The current economic expansion is quite different for those of us that labor for wages.

Let's do a bit of background work on the concept of labor share. The notion of labor share is how economists measure the share of employee compensation as a percentage of the total gross value added to the economy which is defined as:

Gross Value Added = Employee Compensation

+ Corporate Profits

+ Rental Income

+ Net Interest Income

+ Proprietors' Income

+ Net indirect taxes after subsidies

+ Depreciation

Every dollar of income must be earned by production factors of either capital or labor or be taken by government in the form of taxes. Of the above factors, only employee compensation in its entirety is considered labor income. In addition, a portion of proprietors' income is considered labor income; in the case of self-employed workers/proprietors, it is assumed that they pay themselves the same wage that they would otherwise earn in their respective sector of the economy. To calculate labor share, the total labor compensation is then divided by the total value added to the economy, deriving labor share as shown here:

Labor Share = Labor Compensation

Value Added

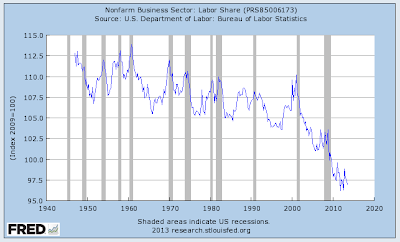

Now that we have that behind us, let's look at what has happened to labor's share of the economy all the way back to the mid-1940s (setting 2009 as a value of 100):

Between 1945 and 2001, other than for a few years in the mid-1990s, labor's share of the non-farm business sector was at or above a value of 105. After nearly every recession since the middle of the 1940s, labor's share of the economy dropped and then began a gradual rise back to its pre-recession levels. This began to change after the 2001 recession as labor's share fell gradually to a value of around 101. Once the Great Recession took hold in 2008, labor's share of the economy fell very rapidly to a low of 96.24 in the third quarter of 2011. Since then, labor's share has not improved by much, rising to only 96.95 in the second quarter of 2013. As you can see from the graph, labor's share of the economy is now just above its 70 year low.

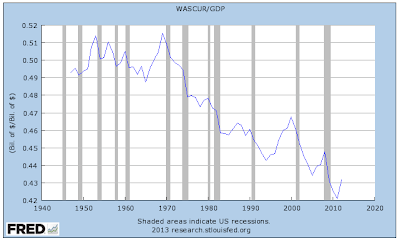

Now, let's look at labor's share of the economy in a slightly different way. Here is a graph from FRED showing the percentage of GDP that is derived from employee wages and salaries:

That's a pretty convincing downward slope, isn't it? At its peak in 1969, wages and salaries made up 51.55 percent of GDP. Since then, save for a few short years during the second Clinton Administration, wages and salaries have made up a decreasing portion of GDP, falling to an annual low of 42.1 percent in 2011. Admittedly, the share did rise in 2012 to 43.1 percent, however, this is still the fourth lowest value on record.

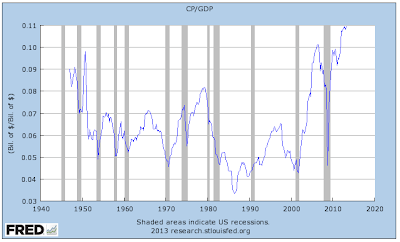

Now, let's look at another part of the value added equation; corporate profit's share of the economy:

In sharp contrast to the labor share of GDP and other than the drop during the Great Recession, that's a pretty convincing upward slope since 2001, isn't it? Looking all the way back to the mid-1940s, after tax corporate profits as a fraction of GDP have never been higher than they are now. In fact, at their current level of 10.9 percent, corporate profits comprise over 1 percentage point more of the total economy than their previous record of 9.8 percent set back in the third quarter of 1950. At their low point during the depths of the Great Recession when after tax corporate profits dropped to a measly 4.6 percent of GDP, the contribution of corporate profits has risen by a staggering 6.4 percentage points or 139 percent.

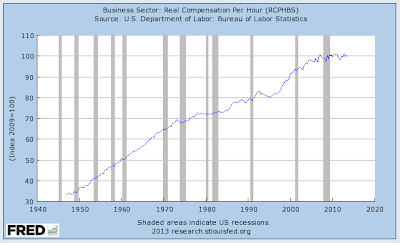

Lastly, let's look at what has happened to real compensation per hour for the entire business sector, setting the year 2009 as a value of 100:

Basically, since the beginning of 2007, after the effects of inflation are removed, hourly compensation for all businesses in the United States has been stagnant. That's nearly 7 years of no movement in wages at the same time that corporate profits made up a bigger portion of the economy.

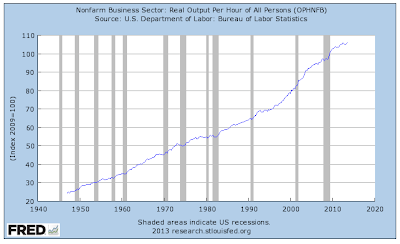

It is quite obvious that this recovery is not evenly distributed through the American economy. Corporations are benefitting on the backs of their workers who, as shown on this last graph, are putting out more than ever before:

Apparently, labor's lost share of the economy is the corporate world's gain.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment