The announcement that the Swiss National Bank (SNB) was allowing the Swiss franc to "readjust" in value took the market by storm. Switzerland had long been preventing the value of the euro to weaken below 1.20 against the franc, maintaining the cap by printing francs to buy euros in the market to maintain its currency at a value that would keep Switzerland's exports competitively priced in the world's markets.

Here is the

wording of the SNB announcement:

"The Swiss National Bank (SNB) is discontinuing the minimum exchange rate of CHF 1.20 per euro. At the same time, it is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold by 0.5 percentage points, to −0.75%. It is moving the target range for the three-month Libor further into negative territory, to between –1.25% and −0.25%, from the current range of between −0.75% and 0.25%.

The minimum exchange rate was introduced during a period of exceptional overvaluation of the Swiss franc and an extremely high level of uncertainty on the financial markets. This exceptional and temporary measure protected the Swiss economy from serious harm. While the Swiss franc is still high, the overvaluation has decreased as a whole since the introduction of the minimum exchange rate. The economy was able to take advantage of this phase to adjust to the new situation.

Recently, divergences between the monetary policies of the major currency areas have increased significantly – a trend that is likely to become even more pronounced. The euro has depreciated considerably against the US dollar and this, in turn, has caused the Swiss franc to weaken against the US dollar. In these circumstances, the SNB concluded that enforcing and maintaining the minimum exchange rate for the Swiss franc against the euro is no longer justified.

The SNB is lowering interest rates significantly to ensure that the discontinuation of the minimum exchange rate does not lead to an inappropriate tightening of monetary conditions. The SNB will continue to take account of the exchange rate situation in formulating its monetary policy in future. If necessary, it will therefore remain active in the foreign exchange market to influence monetary conditions."

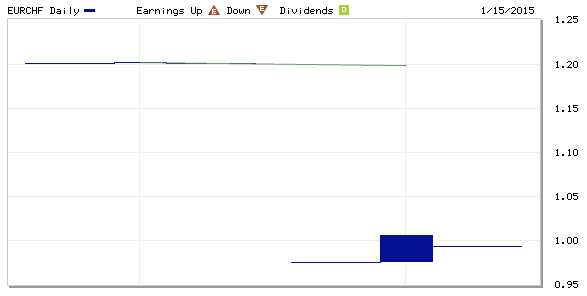

When the SNB removed the cap on the value of the franc, its valued immediately soared against other currencies, particularly the euro as shown on

this chart:

It now only takes around CHF 0.99 to buy one euro, down from CHF 1.20 before the announcement.

If we look at this graph, we get a sense for why the SNB took this unprecedented move:

The Swiss National Bank has a very substantial inventory of euros on its balance sheet, acquired as the SNB kept buying euros to keep the value of the Swiss franc from rising, an action that was particularly necessary during the Eurozone crisis in late 2009 and 2010. At the end of the third quarter of 2014, the SNB was sitting on

€174,335 million which makes up 44.6 percent of the foreign currencies held on its balance sheet. With the European Central Bank (ECB) heading towards its own quantitative easing program which will put additional downward pressure on the value of the euro as Europe's own interest rates fall even further, the cost of holding the value of the Swiss franc below the old peg level would likely have become more and more expensive, leaving the SNB with even more euros on its balance sheet that are worth even less.

What can we learn from this? The spillover effects from central bank monetary policy interventions are interacting with each other, resulting in a series of unintended consequences. With globalization, one central bank, even a relatively small one like the SNB cannot act without provoking a response in another economy.

Click

HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment