I recently took a wander through the website for the Bank for International Settlements or BIS and found one very interesting chart that I'd like to share.

First, I'd like to give you a bit of background information on BIS and then I'd like to give you a quick explanation about derivatives so that we can put the data that you will see in the chart into perspective.

In its own words, here's what BIS is and what it does:

"The mission of the Bank for International Settlements (BIS) is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks. The BIS pursues its mission by promoting discussion and facilitating collaboration among central banks, supporting dialogue with other authorities that are responsible for promoting financial stability, acting as a prime counter-party for central banks in their financial transactions and serving as an agent or trustee in connection with international financial operations

As its customers are central banks and international organisations, the BIS does not accept deposits from, or provide financial services to, private individuals or corporate entities. The BIS strongly advises caution against fraudulent schemes."

Basically, BIS is the banker of all bankers. It is the penultimate central bank, coordinating the efforts of its 58 member banks. BIS has two goals: first, to regulate capital adequacy for banks and second, to make bank's reserve requirements transparent to ensure that the risk of bank runs is minimized. Editorially speaking, I'd say that BIS must have been sitting on its hands during the Great Recession and during the recent implosion of many of the banks in the Eurozone.

On to part two. What is a derivative? Here is the definition from Investopedia:

"A derivative is a security whose price is dependent upon or derived from one or more underlying assets. The derivative itself is merely a contract between two or more parties. Its value is determined by fluctuations in the underlying asset. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Most derivatives are characterized by high leverage."

For those of you that have some knowledge of how stock exchanges work, you are aware that you do not physically have to hold a company share in your account to "own" that share, bond or commodity. You can "own" it by holding a futures contract, an option to buy or sell, a swap or a forward contract. As such, these instruments can be used to deflect risk on such things as future declines in price, future changes in exchange rate or even future changes in weather that could impact the price of a commodity. Basically, you name it, and the minds controlling Wall Street have found a way to monetize it through the creation of a derivative.

Basically, derivatives are just "something that is based on another source", that is, it is something created from something else. In our increasingly "paper economy", it is creating something made of "paper" from something that originally had value. If you want to know just how dangerous these paper fabrications are to the economy, you need to think back only 4 short years ago when the global financial crisis began. In large part, the near implosion of the world's economy was caused, in part, by the creative proliferation of derivative products that were tied to United States residential mortgages.

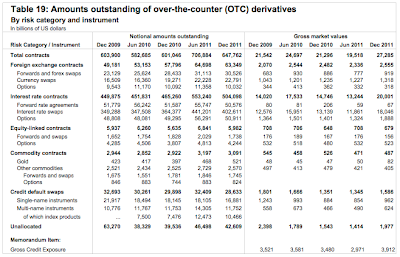

Back to BIS. Here is the chart from their latest Semiannual OTC Derivatives Statistics to the end of December 2011 in billions of dollars, remembering that only 13 of the 58 member countries are reporting their statistics:

All tallied, BIS reports that there were $647.762 trillion worth of derivative contracts globally at the end of December 2011. Of all of the over-the-counter derivatives, interest rate contracts are by far the largest when measured in terms of dollar value. In interest rate swaps, two parties agree to exchange (or swap) interest rate cash flows with the ultimate goal of preventing exposure to fluctuating interest rates or to allow the parties to gain access to a lower interest rate. Clear as mud, right? At the end of 2011, there were $504.098 trillion worth of interest rate contracts and, of these, $402.611 trillion were interest rate swaps.

Let's quickly put these numbers into perspective with this graph from the World Bank:

That's right. The GDP for the entire world was $63.257 trillion in 2010. That means that, according to BIS statistics, the world's entire stock of derivatives was 10 times the size of the world's GDP. What is even worse is that some experts, including Paul Wilmott, estimate that the notional value of the world's derivatives markets is closer to $1.2 quadrillion or nearly twice what BIS statistics tell us.

As I noted above, interest rate swaps are the largest component of the world's derivative market. When interest rates rise, one of the parties will be on the right side of the trade and the other will find themselves on the losing side as is the case with all derivatives. With the size of the interest rate swap market exceeding the size of the world's GDP by many times, the fallout could be very, very ugly particularly when one considers how ugly it got when the much smaller credit default swap market collapsed in 2008 – 2009. There are always winners and there are always losers on any trade; unfortunately, this time, we could all find ourselves on the losing side.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment