This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

I want to open this posting with a definition:

"Gross National Income (GNI) is the total domestic and foreign output claimed by the residents of a nation. GNI consists of gross domestic product (GDP) plus incomes earned by foreign residents of that nation minus income earned in the national economy by non-residents."

The World Bank defines GNI as follows :

"GNI is the sum of value added by all resident producers plus any product taxes (minus subsidies) not included in the valuation of output plus net receipts of primary income (compensation of employees and property income) from abroad."

The main difference between GNI and GDP is that GNI is based ownership whereas GDP is based on location.

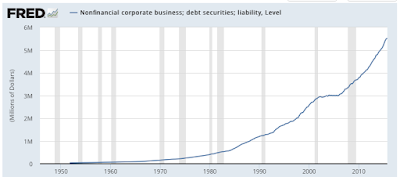

Now that we have that behind us, let's look at corporate debt in the United States as it relates to gross national income. Here is a graph from FRED showing non-financial corporate debt:

Here is a closeup showing the growth in non-financial corporate debt since the beginning of 2008 just before the Federal Reserve implemented a series of unprecedented monetary policies:

In the fourth quarter of 2015 (the latest data from the Federal Reserve's Z.1 Financial Accounts of the United States), non-financial corporate debt hit a record high of $5.518 trillion. This is up $1.99 trillion or 56.4 percent since December 2008 when the Federal Reserve pushed the Federal Funds Rate down to nearly zero percent.

Here is a graph showing the year-over-year percentage increase in corporate debt since 2000:

Since December 2008, corporate debt has risen by between 3.8 percent and 8.8 percent annually, well above the -0.45 percent to 2.5 percent between Q3 2003 and Q3 2006.

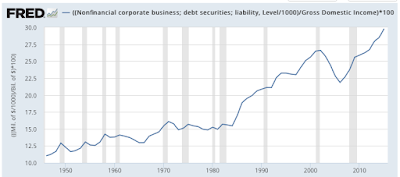

Now, let's use that concept of gross national income. Here is a graph that shows the ratio of non-financial corporate debt to gross national income:

In the fourth quarter of 2015, the ratio of corporate debt to gross domestic income hit 29.8 percent, an all-time high. Since the Federal Reserve began its series of easing policies at the end of 2008, this ratio has risen from 25.6 percent. The graph also shows us that the increase from 21.9 percent in 2006, a rise of 7.9 percentage points, is the fastest increase in corporate debt as a percentage of gross national income since the early- to mid-1980s when the ratio rose by 5.2 percentage points between 1984 and 1989.

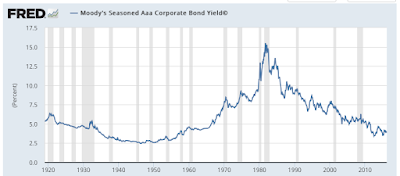

Here is a graph that shows us part of the problem:

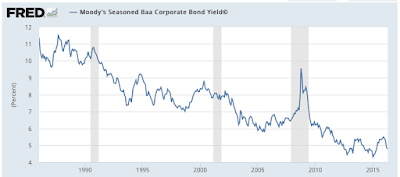

Borrowing for the most creditworthy American corporations has not been this cheap since the 1950s. Even less creditworthy American corporations are tempted to load up with debt with interest rates looking like this:

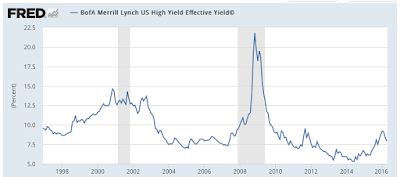

Even corporations whose debt is considered "junk" had it really good through most of 2013, 2014 and 2015 with interest on their debt at decades-low levels as shown here:

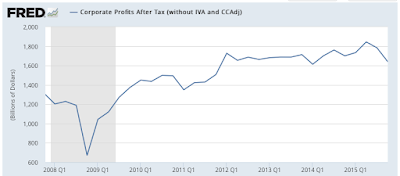

This data shows us the Fed's conundrum. With Corporate America (outside of the financial sector) having levered up with extremely high debt levels, any moves by the Fed to boost interest rates will have a more significant negative impact on American corporations than in recent history. Thanks to the Federal Reserve's ultra-long, ultra-low interest rate experiment, Corporate America has been lured into taking on debt that may prove to be problematic over the medium- to long-term, especially with corporate profits doing this since the Great Recession:

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment