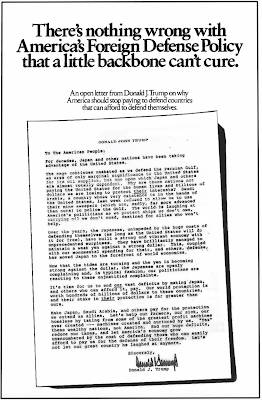

Donald Trump is proving to be one of the most virulent trade warrior that has occupied the White House in our lifetime. This should come as no surprise to anyone given that Mr. Trump paid for this full-page advertisement about America's trade relationship with Japan which appeared in the New York Times, The Washington Post and The Boston Globe on September 2, 1987 when Japan (not China) was the world's most successful trading nation:

A recent analysis by Moody's Analytics shows that the current trade war between Donald Trump and China has entered a dangerous phase that could well impact the global economy.

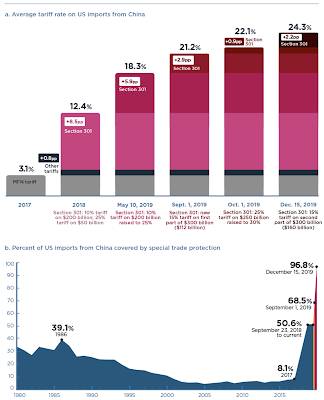

The current Trump-China trade war began on April 6 and 7, 2017 when China's President Xi visited Trump's Mar-a-Lago estate in Florida. At that meeting, the two nations agreed to set up a 100 Day Action Plan to resolve trade differences between the two nations. As we now know, the differences between the two nations have worsened significantly over the past two and a half years. Here is a graphic from the Peterson Institute for Economics (PIIE) showing what has happened to the average tariff rate on United States imports from China and the growing percentage of imports that will be covered under the new tariff regime:

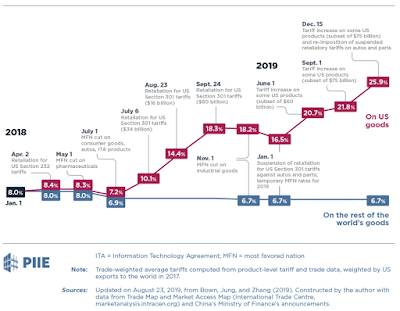

Here is a graphic from PIIE showing how China has responded:

If you wish to read a complete timeline of the ongoing Trump-China trade war, this is an excellent and very complete analysis. You can also find another excellent summary by the Peterson Institute for International Economics here.

Now, let's look at Moody's analysis. Let's look at two scenarios:

1.) Baseline Scenario – In its baseline scenario which has a 50 percent probability of occurring, the October and December tariff hikes will both take place. By the end of the year, U.S. tariffs on $250 billion of Chinese imports will rise from 25 percent to 30 percent and tariffs of 15 percent will be placed on the remaining goods. The economic impact of these (and other trade threats coming from Donald Trump) will prove costly to the economy as follows:

1.) Real U.S. GDP will be 1 percent lower by the end of 2020 than it would have been without tariffs on China.

2.) U.S. job growth slows to the point that unemployment begins to rise.

3.) The Federal Reserve will lower rates by 50 basis points by the beginning of 2020 to support U.S. economic growth.

4.) Global real GDP outside of the United States is 0.5 percent smaller by the end of 2020 thanks to the trade war with China.

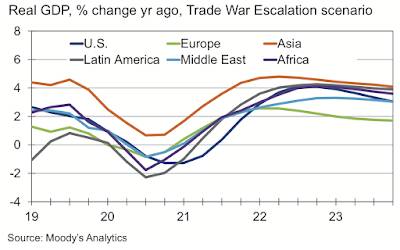

2.) Trade War Escalation Scenario – In in addition to the tariffs already proposed, non tariff barriers are also imposed by the Trump Administration. Washington bans Chinese firms from participating in the technology sector and forbids exports of high-tech goods including microchips. This raises the cost of critical inputs across Southeast's Asia which contributes to a global manufacturing slump. U.S. companies are banned from doing business with Chinese technology giants. The Trump Administration also accuses China of predatory lending in its Belt and Road Initiative and announces actions against financial institutions that fund BRI projects. In addition, in this scenario, Washington imposes a 25 percent tariff on vehicle imports beginning in 2020 and a divided Congress refuses to pass the new U.S.-Mexico-Canada Agreement. The result will be as follows:

1.) The Federal Reserve will have to lower the fed funds rate to the zero lower bound and both major and developing economies adopt monetary stimulus packages.

2.) The U.S. dollar appreciates and emerging market currencies depreciate sharply.

3.) By the fourth quarter of 2021, in the United States, there will be 559,500 fewer non-farm jobs than there would have been under the baseline scenario.

4.) Real global GDP contracts by 0.3 percent from peak to trough with deep recessions in the United States, Europe and most emerging markets and China's economic growth falls to just short of recession as shown on this graphic:

As we can see, there is a high cost, particularly to Americans, to the Trump trade war, particularly if it escalates. This is yet another prime example of an unintended consequence of an ill-conceived idea that has turned into a very high-stakes game of chicken or dare.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment