While Fed head Jerome Powell's speech at Jackson Hole received most of the media's attention, a speech by the head of another influential central bank is proposing a radical change to the world's financial system.

In his speech given on August 23, 2019, Governor of the Bank of England and former Governor of the Bank of Canada, Mark Carney, gave a speech entitled "The Growing Challenges for Monetary Policy in the current International Monetary and Financial System". After a lengthy analysis of what faces the United Kingdom economy in light of the looming Brexit exit, Mr. Carney went on to examine the challenges for central bankers and their monetary policies in the current international monetary and financial system (IMFS) ecosystem. He begins by noting the following:

"For decades, the mainstream view has been that countries can achieve price stability and minimise excessive output variability by adopting flexible inflation targeting and floating exchange rates. The gains from policy coordination were thought to be modest at best, and the prescription was for countries to keep their houses in order.

This consensus is increasingly untenable for several reasons. Globalisation has steadily increased the impact of international developments on all our economies. This in turn has made any deviations from the core assumptions of the canonical view even more critical. In particular, growing dominant currency pricing (DCP) is reducing the shock absorbing properties of flexible exchange rates and altering the inflation-output volatility trade-off facing monetary policy makers. And most fundamentally, a destabilising asymmetry at the heart of the IMFS is growing. While the world economy is being reordered, the US dollar remains as important as when Bretton Woods collapsed." (my bold)

Here is a graphic showing how the U.S. dollar dominates the global economy:

The dominance of the U.S. dollar means that developments in the United States economy have significant spillover effects in the economic performance and financial health of other nations, a dynamic that is increasing the risk of a global liquidity trap. A liquidity trap occurs when interest rates are very low and there is a high amount of savings by households and businesses which means that central bank monetary policies are ineffective. Here is a video that will provide you with more background information on liquidity traps:

Mr. Carney goes on to note that the current international monetary system (IMFS) is lowering the global equilibrium interest rate or r* by:

1.) feeding a global savings glut as emerging market economies accumulate reserves of "safe: U.S. dollar assets as protection from the inadequate and fragmented global financial safety net.

2.) reducing the scale of sustainable cross border flows which results in lowered potential global economic growth.

3.) increasing the downside skew of likely economic outcomes.

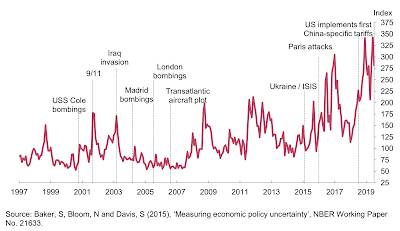

At this point, all of these factors have worked together resulting in global economic policy uncertainty reaching record highs as shown on this graphic:

In the past, economic expansions and contractions were relatively symmetrical across the globe. This has changed substantially over the past two years; at the start of 2019, two-thirds of the global economy was growing at rates below its potential. In contrast, the U.S. economy was very strong with nearly full employment; this forced the Federal Reserve to tighten its policies which resulted in a stronger dollar. The strength of the U.S. dollar has a significant impact on global trade volumes. Research by Emine Boz et al shows that a 1 percent U.S. dollar appreciation results in a 0.6 to 0.8 percent decline with a year in the volume of total trade between countries in the rest of the world. It is the growing asymmetrical economic patterns that are putting the global economy under significant strain. This is particularly pertinent given that the share of global economic activity sourced from emerging market economies has risen from 45 percent at the time of the Fed's last tightening cycle to 60 percent today and it is expected to rise to 75 percent by 2030.

One of Mr. Carney's solutions to dampening the dominance of the U.S. dollar on global trade is the development of a Synthetic Hegemonic Currency. He notes that retail transactions are increasingly taking place online through the use of electronic payments rather than cash. One of the new entrants to the payments infrastructure universe that he touts as a solution is Libra, a payments infrastructure "…based on an international stable coin fully backed by reserve assets in a basket of currencies including the U.S. dollar, the euro and sterling". This cryptocurrency which can be thought of as a fiat currency backed by fiat currencies (i.e. a fiat fiat currency) could be exchanged between participating retailers and users on messaging platforms. Here is a screen capture from Libra's website showing their vision:

Libra claims that it will reinvent money, transform the global economy and make it so that people everywhere can live better lives.

When the international monetary and financial system adopts this new Synthetic Hegemonic Currency (i.e. cryptocurrency), it will dampen the domineering influence of the U.S. dollar on global trade; this would mean that shocks to the U.S. economy would have less potent spillovers through exchange rates and make the flow of capital to emerging market economies less volatile. As well, emerging market economies would be more inclined to diversify their assets away from the U.S. dollar, reducing the downward pressure on equilibrium interest rates, alleviating the aforementioned issue of a global liquidity trap.

Let's close with two further thoughts from Mr. Carney:

'In the longer term, we need to change the game. There should be no illusions that the IMFS can be reformed overnight or that market forces are likely to force a rapid switch of reserve assets. But equally blithe acceptance of the status quo is misguided. Risks are building, and they are structural. As Rudi Dornbusch warned, “In economics, things take longer to happen than you think they will, and then they happen faster than you thought they could”.

When change comes, it shouldn’t be to swap one currency hegemon for another. Any unipolar system is unsuited to a multi-polar world. We would do well to think through every opportunity, including those presented by new technologies, to create a more balanced and effective system."

This proposal by one of the world's most influential central bankers is unprecedented. It clearly shows us two things:

1.) that the current fiat currency reality that we live in is unwinding, forcing central bankers to use their imaginations and come up with a fiat fiat currency which is backed by essentially nothing and

2.) central bankers really have no idea what they are doing and the monetary policy mess that they have created since the Great Recession.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment