With Ireland’s debt crisis still brewing, I thought I’d take a look at Germany’s fiscal situation since they always appear to be a bastion of fiscal responsibility in a sea of many nearly bankrupt Eurozone debtor nations. Once again, all of the data used in this posting is taken from original government sources wherever possible. I’m warning you, there are a lot of numbers but the conclusions can be found just below the "Summary" header.

The German government passed its 2011 budget back in early July 2010. In that budget, Chancellor Angela Merkel’s government made an attempt to rein in spending by cutting its total budget to €307.4 billion. Public spending in 2011 will be cut by 3.8 percent or €11 billion. As well, Germany’s borrowing should be reduced to €48.4 billion in 2011 from €65.2 billion in this fiscal year. The government also proposes to cut spending further to €301 billion by 2014. As of mid November, the budget has passed through Merkel’s coalition cabinet (Christian Democrat and Free Democrats) and through the Bundestag, the German lower house of parliament.

Despite the cut in new debt to €48.4 billion (compared to the €57.5 billion originally proposed by Finance Minister Wolfgang Schaeuble in early 2010), the additional debt will be added to what is already a relatively large overall government debt of €1093 billion.

Germany’s population of 82 million people is suffering from the same permanent shift in demography as most other industrialized nations. Life expectancy is rising and the birth rate is dropping and it is projected that within a few years, there will be more people aged 65 and over than there are people aged 15 and under despite growth in immigration. This will make servicing the public debt more difficult since the elderly tend to consume more social service programs.

From the Economic and Financial data page on the Destatis (Germany’s Federal Statistics Office) website, the 2009 budget deficit stood at €79.32 billion with GDP for Q3 2010 standing at €638.6 billion. Germany’s GDP for 2009 stood at €2397.1 billion (non-seasonally adjusted). In October 2010, there were 2.946 million unemployed workers in Germany, down from 3.031 million the previous month.

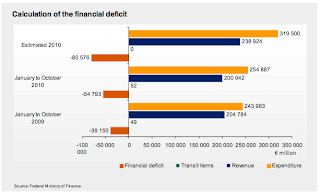

According to the November 2010 Federal Ministry of Finance’s Monthly report found on the Bundesfinanzministerium website, the federal debt stood at €1096.8 billion at the end of September 2010. This is up €4.8 billion from the end of the previous month. For the first 10 months of 2010, the deficit stands at €54.793 billion, up from €39.15 billion for the same period in 2009 and is estimated to come in at €80.6 billion for the entire 2010 fiscal year although the government feels that current trends in the monthly growth of the deficit could result in new net borrowing of only €50 billion (a new record for Germany).

Here’s a chart showing the deficit for 2009 and 2010:

Interest on the debt for the first 10 months of the year (January to October) stands at €32.325 billion, down slightly over €3 billion from the previous year and is estimated to total €36.751 billion for the entire fiscal year. These interest payments consume 12.7 percent of the entire federal fiscal year budget down from 14.6 percent in 2009.

Now, let’s look at my favourite number debt per capita. Germany’s total debt of €1096.8 billion ($1.4928 trillion) is divided amongst its 82,110,097 citizens. This works out to per capita debt of $18,180 and puts Germany well into the low range of the G8 members of the EU as found in this posting.

As well, let’s look at the debt in terms of GDP. For 2009, Destatis records Germany’s GDP at €2397.1 billion. At the end of 2009, Germany’s debt stood at €1053.686 billion. This results in a debt to GDP ratio of 44 percent, well below most other EU countries and below the EU cutoff of 60 percent. Its deficit last year was €34.5 billion or 1.4 percent, well below the EU limit of 3 percent although, according to Destatis, if the deficits of all public budgets is taken into account, the total deficit for 2009 stood at €105.5 billion and the debt of public budgets had risen to €1.692.2 billion at the end of 2009, putting the deficit to GDP at 4.4 percent and the debt to GDP at 70.6 percent. Note that both ratios are well above the EU cutoff guidelines.

Summary

To summarize, it does appear that Germany does have at least some firm ground to stand on when it comes to criticizing its EU partners for fiscal mismanagement, at least by comparison. While the country does have a rather large public debt of €1096 billion, its per capita (€18,180) and debt to GDP level (44 percent) are among the lowest in the G8. What is concerning is its debt growth in the past two years (€79 billion last year and €54 billion so far this year), its aging population and the fact that its population has not really grown in the past 20 years and is projected to drop from 82 million to 72 million by 2050. Interest on the debt is estimated to reach €36.751 billion for fiscal 2010 and will consume 12.7 percent of the entire budget, down 1.9 percentage points from the previous year. These factors, when summed, will make it increasingly difficult for Germany to service a growing debt and will definitely affect the country’s ability to offer further fiscal assistance to other EU Member States as their economies implode.

As an aside, at the end of September 2010, Germany made its final payment of $94 million towards its debt/reparations imposed on the country by the Allies at the end of World War One. This put a final end to the financial obligations Germany acquired after the war 92 years ago. The Treaty of Versailles was signed on June 28th, 1919 and for its part in the conflict, the Allies assessed a penalty of $31.4 billion (equivalent to $382 billion in 2010) The whole debt would have been paid off earlier but Hitler refused to pay and, in part, it was the crippling economic burden of the reparations led to his rise to power. As well, when Germany was divided into East and West, payments were suspended until reunification in 1990.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment