We are all aware that China has massive foreign exchange reserves; at the end of December 2011, China held a total of $3.181 trillion in various currencies, mainly in United States Treasuries. The exact composition of China’s foreign reserves is a great mystery, however, the Treasury Department report that I’m using for this posting is the most reliable source for the U.S. allocation of the total. In recent weeks, the Eurozone debtor nations have been approaching China to invest in their rather toxic stew of sovereign debt, however, the outside world has no way of knowing whether they have actually accepted Europe’s kind offer.

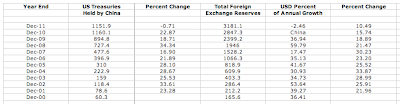

Here is a chart showing the data that I will be using for this posting sourced from the United States Treasury Department for historical data and from here for last year’s data and from the Chinability website:

The Treasury Department releases a monthly summary of Major Foreign Holders of Treasury Securities showing which nations are holding U.S. Treasuries. From that data, we can see how the holding of Treasuries by various countries has varied over time; for example, Japan was the largest holder of Treasuries between the years 2000 ($317.7 billion) and September of 2008 ($617.5 billion) when they were supplanted by China who held $618.2 billion in that month. Since then, China has been the number one holder of U.S. Treasuries.

Here is a graph showing the growth of China’s foreign exchange reserves since 2000:

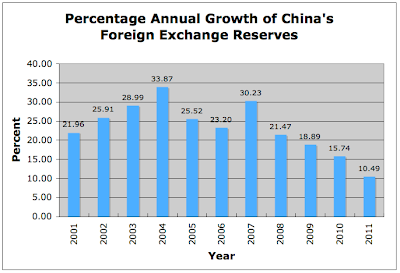

Here is a graph showing the annual percentage growth of China’s foreign exchange reserves since 2000:

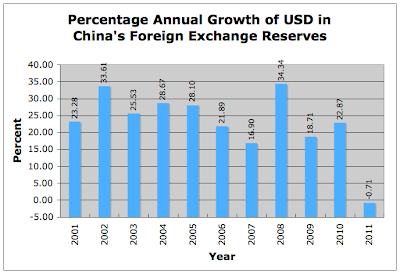

Now, here is a graph showing the annual percentage growth of China’s holdings of United States Treasuries:

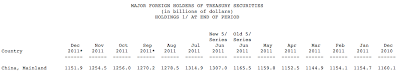

Note that China’s holdings of Treasuries in 2011 actually dropped by 0.71 percent despite the fact that their overall foreign reserves holdings grew by 10.49 percent. United States holdings remained at roughly the same level at the end of 2011 as they were at the beginning; what is interesting to see is how the holdings rose and then dropped during the year as shown here:

China’s holdings of Treasuries peaked at $1.3149 trillion in July of 2011 and then fell to the year end value of $1.1519 trillion by the end of December of 2011, a drop of 12.4 percent.

It is interesting to note that this drop in U.S. holdings occurred during the Eurozone debt crisis. This would suggest that perhaps the Chinese were involved in the purchase of Eurozone debt. It’s also interesting to see that China’s holdings of U.S Treasuries dropped after their Dagong Credit ratings agency warned about the level of U.S. debt as shown here.

It will be interesting to see if China continues to diversify its holdings and see if these changes in the demand for Treasuries ultimately puts upward pressure on interest rates.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment