This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…An oped by Andreas Umland at Eurasia Review provides the world with a rather interesting alternative to war in Ukraine and how meaningful pressure could be put on Russia to end its involvement in the conflict.

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…An oped by Andreas Umland at Eurasia Review provides the world with a rather interesting alternative to war in Ukraine and how meaningful pressure could be put on Russia to end its involvement in the conflict.

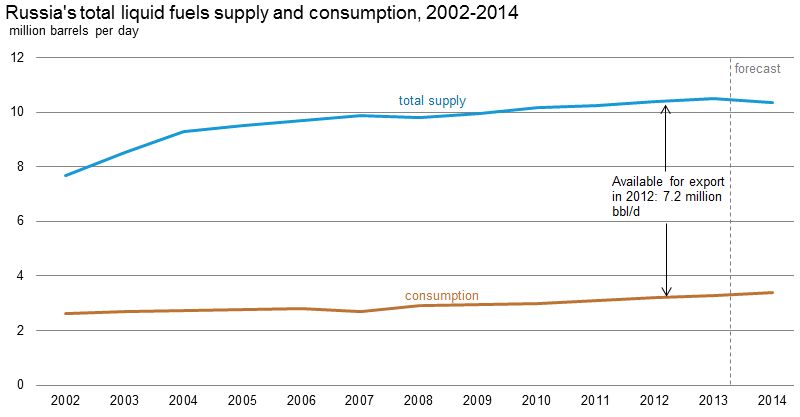

Let's open with a bit of background first. According to the United States Energy Information Administration, in 2012, Russia was the third-largest producer of oil in the world after Saudi Arabia and the United States and remained third-ranked with average production of 10.5 million BOPD through September 2013. Here is a graph showing Russia's total liquid fuels supply and consumption through 2014:

Most of Russia's oil production comes from Western Siberia which contributed 6.422 million BOPD or 62.2 percent of Russia's total oil production in 2012.

According to the BP Statistical Review of World Energy from June 2014, at the end of 2013, Russia had 93 billion barrels of proven oil reserves, 5.5 percent of the world's total. Its reserves-to-production ratio was 23.6, meaning that, at current production levels, if no more oil was found in Russia, its proven reserves would last for 23.6 years. This compares to a ratio of 63.2 for Saudi Arabia. According to BP's analysis, Russia's production in 2013 was 10.788 million BOPD which accounts for 12.9 percent of the world's total oil production. The 2013 production level was up 1.3 percent from the level in 2012.

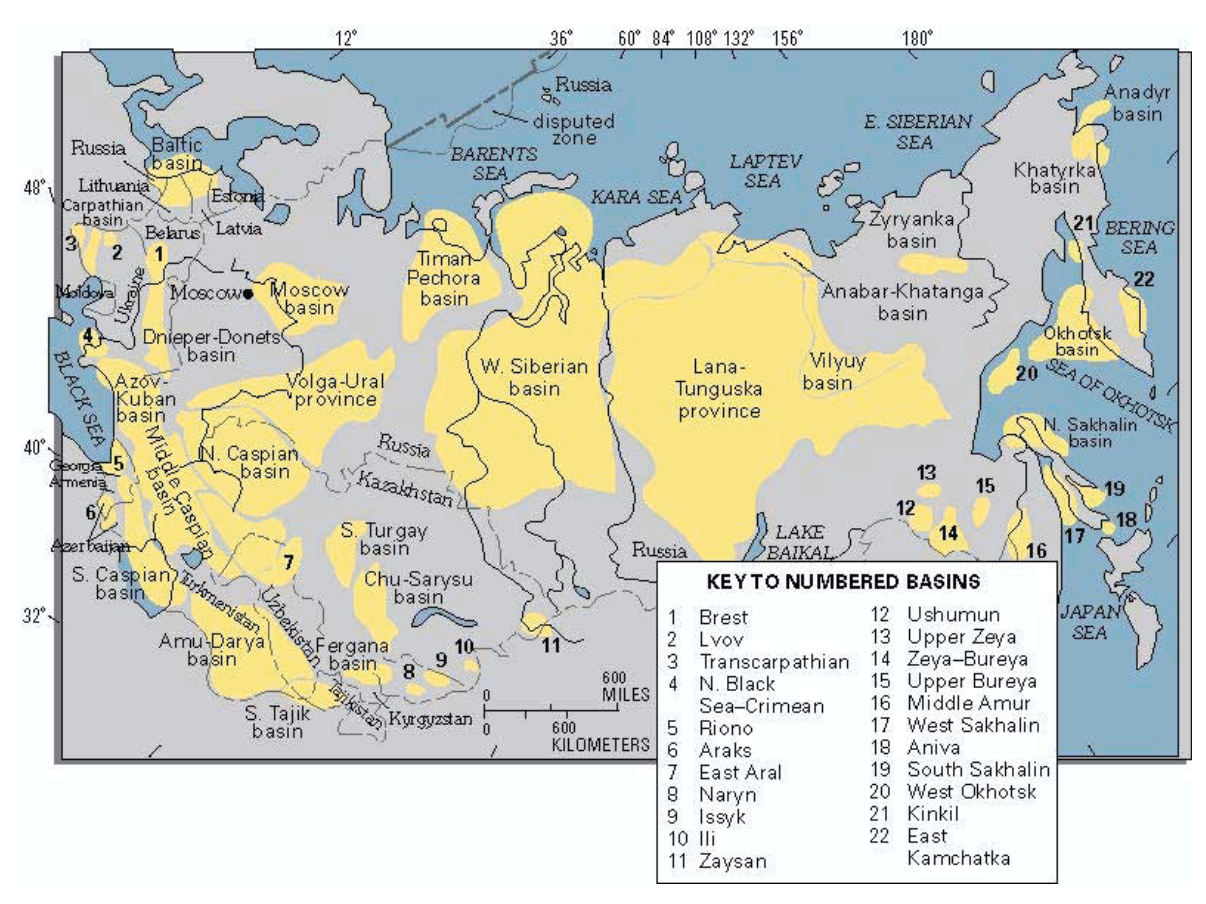

Here is a map which shows the major hydrocarbon basins in the former Soviet Union:

Here is a map showing the oil fields (in green) and natural gas fields (in red) in the West Siberian Basin:

Here is a map showing Russia's oil (in green) and natural gas (in red) pipeline infrastructure:

Notice that a significant number of the oil pipelines carrying Russian oil head toward Europe.

The southern leg of the 2400 mile-long Druzhba pipeline (which you will find in the center left of the map), which has a capacity of 4000,000 BOPD, is the main conduit for transporting Russia crude to central Europe. It runs through northern Ukraine and, in 2013, was the largest supplier of crude oil for Slovakia (115,000 BOPD), Hungary (101,000 BOPD) and the Czech Republic (78,000 BOPD). Slovakia imported 100 percent of its crude through the Druzkba pipeline compared to 94 percent for Hungary and 65 percent for the Czech Republic.

In total, Russia's pipeline infrastructure has the capacity to transport 7.5 million BOPD. As well, Russia has at least 18 ports that serve as outlets for Russia oil exports to Europe, the Americas and Asia. The eight largest and most important ports can handle 3.9 million BOPD.

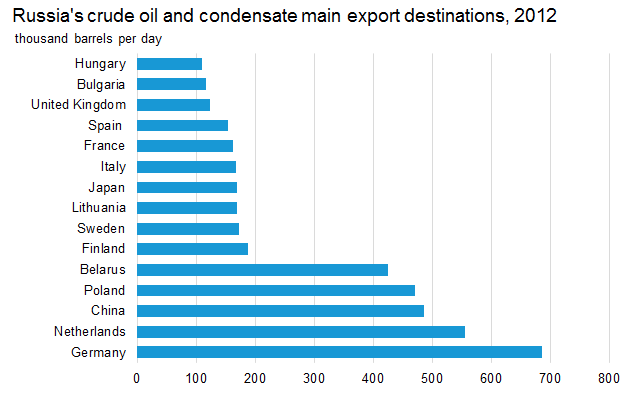

Here is a graphic showing the export destinations for Russia's crude oil and condensate:

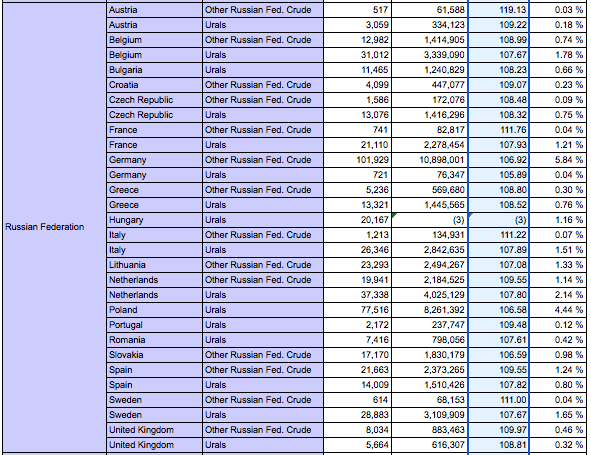

Now, let's look at Europe's oil imports. According to Eurostat, for the first half of 2014, here is how much oil Europe sourced from Russia by country:

In total, Europe imported 31.04 percent of its total volume of imported oil from Russia. In the first half of 2014, Europe imported 541.732 million barrels of oil worth $56.193 billion at prices ranging from $104 to $119 per barrel. Germany was the largest consumer of Russian oil at 5.84 percent of its total imports followed by Poland at 4.44 percent.

Now that we have this background, let's look at Andreas Umland's oped piece. So far, the Western reaction to Russia's moves in Ukraine have included a relatively mild imposition of financial, individual, political and export sanctions. These include exclusion from the G8, visa bans for some high profile Russians and limiting access to Western financial markets. While these have had some impact on Russia, they have done almost nothing to curtail Russia's continuing involvement in Ukraine.

As shown on this graph from the EIA, in 2013, Russia's economy was highly reliant on revenues from oil and natural gas:

Oil exports of $174 billion provided 33 percent of the value of Russia's total exports of all types, much more important than the nation's natural gas exports.

Obviously, oil exports are a very important part of the Russian economy. According to the author, approximately 37 percent of the Russian state budget revenues are sourced from foreign economic activity, most of which is the exportation of oil. In light of that, the author goes on to state that an oil embargo against the Russians would be an extremely effective means of sanctioning, particularly given that these sanctions could remain in place for an extended period of time because Europe, which already gets 10 percent of Saudi Arabia's exported oil, could rely on additional oil from Saudi Arabia and other producing nations. With the current global oil oversupply situation, this would prove to be quite possible. If this source of income was removed from Russia, the Kremlin would find it increasingly difficult to conduct what are termed its "hybrid operations i.e. military interventions, propaganda campaigns (and) political manipulations".

As you can see from the information above, a great deal of Russia's oil transportation infrastructure has been built to service Europe. While it does have a system of export terminals, it will be difficult for Russia to find new markets for its oil quickly. As it stands now, Europe is indirectly funding the Kremlin who is funding the mercenaries and materiel that is required to sustain two new states in Donetsk and Luhansk. By cutting imports of Russian oil, Europe may help slow the tide of violence that has taken over eastern Ukraine. At this point in time, it is obvious that the current sanctions against the Putin regime are laughably ineffective meaning that tougher actions need to be taken if the West has any intention of ending the war.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment