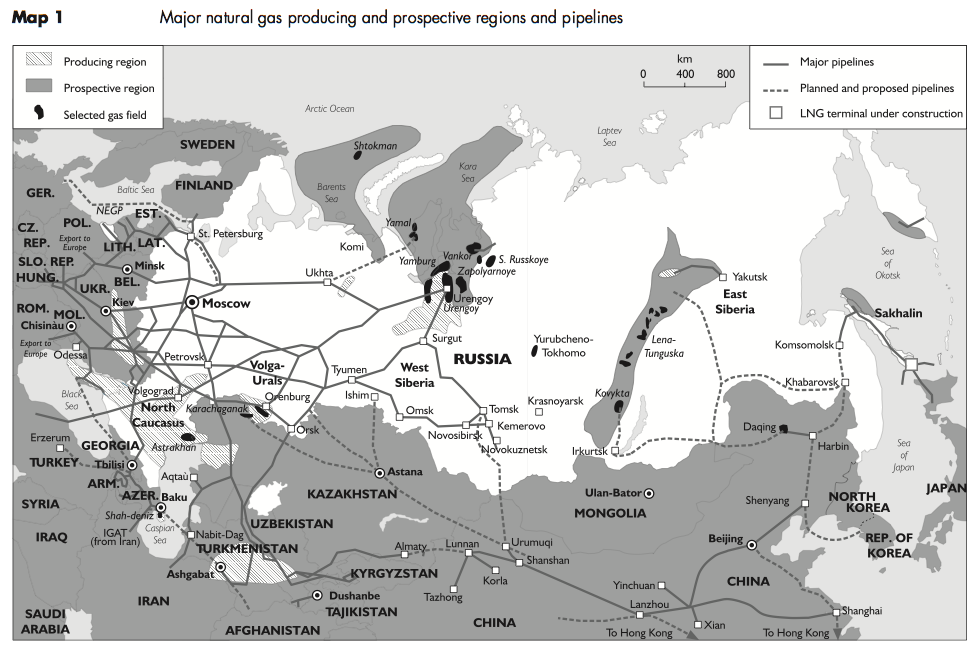

Let's open with this map from the International Energy Agency, showing the flow of natural gas in Europe:

Please note that the red lines are major transit natural gas pipelines that bring the natural gas from the source area and the blue lines are transmission natural gas pipelines that bring the gas to local markets for end users. The thickness of the lines provides us with a relative idea of the volume of natural gas passing through the pipelines with higher volumes passing through lines that are thickest. There are ten major pipelines in Russia with eight of them being export pipelines that carry Russia gas to Eastern and Western European markets through Ukraine, Belarus and across the Baltic Sea. The five pipelines that transport the gas to European markets have a total capacity of 6 Tcf per day, to put this number into perspective, Canada exported 3.274 Tcf to the United States in all of 2011 according to the Canadian Gas Association!

You'll notice something right away. The red lines are thickest on the east side of the map for this reason:

According to the U.S. Energy Information Administration EIA), Russia is the world's second largest producer of natural gas (and the world's third largest producer of oil after Saudi Arabia and the United States). Russia holds the world's largest proven reserves of natural gas at 1688 trillion cubic feet as shown in this chart, 26 percent of the world's total, dwarfing the natural gas reserves of the United States by a 5 to 1 margin:

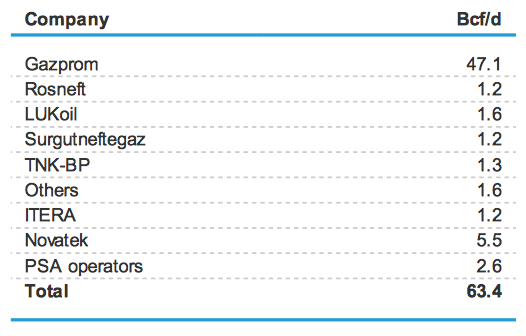

As you saw on the map above, most of Russia's natural gas reserves are located in Western Siberia with three fields alone, Urengoy, Medvezh-ye and Yamburg accounting for more than 40 percent of Russia's total reserves. Three-quarters of Russia's natural gas is produced by state-run Gazprom which also controls more than 65 percent of proven reserves. Here is a chart showing Russia's daily natural gas production by company for 2012, the latest full year for which data is available:

In 2012, total natural gas production reached 23.8 Tcf, second to the United States which produced 24.1 Tcf from a far smaller reserve base. This means that unless America's natural gas reserve base increases rapidly, likely through the drilling of unconventional reservoirs (i.e. fracking), the U.S. ultimate reserve life index is far, far shorter than that of Russia.

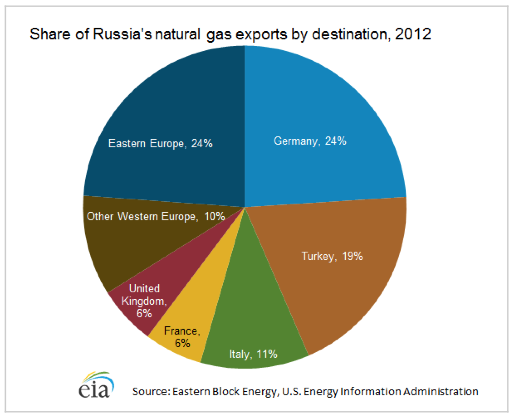

As noted above, Russia is a massive exporter of natural gas. Here is a pie chart showing the destination of Russia's natural gas:

You will notice that 24 percent of Russia's natural gas is exported to Germany, 24 percent to Eastern Europe, 11 percent to Italy, 10 percent to Western Europe and 6 percent to each of the United Kingdom and France. This is where the geopolitical intrigue enters the stage.

Germany is the largest energy consumer in Europe outside of Russia, and the world's seventh largest energy consumer. Unfortunately, with a paucity of hydrocarbon-based natural resources, Germany must rely on imports to fulfill its energy needs, a point of vulnerability.

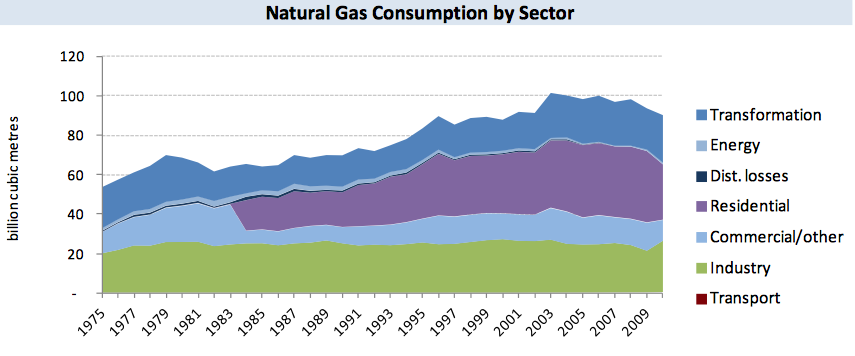

Let's open this section with a graphic showing the sector-by-sector demand for natural gas in Germany's economy:

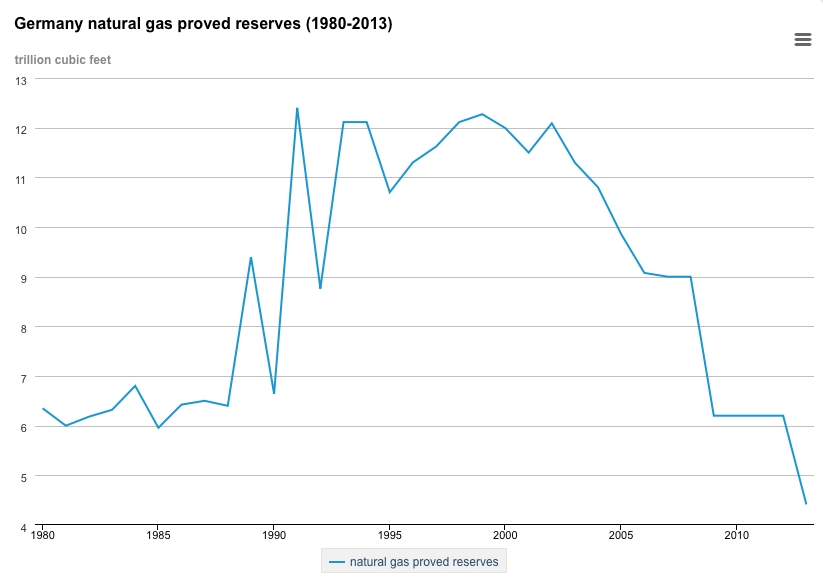

According to the EIA, Germany has almost no natural gas reserves as shown here:

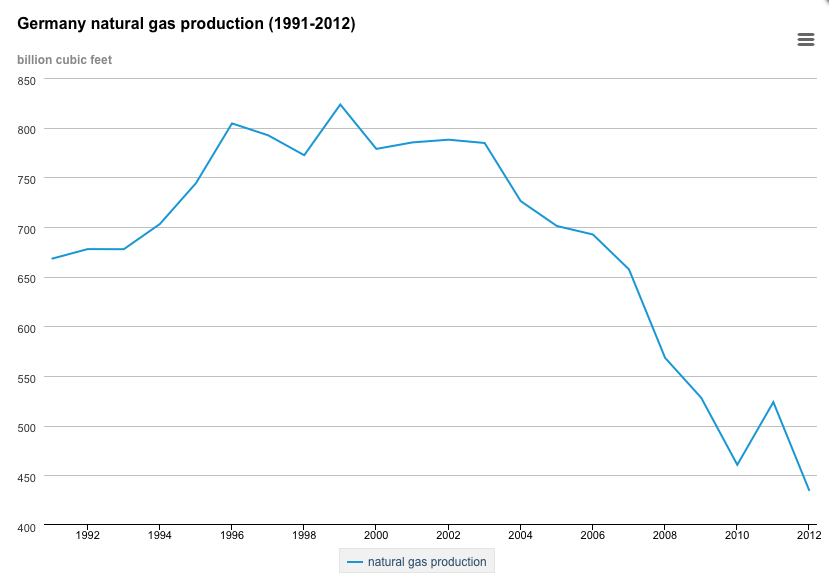

As a consequence, Germany produces negligible volumes of natural gas when compared to its consumption levels as shown here:

Germany's production of natural gas is expected to decline by an average of 5 percent per year over the coming years from its already low level.

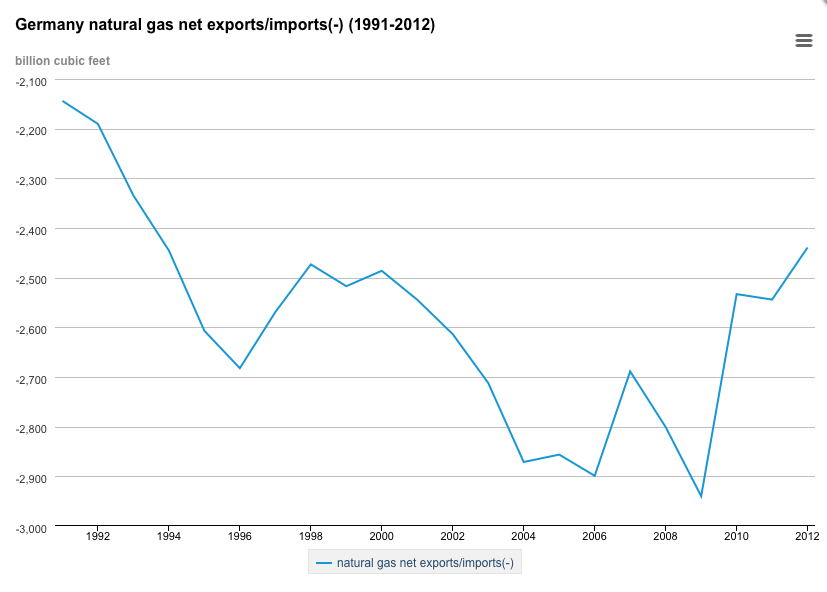

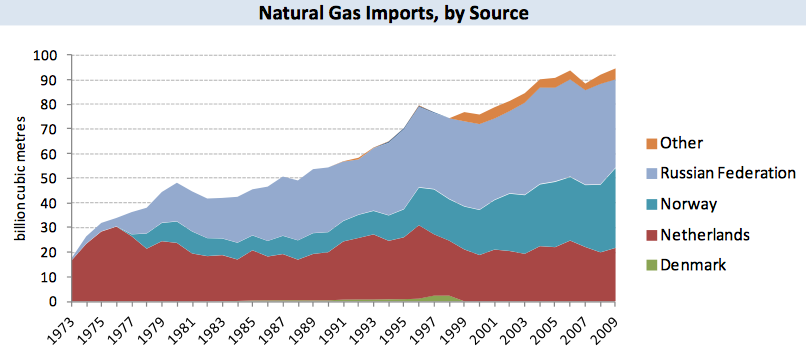

This has led to a need for natural gas imports as shown here:

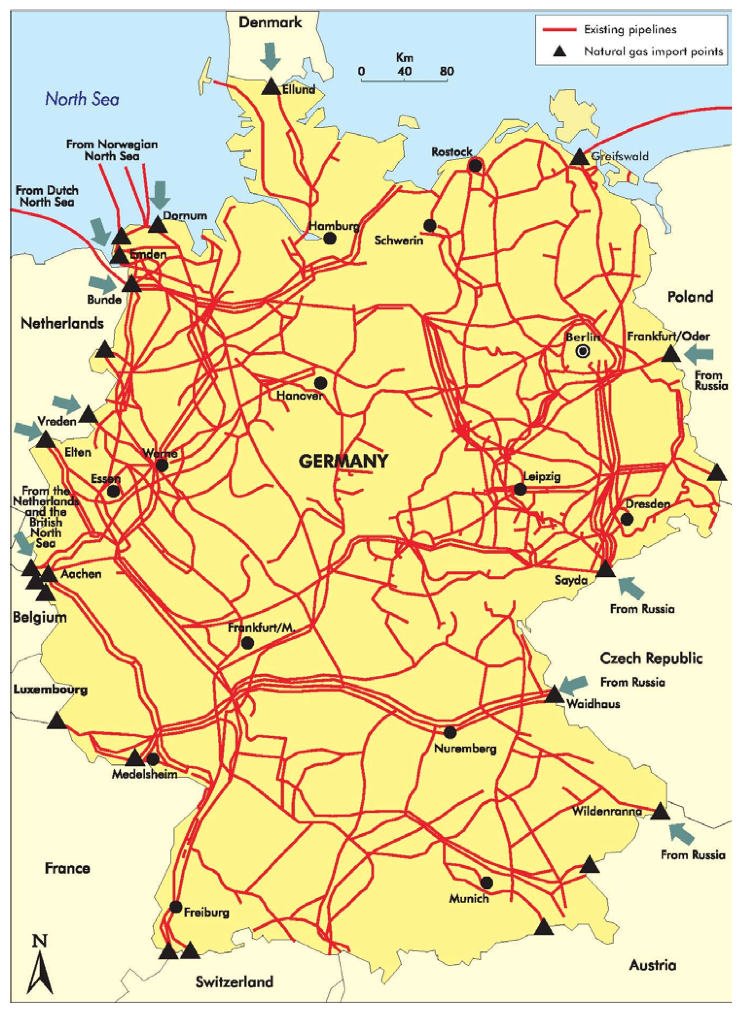

Germany's natural gas imports have risen from 2.15 Tcf in 1991, hitting a peak of 2.95 Tcf in 2009 and have fallen back to 2.45 Tcf in 2012 because of increased energy efficiencies. Germany has no liquified natural gas terminals (LNG), so it must rely on overland pipelines for its natural gas imports. Here is a map showing Germany's internal natural gas infrastructure and the entry points for natural gas from outside sources:

In 2011, Germany was 84.9 percent dependent on imports for its natural gas needs. Germany has no compulsory natural gas storage facilities, however, there are 47 gas storage facilities with total capacity of 738 Bcf.

Now, let's look at where Germany gets its natural gas imports from:

In 2010, Russia was the largest source of Germany's natural gas imports at 39 percent followed by Norway at 35 percent and the Netherlands at 22 percent.

Germany and, by extension, the rest of Europe since Germany is its largest economy, is vulnerable to supply cuts from Russia since it is unlikely that either Norway or the Netherlands could step in quickly to fill any shortfall, particularly given that natural gas production from the North Sea is expected to decline by 2.6 percent annually between 2010 and 2020. Russia has had supply disputes with nations before, including Ukraine where Russia halted gas supplies for 13 days in 2009, a dispute that affected supplies in Southeastern Europe as well. Russia also threatened to cut off supplies to Belarus and Georgia in late 1996, showing that Russia is not afraid to use its weight as the world's key natural gas supplier and holder of over one-quarter of the world's reserves to pressure outside nations to "see things its way".

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment