This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

While third quarter preliminary GDP numbers look fair at best, showing growth at 2.1 percent, some key statistics show that the economy may be showing signs that are worrisome, most particularly corporate profits. Data from Factset shows us how weak Corporate America's earnings have become in the last quarter of 2015, particularly in the energy and materials sectors.

Here are three metrics that are showing stress:

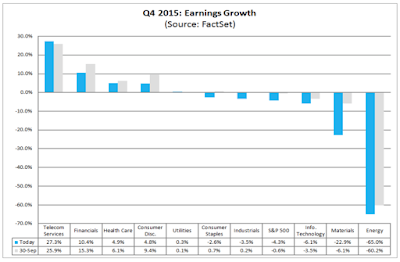

1.) Earnings Growth: For Q4 2015, earnings are estimated to decline at -4.3 percent. This is much higher than the expected decline of -0.8 percent projected on June 30, 2015. If this projection is accurate, this will be the first time that the index has seen three consecutive quarters of year-over-year declines in earnings since Q1 2009.

2.) Earnings Guidance: for Q4 2015, 83 companies have issued negative earnings per share guidance and only 26 have issued positive earnings guidance.

3.) Earnings Revisions: On September 30, 2015, the estimated earnings decline for Q4 2015 was -0.6 percent with eight sectors now showing lower earnings growth rates when compared to the September 30 date.

On a per-share basis, estimated earnings for Q4 2015 have fallen by -3.4 percent since September 30, 2015, a much larger decline than the five year trailing average of -2.7 percent. Of the ten sectors of the economy, five sectors are projected to report year-over-year growth in earnings with five sectors showing year-over year declines in earnings.

Here are the two biggest winning sectors on a year-over-year basis in terms of earnings:

Telecom Services – earnings growth rate of 27.3 percent

Financials – earnings growth rate of 10.4 percent

Here are the two biggest losing sectors on a year-over-year basis in terms of earnings:

Energy – earnings decline rate of 65 percent

Materials – earnings decline rate of 22.9 percent

It is important to keep in mind that most of the earnings growth in the Financial sector are due to earnings growth at Citigroup where earnings growth is projected to be $1.20 per share in Q4 2015 compared to $0.06 in Q4 2014. Without Citi's contribution, growth in the Financial sector would only be 3.5 percent instead of 10.4 percent. In the case of earnings declines in the Energy sector, the Oil and Gas Exploration and Production subsector is predicted to experience the largest year-over-year decline in earnings, a very substantial decline of 147 percent in Q4 2015. In the Materials sector, the Metals and Mining subsector is predicted to experience the largest year-over-year decline in earnings with a drop of 64 percent in Q4 2015.

Here is a graphic showing earnings growth/shrinkage for all ten sectors for the fourth quarter of 2015:

Note that in eight sectors, earnings growth in Q4 is projected to be lower than the level projected on September 30, 2015 and earnings shrinkage for the five most poorly performing sectors are expected to be larger than originally anticipated.

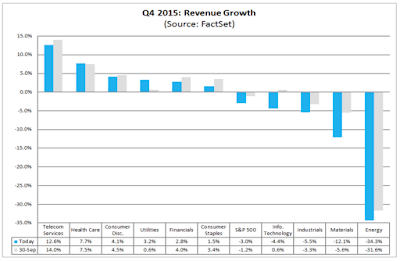

Not only are earnings expected to drop in Q4 2015, the drop in revenues that has taken place over the past three quarters is expected to continue with a drop of 3 percent. This is the first time that the index has seen four consecutive quarters of declines in revenue since the period between Q4 2008 and Q3 2009. Of the ten sectors of the economy, four are expected to show declines in revenue during Q4 2015 (led by Energy and Materials) and six are expected to see revenue growth (led by Telecom Services and Health Care as you can see on this graphic:

Note that in eight of the ten sectors, revenue growth is projected to drop more in Q4 than was projected on September 30, 2015.

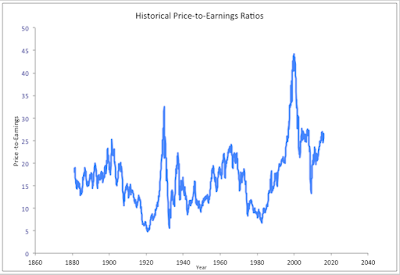

Let's close this posting by looking at the latest price-to-earnings data for the U.S. stock markets from Robert Shiller:

At its current level of 26.6, the price-to-earnings ratio is well above its long-term average of 16.54. In fact, it is very close to its peak value since the beginning of the Great Recession (26.99). If, in fact, the Factset projections about earnings in Q4 2015 are accurate, investors may find that the stock market is way, way overvalued, a situation that will put significant downward pressure on stock prices when it becomes very clear that a substantial part of Corporate America is suffering.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment