The Bank of Canada – How Canadians Feel about a Canadian Dollar CBDC

There is little doubt that the world is heading towards a central bank digital currency-dominated future, thanks to the efforts of organizations like the Bank for International Settlements, the World Economic Forum and like-minded organizations. While the implementation of CBDCs may be unavoidable, one of the world’s central banks, the Bank of Canada, undertook a survey of Canadians to understand their views on the development and rollout of CBDCs. The results of the public consultation portion of this survey were just released and are rather eye-opening:

Let’s look at some of the highlights.

A total of 89,432 responses were collected during the public consultation which took place from May 8 to June 19, 2023 which the Bank of Canada considers a “high level of engagement”. The survey was divided into five main sections:

1.) How you pay for things today

2.) Design concepts and principles

3.) Design features and use cases

4.) Your advice

5.) About you

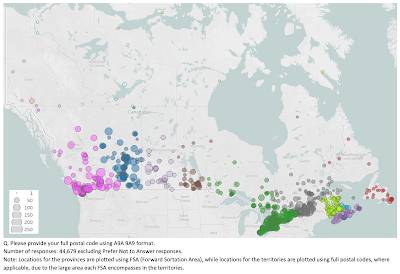

The individuals that took the time to complete the 30 question survey exhibited a high level of familiarity with the concept of a digital Canadian dollar with 87 percent having heard about a Bank of Canada CBDC. Here is a map showing how respondents represented the vast geography of Canada:

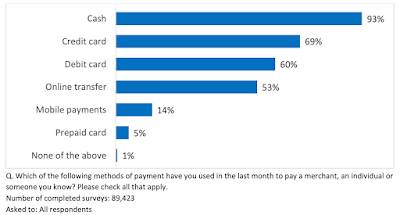

Here is a graphic showing the payment types used by respondents in the last month before they completed the survey:

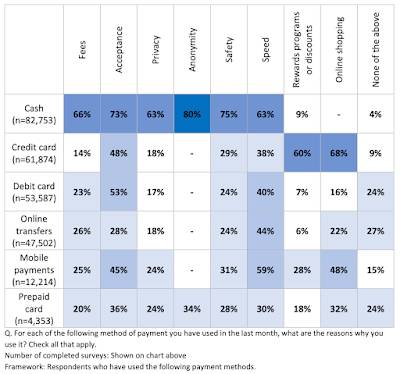

Here are the reasons for using these payment methods noting that cash was often used for “privacy”, “safety” and “anonymity”:

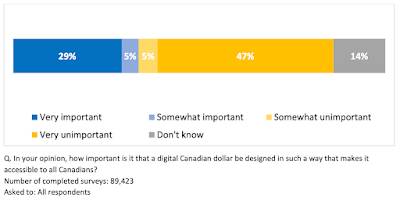

When asked about the importance of a universally accessible digital Canadian dollar, respondents answered as follows:

Note that nearly half of respondents felt that accessibility was very unimportant compared to only 29 percent who felt that it was very important.

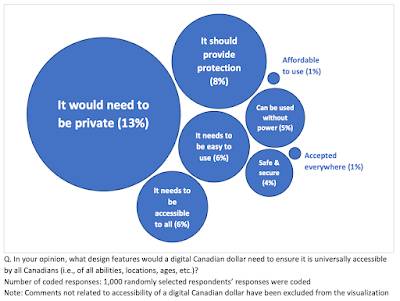

When it comes to the design features of a digital Canadian currency, here are respondents’ recommendations:

In Canadians’ opinion, the most important feature is privacy (13 percent) followed by protection against government abuse or control (8 percent).

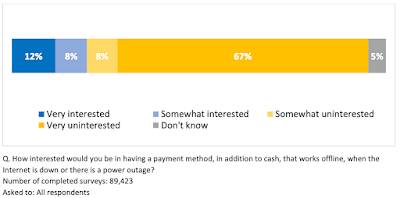

When asked if they would be interested in having a payment method in addition to cash that would work offline when the internet is not functioning or there is a power, outage, two-thirds of Canadians said that they were uninterested in such a feature:

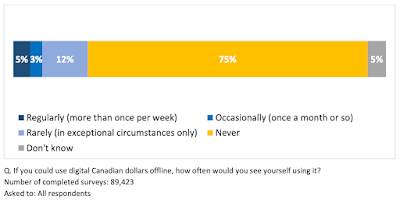

When asked how often they would use digital Canadian dollars offline, here’s what Canadians said:

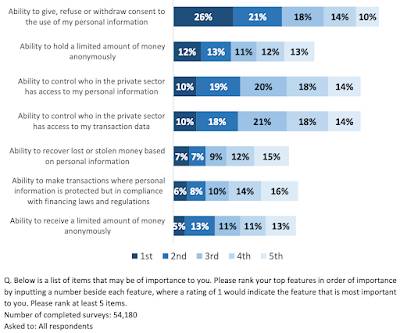

Now let’s get to the most important aspect of a central bank/government-controlled digital currency, the issue of privacy and trust in the Bank of Canada to issue a digital currency that is secure from fraud, cyberattack or theft:

The top privacy features of a Canadian digital dollar that would be expected are as follows:

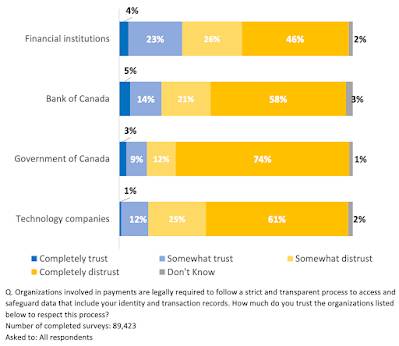

Lastly, here’s how much Canadians trust their own financial institutions, the Bank of Canada, the Government of Canada and Big Tech:

It is quite clear that Canadians have very little trust in their nation’s financial system, particularly the Bank of Canada, the Government of Canada and Big Tech, when it coms to protecting their personal information and spending habits.

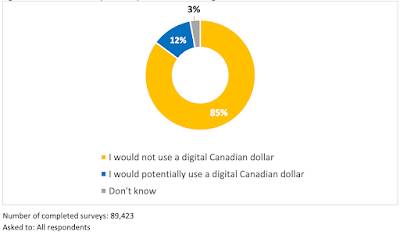

Let’s close with this graphic which shows the percentage of respondents that would use a digital Canadian dollar:

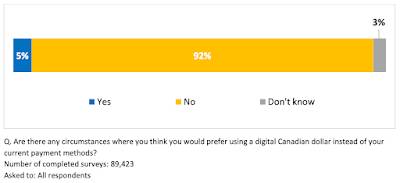

…and the percentage of Canadians who would use a digital Canadian dollar rather than their current form of payment:

To summarize, 86 percent of respondents responded negatively when commenting on the idea of a digital Canadian dollar with only 5 percent responding positively. One commenter even noted the Trudeau government’s attempts to freeze the bank accounts of Canadians who disagreed with their response to the COVID-19 pandemic during the Truckers’ Protest of February 2022.

Let’s close with a couple of comments from the Bank of Canada’s summary of their own survey:

“Overall, the public consultation gathered a diversity of attitudes and concerns from Canadians regarding a digital Canadian dollar, underlining significant reservations related to privacy and security and a strong preference for existing payment methods….

Ultimately, it will be up to Parliament and the Government of Canada to determine if or when to issue a digital Canadian dollar.“

Personally, I think that that the implementation of CBDCs in Canada is a done deal no matter what Canadian voters want but that’s just my opinion. All that it will take is some type of financial catastrophe to push the Bank of Canada and the Government of Canada to force CBDCs on Canadians or the perceived need to remain competitive with the central banks of other nations who implement their own central bank digital currencies.

Be the first to comment