This article was last updated on April 16, 2022

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

As June 23 looms closer and closer and Britain makes the ultimate decision whether it should stay in the European Union or go it alone, a recent thorough analysis by Holger Breinlich, Swati Dhingra, Thomas Sampson and John Van Reenen at the Centre for Economic Performance (CEP) at the London School of Economics looks at what various changes in income various income groups in the United Kingdom will experience if the UK decides to cast its membership in the European Union aside on June 23, 2016.

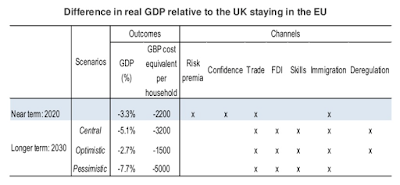

Let's start with a bit of background. An analysis by the OECD shows that, if the United Kingdom chooses to leave the EU, its economy will see its real GDP change as shown on this graphic:

Obviously, this lower level of economic growth is going to have an impact on British citizens, some more than others, an issue that the analysis by the CEP addresses.

The United Kingdom's exit from the EU could certainly lead to lower trade levels. The authors of the CEP study looked at 31 industries and tracked how changes in trade will impact prices across each of these industrial sectors. They consider two scenarios:

1.) An optimistic scenario where the UK remains a member of the European Economic Area (EEA), similar to the relationship that Norway has with Europe.

2.) A pessimistic scenario where the UK remains a member of the World Trade Organization.

Currently, it appears that the EEA scenario is less likely meaning that the pessimistic outcome is more realistic.

Trade costs will likely increase after Brexit for three reasons:

1.) higher tariff barriers between the EU and the United Kingdom.

2.) higher non-tariff barriers to trade resulting from border controls etcetera.

3.) the UK will be unable to participate in future steps that the EU takes toward reduction of non-tariff barriers.

One example of how Brexit will impact consumers is the imposition of higher tariffs on transportation equipment; consumers will experience an increase in the price of imported cars as well as an increase in the tariffs on the steel that is used to manufacture vehicles domestically.

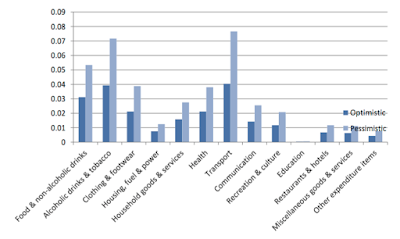

Here is a figure that shows the predicted price changes for 13 groups of commonly consumed household goods and services for both the optimistic and pessimistic scenarios:

Prices would rise the most for transportation (either 4.0 (optimistic scenario) or 7.7 percent (pessimistic scenario)), alcoholic drinks and tobacco (either 3.9 and 7.2 percent), food and non-alcoholic drinks (either 3.1 or 5.3 percent) and clothing and footwear (either 2.1 or 3.9 percent). Service sectors like restaurants would see smaller increases since they generally consume local products.

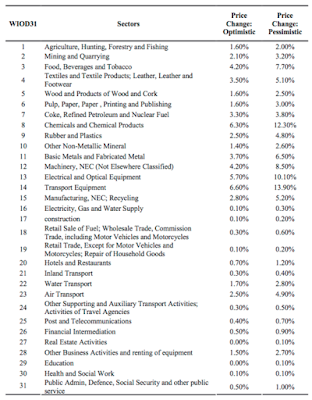

Here is a more detailed listing of price changes under both scenarios:

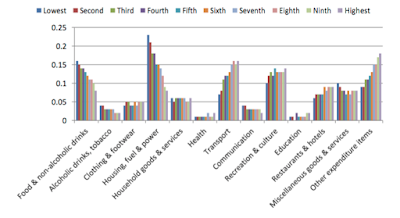

The authors then examined the 10 income groups (deciles) ranging from the poorest 10 percent to the richest 10 percent and then looked at how each group spends their money, in other words, their spending share. The poorest 10 percent spend 16 percent of their household income on food and non-alcoholic drinks compared to only 8 percent for the richest 10 percent. The poorest 10 percent spend 7 percent of their household income on transportation (including purchasing vehicles, rail and air travel) whereas the richest 10 percent spend 16 percent of their income on transportation. Here is a graphic showing the spending share for each of the 13 groups by income decile:

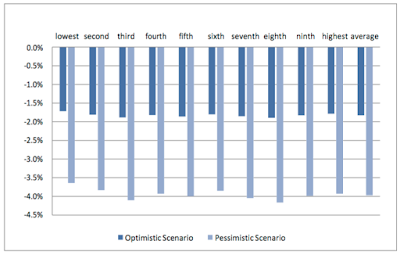

In the optimistic scenario, an average UK household sees real income fall by 1.8 percent which rises to 4 percent in the pessimistic scenario. Households in the middle income group are hit the highest with income drops of up to 4.2 percent. as shown on this graphic which shows real income loss by household income decile:

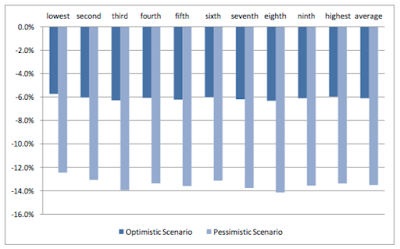

The actual "real world" scenario is far worse over the long-term. When the authors included the effects of changes in trade on productivity and the impact of changes in foreign direct investment in the UK economy (the dynamic scenario), the magnitude of the losses on household income more than triples as shown here:

Under the dynamic scenario, long-term average household real income drops between 6.1 and 13.5 percent annually. The poorest 10 percent who have an average gross income of £10,019 will see their incomes drop by £1,248 or 12.5 percent and the wealthiest 10 percent who have an average gross income of £110,228 will see their incomes drop by £14,744. The average household gross income of £41,238 will drop by £5,573 or 13.5 percent.

While some pro-Brexit economists suggest that the economic cost of Brexit will be borne by the wealthy and that lower income households will benefit because the demand for their services will increase, pushing up wages, this analysis suggests that the pain of Brexit would be borne by all income levels and that the middle income British would suffer slightly more than their poorer and wealthier counterparts. As well, the CEP analysis completely refutes the suggestion that a post-Brexit UK will see household incomes, particularly those at the lower income levels, rise because of reduced immigration from EU nations which is currently blamed for keeping wages lower for low income households. Additionally, this analysis shows that the cost of lower trade and foreign investment in the UK will not be offset by a reduction in the financial transfers that the UK makes to the EU as part of its commitment to the union of nations and that all British citizens will suffer financially if Brexit is the option chosen on June 23.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment