The World Economic Forum, Digital Identification and the Interlocking Social Credit Score

For anyone paying attention, it has become very clear that the world is headed toward a system of digital identification. One proponent of this scheme is the World Economic Forum, the group of global rulers who seemingly has an answer to every negative issue facing humanity. Back in February 2022 while the world was grappling with high inflation and the Omicron variant, the WEF released this document:

In this report, The WEF’s Task Force on Data Intermediaries which is composed of these individuals:

….looked at what data privacy could look like in the future given the rapid changes in technology which have expanded data collection well beyond website cookies etcetera which are collected on our devices every time that we use them and are being used for commercial and/or public purposes. For example, thanks to the Internet of Things (IoT) (i.e. screenless technology), data is collected unbeknownst to all of us every time we use smart devices in our homes. The WEF suggests that data intermediaries could serve as a “police force” which would provide checks and balances for the use of our data. These intermediaries could be private for-profit or public (i.e. a government agency).

Here’s what the report has to say about public data intermediaries:

“A public body or government agency could take on the role of an intermediary, especially as it relates to data coming from public bodies. Therefore, it can also act as an aggregator or gateway for such information. Such an intermediary could play an even greater role in making the data more easily accessible, identifiable, searchable and usable, including coordinating interoperable systems, especially across the public sector at least. Therefore, the role of a public body is arguably greater if it is an aggregator of multiple sources of public data. Another role it could play is to act as a super- intermediary, setting the national standard, data architecture and data standards for which all organizations would be required to comply. This will require deep expertise in privacy, data and technology, and therefore upskilling of the staff and/or hiring of a “data steward” with the required skillsets.“

Here’s what the report says about private for-profit data intermediaries:

“Whether and how a for-profit commercial entity can successfully serve its clientele under voluntary fiduciary duties of care and loyalty remain open to debate among stakeholders.29 A key driver of the success of this model is how the intermediary derives economic value to be able to perform and make this service available. Without strict controls on the access, use and transfer of the underlying data provided by data ecosystem participants, this model could incentivize the intermediary to examine ways to profit from the data itself, unless prohibited by law or contractual arrangements. Where a participation fee may not generate sufficient profit, the provision of additional services could satisfy the economic argument without – requiring any service that involves or enables the intermediary to profit from the data itself, directly or indirectly. A hybrid of this approach and variation of cost models could bridge this issue. Various models could also co-exist, with a certification or trust mark for those that abide by certain agreed standards. On the other hand, however, is an immense opportunity for the most responsible organizations that could be incentivized to create or pay a trusted third-party intermediary to increase their independence and transparency with respect to their user base and thus commercial appeal with respect to offering services to their users.“

Let’s get to the “meat” (or insects) of this posting. In the chapter entitled “Moving towards trusted digital agency”, the authors look at the implementation of a digital identity scheme. Here is a quote from the chapter:

“A digital ID is the electronic equivalent of an individual’s identity card. It is a way to provide verified personally identifying information of an individual for a software to read and process. Both online and offline environments can adopt digital identity. And it can also act as a key by storing and deploying permission.

Carefully designed and properly managed, digital ID can also enhance privacy protection and reduce the rise of identity fraud since each time only minimum information is needed for authentication for the specific purpose. Some of the biometric based digital ID systems have already been adopted in financial transactions and for a cash-free shopping experience. Such authentication and authorization processes can be completed in real time and free of hassle.”

I always like how the WEF frames things in such positive terms as though, in this particular case, there is no nefarious aspect to the implementation of a digital identity.

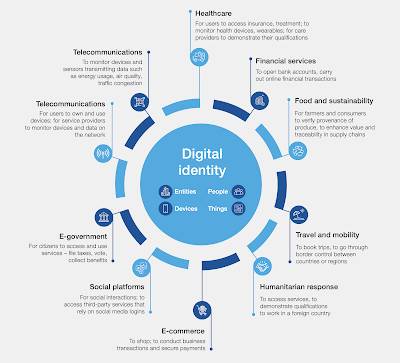

As is typical of WEF publications, they provide this marvellous (and meaningless) graphic showing the importance of identity in the everyday lives of the servant class and how it can be wrapped into a digital identity:

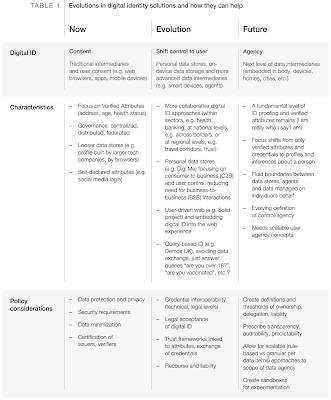

Most importantly, this table shows the evolution of digital identities into the future:

And, there you have it. According to the authors, the evolution of digital identities will become increasingly all-encompassing, particularly if/when Klaus Schwab’s Fourth Industrial Revolution wet dream of implantable technology comes to fruition. You will notice that the focus of digital identity will shift from “verified attributes and credentials” to “interferences about a person” .

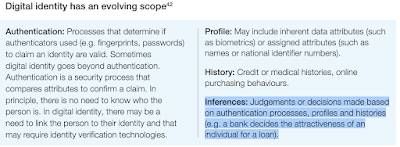

If we got back to this graphic which is located just above the table, we find this clarification of “interferences” when looking at the evolving scope of digital identity:

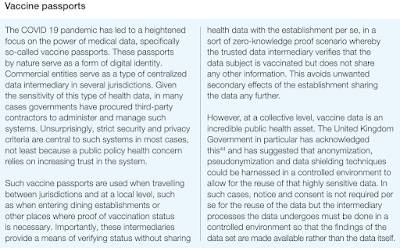

This certainly would appear to suggest that your digital identity could be used as a form of social credit score with your online and offline behaviours being tracked and traced and used to infer your worthiness, interlocking your digital identity with your social credit score. For example, your social behaviour which will be assessed through the analysis of your data which will be used to determine whether you are allowed to travel, make certain purchases of goods and services etcetera, similar to the system being used in China. We saw the first tentative steps in the development of a social credit score ecosystem with the implementation of vaccine passports in many nations around the world which resulted in non-vaccinated individuals being stripped of their ability to travel, enter restaurants and pubs, play sports, retain their jobs etcetera. This is even discussed in this report as shown here:

I’m quite certain that technology companies who are members of the World Economic Forum’s inner circle are quite thrilled with the prospect of massive profits generated by the implementation of a data intermediary reality associated with a digital identity scheme. Major shareholders of these companies stand to benefit personally just as the executives of certain Big Pharma companies benefitted during the pandemic, particularly when governments came on board to force their citizens to be vaccinated. As well, if there is anything that we’ve learned in the post-September 11, 2001 era, it’s that governments could care less about our privacy no matter what they may tell us and that the COVID-19 era has taught us that governments will use whatever means available to them, particularly virtual documents, to control our behaviours.

Remember, your personal data is the next “golden asset” class. The ruling class knows this and needs it to implement their dystopian plans for our futures.

Be the first to comment