Ben Bernanke’s testimony in Washington today brought up an interesting point, a point that would make it appear that he has finally seen the light (along with the errors that his policies have created)…well, at least to some degree.

Ben Bernanke’s testimony in Washington today brought up an interesting point, a point that would make it appear that he has finally seen the light (along with the errors that his policies have created)…well, at least to some degree.Here is an excerpt from his musings:

"Even the prospect of unsustainable deficits has costs, including an increased possibility of a sudden fiscal crisis. As we have seen in a number of countries recently, interest rates can soar quickly if investors lose confidence in the ability of a government to manage its fiscal policy. Although historical experience and economic theory do not indicate the exact threshold at which the perceived risks associated with the U.S. public debt would increase markedly, we can be sure that, without corrective action, our fiscal trajectory will move the nation ever closer to that point." (my bold)

This is an issue that has concerned me for quite some time. Just ask Europe’s debt transgressors how quickly things can go wrong. Please note that for the purposes of this posting, I will be updating some of the calculations I made for a posting back in late November 2011.

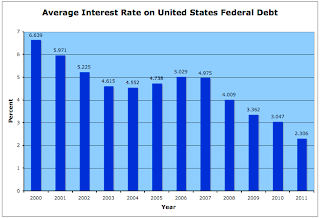

Let’s start by taking a look at the average annual interest rate on the United States debt over the past 12 years:

Notice how the average interest rate on the debt has generally declined since the turn of the millenium and how the interest rate in 2011 is at a decade-long low. As well, the average interest rate for the decade is 4.539 percent, once again, the interest rate in 2011 was only 63 percent of the long-term average.

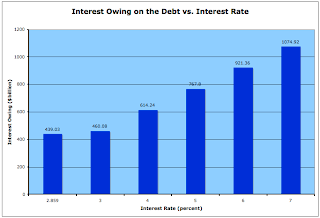

Now, let’s look at the debt. The most up-to-date debt figure for the debt was January 31, 2012 and the debt on that day stood at $15.356 trillion. Now, let’s multiply that by the average interest rate on the debt for 2011 (2.859 percent) along with other interest rates ranging up to 7 percent to see just how rapidly things could go very, very wrong. Here is a graph showing the results:

You must remember one thing. I am holding the level of the debt constant when, in fact, it is growing by billions every day, making my calculations a best-case scenario. As well, notice that the 7 percent interest rate seems stratospherically high by today’s standards but it is less than one half percent below the rate back in 2000. Let’s put these interest totals into context. If we look at Washington’s final tally for fiscal 2011, the budget deficit was $1.299 trillion for the year. Receipts from individual income tax reached $1.091 trillion, just above my calculated total interest owing on the debt should the average interest rate on the debt reach 7 percent. So much for those fantasies of fiscal balance.

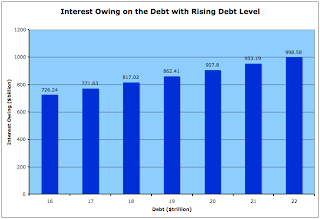

Now, let’s take the 12 year average interest rate on the entire debt of 4.539 percent and elevate the debt in trillion dollar jumps and see how the interest owing on the debt rises as Washington incurs increasing levels of debt:

With a historically accurate 12 year average interest rate of 4.539 percent, the interest owing on the debt rises by $45.39 billion for each $1 trillion increase in the level of the debt. By the time Washington’s debt reaches $22 trillion, the annual interest owing on the debt at the above noted level will nearly reach the trillion mark and would consume all of the 2011 revenue from individual taxes.

I’m not going to go through the entire exercise, but if the debt reaches $20 trillion (a most achievable goal; should Washington continue to accumulate debt at $1.3 trillion annually, the $20 trillion mark will be reached in 3 years and 10 months) and average interest rates on the debt reach a still modest 6 percent, the annual interest on the debt will be $1 trillion. This is basically what Washington spent on Medicare and Social Security in fiscal 2011.

From the calculations that I’ve completed for this posting, my gut instinct is that Washington will never achieve fiscal balance, largely because the debt is already too large. We are entering a phase where structural deficits will be a permanent annual fixture; no matter how much the economy grows, spending will always be more than revenue, largely because of one factor – interest owing on the debt. Right now, Washington is in the fortunate, once-in-a-lifetime situation of having two factors working in its favour; first, a prolonged period of ultra-low interest rates, thanks in large part to Mr. Bernanke and his gang of bankers, and second, the fact that Treasuries are regarded by the world’s bond markets as the investment of last resort.

In closing, here’s another quote from the illustrious Mr. B:

"To achieve economic and financial stability, U.S. fiscal policy must be placed on a sustainable path that ensures that debt relative to national income is at least stable or, preferably, declining over time. Attaining this goal should be a top priority.

Even as fiscal policymakers address the urgent issue of fiscal sustainability, they should take care not to unnecessarily impede the current economic recovery. Fortunately, the two goals of achieving long-term fiscal sustainability and avoiding additional fiscal headwinds for the current recovery are fully compatible–indeed, they are mutually reinforcing. On the one hand, a more robust recovery will lead to lower deficits and debt in coming years. On the other hand, a plan that clearly and credibly puts fiscal policy on a path to sustainability could help keep longer-term interest rates low and improve household and business confidence, thereby supporting improved economic performance today." (my bold and underline)

Is it just me or does Mr. Bernanke think that he can both have his cake and eat it too? Best of luck with that, Mr. Bernanke. Best of luck indeed. Just as the world’s bond markets can dictate ultra-low rates for Treasuries, it can dictate ultra-high rates as well.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment