It seems that no matter what, Canada's housing prices keep rising. Obviously, what goes up can come down very quickly. To that end, a brief analysis from the OECD examines house prices across the OECD nations, including Canada, and compares two ratios; the price-to-rent ratio and the price-to-income ratio. Let's start by explaining the two ratios:

1.) Price-to-income: this ratio measures the affordability of housing as it relates to household income. Obviously, when this ratio is high, a housing market is less affordable.

2.) Price-to-rent: this ratio measures the profitability of owning a home. This ratio compares the total cost of owning a home to the cost of renting a similar property. The total cost of ownership includes mortgage principal and interest payments, insurance, property taxes, mortgage insurance and any closing costs. Once again, when this ratio is high, it is less expensive to rent a home than it is to buy a home.

Where both the price-to-income and price-to-rent ratios are high, a residential real estate market is considered to be overvalued.

Here is a bar graph from the OECD analysis showing the aforementioned ratios for the world's developed economies:

Here are the top five nations with overvalued residential real estate measured using the price-to-rent ratio (in blue):

1.) Norway – ratio of 71

2.) Canada – ratio of 64

3.) Belgium – ratio of 63

4.) New Zealand – ratio of 61

5.) Australia – ratio of 37

Here are the top five nations with overvalued residential real estate measured using the price-to-income ratio (in red):

1.) Belgium – ratio of 49

2.) France – ratio of 33

3.) Canada – ratio of 30

4.) Norway – ratio of 27

5.) New Zealand, Sweden and Netherlands – ratio of 23

Notice that Canada has the second highest overvalued residential real estate market when measured in terms of price-to-rent and the third highest overvalued market when measured in terms of price-to-income. Canada's average ratio of 47 puts it in third place after Belgium at 56 and Norway at 49.

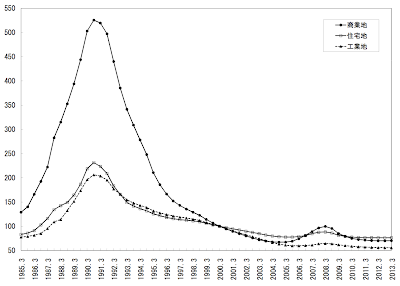

In sharp contrast, Japan which at one time had some of the world's most overpriced real estate now finds itself with the developed world's most affordable residential real estate with a price-to-rent ratio of -38 and a price-to-income ratio of -36 for an average of -37. In the case of Japan, here's what happened to the price of commercial (line with circles), residential (line with squares) and industrial (line with triangles) real estate in six major city areas from 1985 to the present:

Residential real estate fell from a value of 218.8 in 1990 to its current level of 76.3 (end of March 2000 = 100) after rising by 33.1 percent between 1985 and 1990.

It's becoming increasingly obvious that, despite more-or-less continuous rises in Canadian residential real estate valuations, the bubble will not continue to inflate forever, particularly given this:

With average Canadian hourly wages rising by only 5.6 percent over the past three years and Canada's 11 City House Price Index rising by 13.8 percent over the same timeframe, it is obviously becoming increasingly difficult for a Canadian family to afford to purchase a home, a situation that will inevitably put downward pressure on housing prices. The current housing bubble in Canada is a mirage that only appears to have no end.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Although all your ratios may be correct and offscomment_IDe relative to historical measures, Real Estate cannot be permitted to collapse…at least not at these current levels. This would take down governments, banks, corporations and citizens all of which are over leveraged.

We are near the end of the fourth monetary collapse in the past one hundred years or so. We will be starting a new monetary system by the end of this decade. Each one last approximately forty years. The first on ended in 1913, the second in 1939, the third in 1971. This does not imply the end of the world where people will end up in caves.

However, the dark truth is that a monetary reset will involve a huge transfer of wealth to the “Have’s from the “Have-not”. People un-prepared will lose ownership of their homes because prices will rise dramatically and credit will cease for a while as a direct result of a currency reset. People will end up renting the house they previously owned.

The only immunization is to have no revolving debt and preferably no mortgage. Those that do have mortgages can weather the storm by avocomment_IDing a renewal during the reset. This means a seven to ten year fixed rate term to get you over the hump. There are no guarantees here either as property taxes and other expenses need to be pacomment_ID but this advice which is simple and inexpensive to implement will go a long way to prevent your largest asset from been taken away from you.