As a baby boomer, my interest in pension plans has grown as I approach the magic age when "mailbox money" will appear in my bank account every month. When I entered the workforce in the late 1970s, pension plans were a foundation of every employment contract along with a monthly salary and health insurance. We were led to believe that our employer was contributing to a guaranteed benefit on our behalf, a benefit that we would have access to once we reached the requisite pensionable age. Unfortunately, as the decades passed, pension plans changed and employers, realizing that there was no way that their defined benefit plans were sustainable over the long-term, switched to some form of defined contribution plans by offering employees a one-time cash payment/buyout. As we now know, pension income is going to be far different for baby boomers than it was for our parents.

According to the Pension Rights Center (PRC) and the Center for Retirement Research at Boston College, the relatively recent Multiemployer Pension Reform Act of 2014 has been a game-changer for a significant part of the American pension system. Multiemployer Pension Plans or MEPPs are employee benefit plans that have been maintained under one or more union collective bargaining agreements to which more than one employer contributes. These agreements generally involve one or more local unions that are part of the same national or international labour union and also involve more than a single employer. According to the International Foundation of Employee Benefit Plans, there are/were significant benefits to MEPPs as follows:

“Workers: Multiemployer plans provide benefit security for participants and beneficiaries through pooling of risk and economies of scale for employees in a unionized workforce covered by the plan. They also provide portability of certain benefits and eligibility for those employees who move from employer to employer within the industry covered by the plan. As a result, multiemployer plans often enable eligibility to be transferred from employer to employer or job to job which can avoid interruptions in coverage that would apply without this portability.

Employers: Multiemployer plans also help employers with a union workforce in the affected area and industry by making available coverages on a more economical basis due to a pooling of risk and economies of scale.”

That sounds pretty good, doesn't it? The assurance of pension security has always been one of the key foundation stones of a Multiemployer Pension Plan.”

Unfortunately, the 2015 Omnibus spending bill (H.R. 83) which was signed into law by President Obama in December 2014 included various provisions that allowed trustees of MEPPs to cut retirees' pension plan payments as shown here:

1 “The legislation permits deep pension cuts to retirees in certain financially-troubled multiemployer plans. Financially-troubled plans are plans expected to not have enough money to pay 100% of benefits within 15 and, in some cases, 20 years. There are instances where the cuts could be more than 60% of a participant’s benefits.

2 The decision to cut benefits is made by plan trustees, who are typically more aligned with active workers and employers than with retirees.

3 Retirees who are age 80 or over, or who are receiving a disability pension, are not subject to benefit cuts. Retirees ages 75-79 are subject to smaller cuts than retirees under age 75.

4 How big or small the cuts are for those under age 75 is determined by the trustees. The cuts are subject to certain legal limits, the most important of which is that benefits cannot be cut below 110% of the amounts that the federal pension insurance agency guarantees.

5 Plan trustees decide how to allocate the cuts. For example, they can cut retirees’ benefits more than those of active workers, and they can decide whether and how much to reduce survivors’ benefits.

6 Plan trustees are required to reduce the benefits of participants whose employers went out of business (or withdrew from the plan for other reasons without paying all of their obligations) first, before they reduce the benefits of any other plan participants. This will mean that those retirees whose companies went bankrupt will have greater reductions than other retirees.

7 Even if all participants vote against cuts, the Treasury Department, in consultation with the Department of Labor and the Pension Benefit Guaranty Corporation (PBGC, the federal pension insurance program) can override the vote and uphold the trustees’ decision to make cuts if it concludes that the plan’s insolvency would increase the PBGC’s projected liabilities by $1 billion or more.

8 The insurance premiums that multiemployer plans pay to the PBGC are increased from $13 to $26 per participant per year. In contrast, premiums paid to the single-employer plan program are between $57 and $475 per participant per year.

9 Retirees, widows, and widowers whose benefits are reduced cannot bring a lawsuit under the federal private pension law, ERISA, to challenge the legality of the reductions."

Obviously, pension plans are in big trouble, particularly those Multiemployer plans that were put in place to ensure pension security.

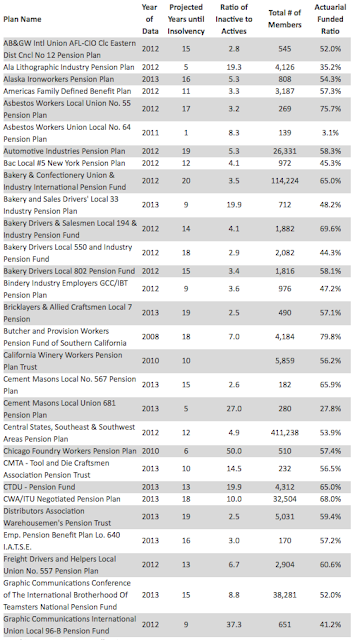

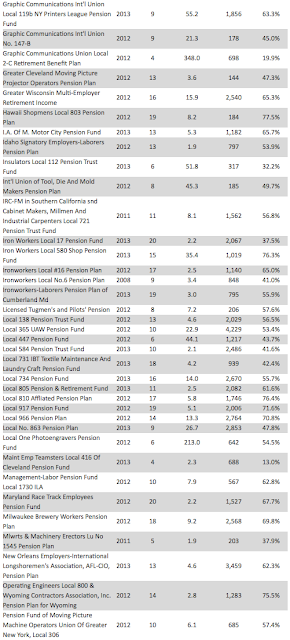

The Center for Retirement Research at Boston College has compiled a partial list of 100 MEPPs that may be permitted to cut benefits as a result of the new law. Here is an alphabetical list of the plans:

Note the high ratio of inactive members to active members (i.e. the number of members that are funding each retiree), the very low funded ratios and the fact that some plans are expected to be insolvent in less than five years. In the worst case scenario, the Southern California, Arizona, Colorado and Southern Nevada Glaziers, Architectural Metal and Glass Workers Pension Plan has one year to insolvency and has a funding rain of only 5.3 percent. There are 4580 members of this pension plan. The largest pension plan (in terms of membership) in the list, the Central States, Southeast and Southwest Areas Pension Plan has 411,238 members. It is only 53.9 percent funded and has 12 years until insolvency.

According to the new law, pension plans that are projected to run out of money within 20 years can cut benefits if their are twice as many retirees as their are active workers in the plan or if the plan does not have enough money to pay more than 80 percent of future "promised" benefits. Plans are not allowed to cut benefits unless the benefit cuts are projected to restore the plan to a solvent state.

As we can see, pension plans have turned out to be a gigantic Ponzi scheme where employees who will reach pensionable age later this century will find it increasingly unlikely that they will receive benefits of any significant amount.

Click HERE to read more of Glen Asher's columns.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment