Since Mr. Bernanke is updating us on the "state of the union" from a central banker's perspective, I thought that it would be a good idea to take a look back at his tenure as the man at the helm of the world's largest economy and how his policies have impacted a few aspects of life in America. Here's what the economy looked like when Mr. Bernanke took the position of Chairman of the Fed on February 1, 2006.

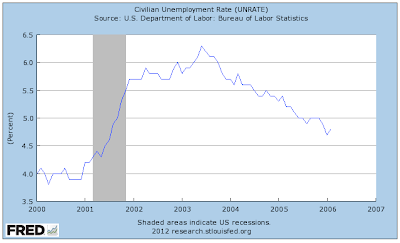

Unemployment was 4.8 percent:

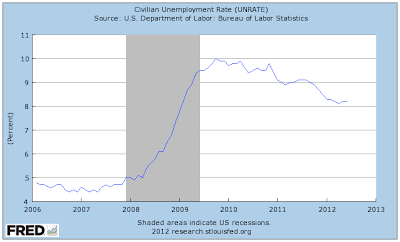

Here's what unemployment looked like after February 2006 (please note the change in scale):

Unemployment peaked at 10 percent in October 2009 and has fallen to 8.2 percent and has been stuck in a range from 8.1 to 8.3 percent since the beginning of 2012.

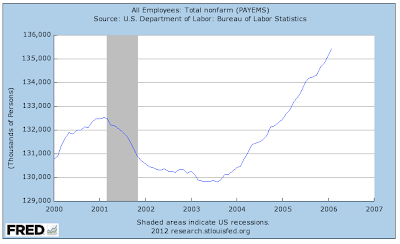

When Mr. Bernanke took over from his predecessor, this is what employment looked like:

In February 2006, 135,413,000 Americans were employed and employment growth was rising nicely after its post-recessional drop.

Here is what has happened to the number of employed Americans since then:

The number of employed Americans hit a peak of 138,023,000 in January 2008, then fell to a low of 129,244,000 in February 2010, a drop of 6.5 percent. Since then, the number of employed Americans has risen to 133,088,000, a rise of only 3 percent. The economy is not even close to making up for the jobs lost in the period from 2008 to 2010.

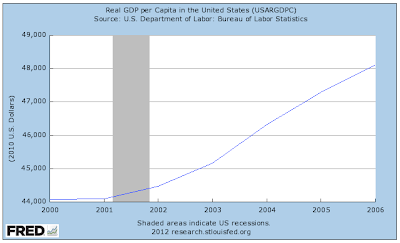

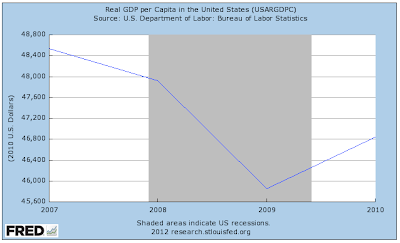

Real GDP per capita had grown from $44,081 in the year 2000 to $48,095 in 2006, a rise of 9.1 percent, as shown here:

By 2010, it sat at $46,844, a drop of 2.6 percent since Mr. Bernanke took office:

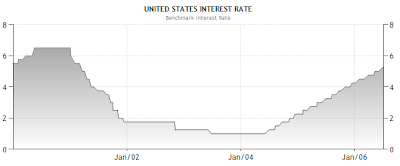

Here's what the Fed's benchmark interest rate looked like prior to Mr. Bernanke's rule:

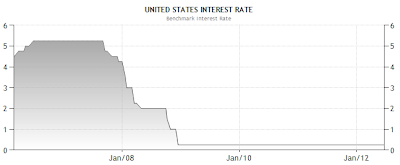

Here's what it has looked like since, showing a modest amount of policy desperation:

While low interest rates seem good on the surface, sometimes they work against us. Since longer Treasuries formed an important component of pension plans in the early part of the millennium, let's look at the interest rates on 10 year Treasuries. The interest rate on 10 year Treasuries was a reasonable 4.57 percent in February 2006, down from its high of 6.79 percent in January 2000:

As shown here, ten year Treasuries are now yielding 1.52 percent, a drop of just over 3 percentage points since Mr. Bernanke appeared as Fed Chairman:

This has forced pension plans to look at riskier equity investments to meet their 7 to 8 percent expected rate of return and, thanks to this prolonged period of ultra-low interest rates, many pension plans are heavily under-funded.

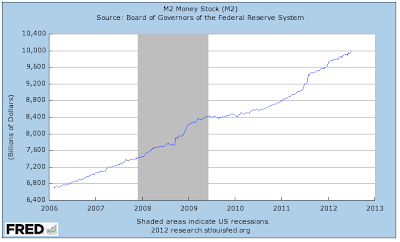

Lastly, let's look at the M2 money supply prior to the Bernanke era:

From the beginning of the new millennium until February 2006, M2 grew from $4.633 trillion to $6.696 trillion, an increase of 44.5 percent.

Here's what has happened since:

M2 money supply has grown to $9.992 trillion, an increase of 49.2 percent. This is nearly double the level of January 2000.

As background information for those of you who are not aware, Congress sets the salaries of the Federal Reserve Board Members. This year, the Chairman's salary was set at $199,700 and the other Board members receive $179,200. The members of the Board of Governors are nominated by the President and, even though they are supposed to represent a wide range of industries, many of them tend to have banking backgrounds. They are appointed for a 14 year term and they may not be reappointed. Here's a quote from the Federal Reserve website:

"Once appointed, Governors may not be removed from office for their policy views. The lengthy terms and staggered appointments are intended to contribute to the insulation of the Board–and the Federal Reserve System as a whole–from day-to-day political pressures to which it might otherwise be subject."

Ben Bernanke was appointed as a member of the Federal Reserve Board on February 1, 2006, the same day that he started his first term as Federal Reserve Chairman. His 14 year term as Board member ends January 31, 2020 and his current term as Chairman ends on January 31, 2014.

Now that we've seen how well Mr. Bernanke has done, here is a link to the Federal Reserve Bank of San Francisco website. This game will allow you act as Federal Reserve Chairman, changing the federal funds rate and seeing how it impacts inflation and unemployment.

I wonder if Mr. Bernanke uses this as a policy tool? Could it be any worse than all of that ineffective easing and Twisting?

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment