Let's open with a classic video:

An interesting opinion piece by Ron Haskins, Co-Director of the Center on Children and Families, Budgeting for National Priorities, on the Brookings website, takes a look at the fiscal problem that will face President Obama and a divided Congress first thing in 2013. The looming "fiscal cliff", a series of tax increases and spending cuts that will act to decrease the deficit, will expire on January 1.

These changes, if they actually occur, will result in a 19.6 percent increase in tax revenue and a measly 0.25 percent drop in spending. This will cut the deficit to an estimated $641 billion in 2013, half a trillion dollars less than the deficit in fiscal 2012. Unfortunately, there are consequences; the Congressional Budget Office suggests that these fiscal measures could throw the United States into a recession with real GDP declining by 0.5 percent between the fourth quarters of 2012 and 2013.

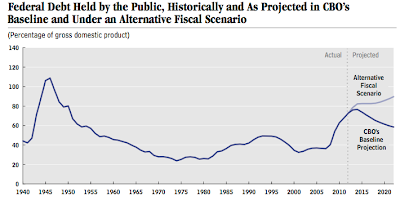

Right now, debt held by the public stands at 72 percent of GDP (by some measures); while that doesn't seem bad by European standards, it has risen from 36 percent of GDP at the end of 2007 and has only remained as low as it currently is because of economic growth. The deficit in 2012 is 7.3 percent of GDP; if the tax increases and spending cuts are allowed to proceed unhindered, this will drop to 4.0 percent in 2013, 2.4 percent in 2014 and to 1.0 percent between 2015 and 2022. After four years of deficits totalling more than $4.5 trillion, the CBO's projections show that deficits under the "higher tax and lower spending" scenario will total $2.3 trillion between 2013 and 2022 with debt-to-GDP falling from 72 percent to 58 percent. Here's what it looks like in graphical form:

The darker blue line shows what happens to debt under the "fiscal cliff" scenario and the lighter blue line shows what happens to debt when the aforementioned legislation is extended, keeping taxes low and spending higher.

Unfortunately, as I noted above, this scenario has a heavy short-term cost; another recession with slower economic growth and unemployment remaining above 8 percent with an additional loss of 2 million jobs. It's not like the recession ever ended for many Americans and, understandably, this would be a very bitter pill to swallow.

Mr. Haskins has four suggestions for Congress:

1.) Postpone the various legislative elements of the fiscal cliff for four months and raise the debt ceiling to avoid another prolonged partisan mudslinging episode.

2.) Give Congress until June 1, 2013 to come up with a solution that would reduce the deficit by a set amount over a set period of time. This solution would be voted on with no amendments.

3.) The compromise would include an automatic backup that would provide for tax increases and spending cuts equivalent to produce the same amount of deficit savings if Congress doesn't meet its June 1 deadline.

4.) Spending cuts over the next ten years totalling half a trillion dollars would be implemented in any case.

Washington can no longer afford to kick this can further down the road. While a highly partisan and divided Congress has, thus far, successfully pushed the problem onto future generations, obviously this cannot continue ad infinitum. Action on this huge problem will be a "damned if you do, damned if you don't" moment for the new administration. The short-term pain of a recession in 2013 may look positively cheery compared to the pain of a European-style debt crisis should the world's bond traders lose confidence in their piles of Treasuries. A bit of compromise by Congress and the president could go a long way to restoring that confidence. Unfortunately, with the next Congress not being sworn in until January 3, 2013, it may already be too late.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment