Now that Quebec's election is in the final stretch, I thought it would be prudent to take a look at their fiscal picture, comparing it to the rest of Canada's provinces.

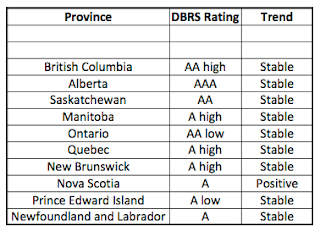

Let's open by looking at how the Dominion Bond Rating Services (DBRS) rates Quebec's long-term debt compared to its peers:

Quebec sits in the middle of the pack with an "A high" rating. According to DBRS the "A" rating suggests the following that seem to apply to Quebec in specific:

1.) GDP growth may have been steadily below average or inconsistent in previous years.

2.) Tax burdens may already be somewhat high, limited the ability of government to raise taxes if needed.

3.) Government has reduced ability or willingness to manage downturns through meaningful expenditure restraint or revenue-raising initiatives.

4.) The borrowing platform may be somewhat narrow and is generally limited to Canada.

5.) Unfunded public sector liabilities are large and growing.

6.) Less co-operative relationship with senior government and overlapping areas of responsibility.

One example of a growing public sector liability in the province is the City of Montreal's pension plan; this plan now accounts for 13 percent of the city's operating budget, even more than the amount that is spent on public transit. This is not a sustainable or healthy situation.

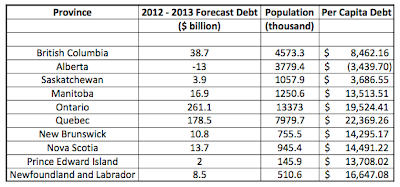

Now, let's take a look at specific provincial deficit and debt statistics from TD Economics. Please note that I'm using the 2012 – 2013 budget estimates for both statistics:

Quebec's forecast deficit for fiscal 2012 – 2013 looks quite good compared to its provincial peers, coming in roughly one-third the size of Ontario's and sitting right in the middle of the pack. Quebec's overall projected debt doesn't look quite as good, coming in second highest behind Ontario and well above the rest of its peers.

Let's look at my favourite metric, per capita debt. Please note that population data is current to the end of 2011 and is taken from Statistics Canada's database for consistency:

Quebec has the highest per capita debt level, coming in at $22,369 per man, woman and child. Ontario is in second place with a per capita debt of $19,524 and Newfoundland and Labrador are in third place with a per capita debt of $16,647. Alberta comes in with an actual surplus of $3,439 for every Albertan.

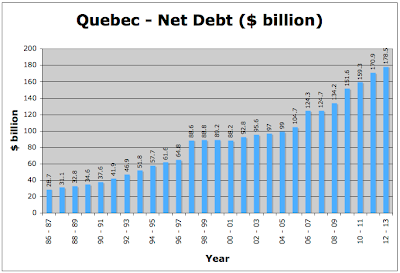

Let's look at how Quebec's debt has grown over the past two and a half decades:

Now let's look at how Quebec's debt-to-GDP level, now the highest in Canada by a wide margin, has grown over the same time period:

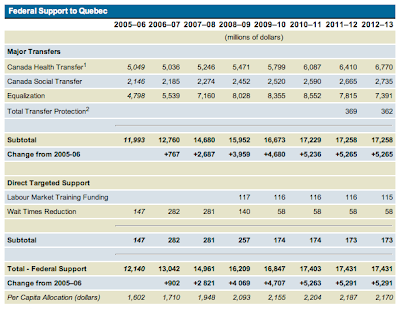

While Ms. Marois may be caught in the "sovereignty loop", Quebec's fiscal picture is a far cry from healthy and must be considered before the PQ rattles the "sovereignty sabre" yet again. This is particularly apparent if one considers the fact that the Harper government consistently threatens that they will wean Canada's have-nots from federal transfers which are expected to total $17.431 billion for Quebec in fiscal 2012 – 2013 as shown here:

Without billions of dollars in annual federal transfers, Quebec's illusion of fiscal prudence will vanish along with its ability to "go it alone" without the rest of Canada. Let's hope that saner heads prevail.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment