Six months ago I posted an article that looked at one of the very few leading economic indicators that can be used to give us a sense of the economy's direction. Rather than using trailing indicators like consumer spending, the housing market or employment that provide us with data that is already at least a month old in most cases, this indicator tells us where the economy is headed rather than where it has already been.

The Transportation Services Index or TSI is the broadest measure of United States domestic transportation services and reflects real monthly changes in both passenger and freight transportation services within the U.S. It includes three components; a freight index (the freight TSI), a passenger index (the passenger TSI) and a combined or total index (total TSI). The freight component of the TSI, which includes five modes of transportation (highway, air, railway, waterway and pipeline), appears to show a very close relationship with the pattern of national economic growth. The TSI includes only domestic for-hire transportation that is operated on behalf of or by a company that provides freight or passenger transportation services to external companies for a fee. Not included is transportation in vehicles owned by private firms providing services to that firm, taxis and intercity bus services and noncommercial passenger travel which includes trips in the family car. The for-hire component constitutes roughly 60 percent of total national transportation services.

Here is a table showing the data sources for the TSI:

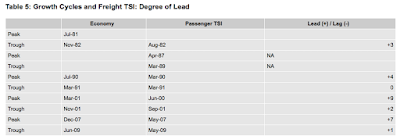

A 2009 study (updated in December 2014) by Peg Young and Ken Notis at the United States Department of Transportation observed that the Bureau of Transportation Statistics freight Transportation Services Index (TSI) showed a decline or deceleration a full 18 months before the start of the Great Recession. This suggests that the TSI may, in fact, prove to be a useful indicator of economic downturns. In addition, on average over the past three decades, the freight TSI turned downward 4 to 5 months before the broader economy began to slow as shown on this table:

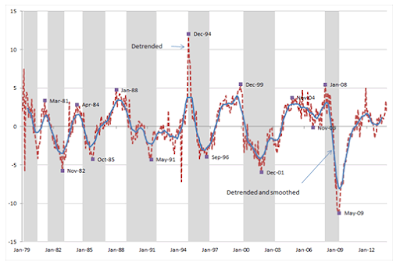

Here is a graphic showing the changes in the freight TSI since 1979 and economic cycles (shaded grey) over that period with the turning points (or decelerations) noted as month and year:

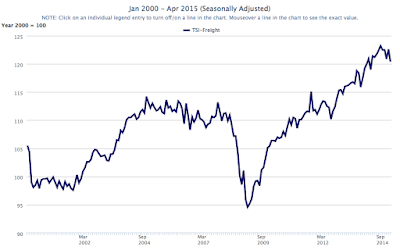

Now, let's look at the freight TSI data from January 2000 to April 2015:

It's quite clear that since November 2014, the freight TSI has plateaued and is showing signs of declining. At the very least, its growth trend from the end of the Great Recession in June 2009 has ended.

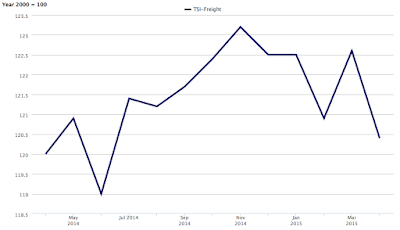

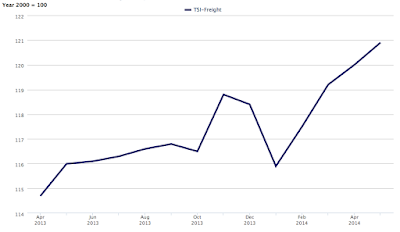

Here is a closeup of the data over the past year:

This curve looks substantially different than it did over the period between April 2013 and April 2014:

If the authors' analysis is to be believed, it certainly looks like an economic slowdown could be in the cards. With first quarter 2015 negative GDP growth being blamed on weather-related issues, the plateauing and declining freight TSI may already be foretelling a second quarter of very low or negative economic growth no matter what the Federal Reserve tells us.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment