The December 2016 edition of the BIS Quarterly Review by the Bank for International Settlements has been released and actually provides readers with an interesting look at why there has not been a major “global bond market temper tantrum” with rising yields that have already led to a nearly $2 trillion loss in global fixed income investments. Here is BIS’ rationale for this unusual development which they term a “bond market sell-off with few ripples”.

Let’s start by looking at the opening paragraph of the Quarterly Review so we can get a sense of BIS’ mindset:

“Global bond yields have continued to rise markedly in recent months. After core fixed income markets had plumbed new historical depths this summer, overall yields had jumped sharply by the end of November – in fact by a magnitude similar to that of the taper tantrum of May–September 2013. But despite record high duration risk, there were few signs of stress in credit markets as spreads remained tight and volatility was contained.” (my bold)

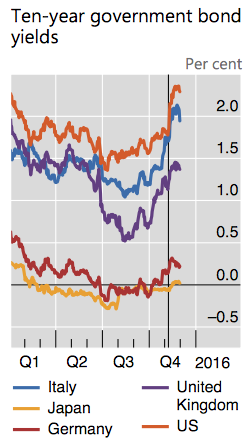

Here is a graphic showing what has happened to the yield on key ten-year government bonds over the entirety of 2016 with the vertical line showing the date of the U.S. presidential election for reference:

As you can see, the yields on government bonds outside of Japan pretty much mirrored the performance of Treasuries.

Let’s focus on Treasuries since they are the bond market bellwether sovereign debt security. Prior to the November 8 election, ten-year Treasury yields had gained about 50 basis points from their historical lows seen in July as shown here:

In response to the election outcome, ten-year Treasury yields jumped by a very significant 20 basis points, the largest one-day jump in yield since the taper tantrum of 2013 and greater than all but one percent of one-day movements in yield over the last 25 years. Since early July 2016, yields on ten-year Treasuries have jumped a very significant 85.4 percent; while the 1.17 percentage point jump may not seem significant thanks to the Fed’s long experiment with ultra-low interest rates, the 85.4 percent jump certainly is and is above the 83 percent jump in yields during the taper tantrum of mid-2013.

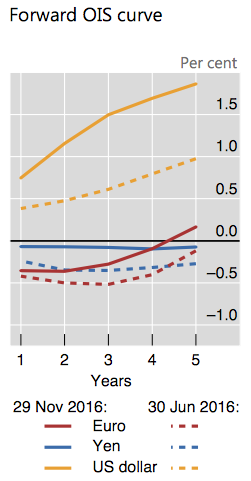

The forward expectations of higher future interest rates from the Federal Reserve are also putting additional upward pressure on yields as shown on the yellow line in this graphic:

According to Reuters, the unexpected win by Donald Trump resulted in two day bond market losses of more than $1 trillion across the globe. According to Bloomberg, November’s bond market rout saw a total of $1.7 trillion disappear from the Bloomberg Barclays Global Aggregate Total Return Index.

Normally, one would think that this situation would result in even more significant bond market volatility, however, as you will see, BIS has an explanation for that phenomenon. The authors of the BIS Quarterly Review go on to look at one very interesting aspect of the recent bond market correction, explaining why bond market volatility remained “well contained”. Here is a quote:

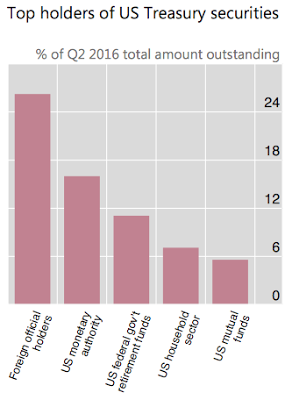

“The limited market impact of higher yields may in part have reflected the capacity of major holders of government bonds to bear mark-to-market losses as well as limited evidence of negative feedback loops through hedging activities. For instance, around 40% of US Treasuries are owned by the Federal Reserve and the foreign official sector. Pension funds (the third largest holders of Treasuries) and insurance companies may even benefit from rising rates in the medium term, as a normalised yield environment would allow them to more easily meet promised returns. However, valuation losses in the short run may affect profits and capital depending on accounting standards. In addition, the hedging activities of the US government-sponsored enterprises (GSEs), which contributed to the bond market turbulence of 1994, are much lower now. This is because, as part of quantitative easing policies, GSEs sold a large share of their portfolios to the Federal Reserve, which does not hedge its securities.” (my bold)

As backup for this statement, here is a graphic that shows the top holders of U.S. Treasuries keeping in mind that the “U.S. monetary authority” is the Federal Reserve:

Basically, thanks in large part to the Federal Reserve and its massive holdings of U.S. sovereign debt and the fact that it doesn’t have to implement mark-to-market losses like other “real world” entities, BIS feels that this factor explains a great deal of why the bond market volatility has remained relatively subdued compared to what would normally be expected in a situation where prices had fallen to the point where yields very nearly doubled.

Obviously, the brilliant minds at the Bank for International Settlements feel that there has been a paradigm shift in the bond market which has led to lower levels of global bond market volatility thanks to the changing ownership of sovereign debt when compared to past economic cycles. Only time will tell whether the “new bond market reality” holds true during the next global economic contraction when central banks are forced to use new, imaginative monetary policies unless, of course, they find it desirable to own even more government debt.

Click HERE to read more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment