It seems that over the past few months, market sentiment around the world changes on a daily (or semi-daily) basis depending on what has happened (or perceived to have happened) in Europe. This is particularly noticeable in North America since our markets open well after both bond and stock markets have opened in Europe. I can’t tell you how many mornings I’ve checked the online version of major North American newspapers to find one of the following banners:

It seems that over the past few months, market sentiment around the world changes on a daily (or semi-daily) basis depending on what has happened (or perceived to have happened) in Europe. This is particularly noticeable in North America since our markets open well after both bond and stock markets have opened in Europe. I can’t tell you how many mornings I’ve checked the online version of major North American newspapers to find one of the following banners:"Market Futures Point Up on Easing of Fears About Eurozone Debt"

"Market Futures Point Down on Increased Worries About Eurozone Debt"

It was rather amusing this morning to note that the "teasers", as I call them, in one major Canadian newspaper had one from late yesterday proclaiming that Wednesday’s market was down based on fears about potential debt downgrades in Europe while, the headline banner two “teasers” higher on the page, just after the market opened, stated that the market was up based on a good bond auction for both Italy and Spain. Did anything, other than sentiment, change?

As far as I can see, in recent weeks, absolutely nothing has changed regarding Europe’s sovereign debt situation save one thing; we’re now used to it. The Eurozone story has been moved from page one to page thirteen for the most part. It’s unfortunate, but the mainstream media seems to ignore some facets of the ongoing story that are actually quite interesting and that may give us a heads up about what to expect in the future should other Eurozone nations face further fiscal pressures as surely they will, particularly since it appears that the better part of the world’s economy is slipping into recession.

According to the Telegraph, the market was recently all aquiver because Italy and Spain sold three and four year bonds at far better rates than they had in recent months. Spain sold nearly €10 billion worth of bonds, twice what was expected at rates that were about 1 percentage point lower than previously and Italy sold €12 billion worth of one year bonds at 2.735 percent, less than half the rate from the previous month. This was cause for great rejoicing, despite the fact that Italy needs to repay €50 billion in debt in the first quarter alone and Spain has admitted that it will miss its 2011 deficit goal of 6 percent of GDP and hopes to reach a deficit of "only" 4.4 percent of GDP. Remember, even if Spain does achieve a deficit of 4.4 percent of GDP, that level is still well above the mandated European target of 3 percent. With the economies of both nations teetering on recession, the chances of actually meeting this target is negligible. As well, Europe’s bond market has been impacted by the European Central Bank having just dumped €489 billion into the coffers of Europe’s banking industry, available to banks at only 1 percent interest. These funds are being used to promote purchasing of troubled European bond assets, so, perhaps banks are just playing the spread. Europe’s banks are now able to purchase bonds from troubled Eurozone nations, pay the ECB 1 percent interest and pocket the difference. In the case of Italy’s bond issue today, that works out to a fat 1.735 percent profit just for showing up and doing nothing, the only risk being that Italy could default.

Now, let’s look at the story behind the story, focusing on poor old Greece which has been pretty much ignored these past weeks.

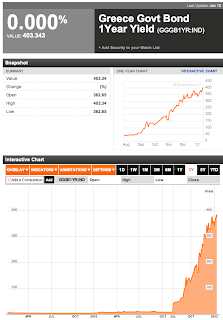

Here is a chart showing the yield on one year Greek bonds over the past three years:

Here is a chart showing the yield on two year Greek bonds over the past three years:

Here’s one last chart showing the yield on two year Italy bonds for comparison, showing the recent interest rate drop :

Yes readers, you are not imagining things. While the mainstream media is all abuzz about the dropping yields on bonds issued by both Italy and Spain, they seem to have forgotten that the yield on a one year Greek bond is a stratospheric 403.34 percent and a whopping 170.1 percent for two years and, for the most part, still rising on a daily basis. The yield for the one year Greek bond at the beginning of November 2010 was a rather paltry 6.228 percent. Who in their right mind would have predicted that the yield would have climbed nearly 65 fold in just over 14 months? If you had told someone in November 2010 that the yield on Greek one year bonds would be in excess of 400 percent, they would have thought that you were daft. At this point in time, it would appear that the market has priced in complete default, with Greek bonds being worth little more than that white paper that comes on a roll.

What is most concerning is that a similar scenario involving the far more heavily indebted nation of Italy could prove catastrophic. According to the Banca D’Italia’s most recent external debt statement, current to the end of September 2011, the country’s external debt reached €1.848 trillion euros. Public debt in 2011 was expected to reach 119 percent of GDP, well below Greece’s current level of roughly 160 percent of GDP and its projected level of 187 percent of GDP in 2013. That said, should part two of the Great Contraction entrench itself in the world’s economy, even the best laid plans for fiscal finessing could go to waste and the world’s third largest debtor nation could find itself battling interest rates approximating those being experienced by Greece now. That scenario would be the farthest thing from pretty.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment