With Washington trying desperately (well, they are at least pretending that they are trying desperately) to balance their revenues with their expenditures at the same time as they are trying to reduce joblessness, talk of changes to America’s corporate tax rates appear in the mainstream media’s business publications on a regular basis. While posting about corporations who pay their CEO’s more than they pay in taxes last week, I stumbled on the pre-release for this study released by the group Citizens for Tax Justice (CTJ), a public interest research and advocacy organization whose mission is “…to give ordinary people a greater voice in the development of tax laws.”. In their brief entitled “Twelve Corporations Pay Effective Tax Rate of Negative 1.5% on $171 Billion in Profits; Reap $62.4 Billion in Tax Subsidies“, CTJ analyzes the pretax profits, federal tax paid and effective tax rates of 12 Fortune 500 companies for the years between 2008 and 2010. Here are CTJ’s findings as outlined in the pre-release. Please note that the full study has not yet been released to the public but when it is, I will post on CTJ’s final observations.

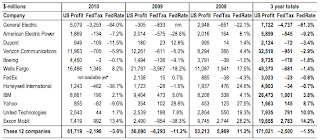

CTJ studied the pretax profits and taxes paid by American Electric Power, Boeing, Dupont, ExxonMobil, FedEx, General Electric, Honeywell International, IBM, United Technologies, Verizon Communications, Wells Fargo and Yahoo. Their analysis shows that not a single one of these companies paid the much-touted and bemoaned 35 percent corporate tax rate. Let’s take a look at a few examples of which corporations paid or didn’t pay among the twelve:

1.) The most heavily taxed as a percentage of U.S. profits: The award for this honour goes to ExxonMobil which paid an effective tax rate of 14.2 percent, only only 40.6 percent of the headline 35 percent rate. Over the three year period from 2008 to 2010, ExxonMobil paid only $2.783 billion in taxes on $19.655 billion in profits. That is particularly juicy in this time of high oil prices.

2.) The most profitable corporation: The award for this honour goes to Wells Fargo which made a massive profit of $49.370 billion over the three year period of the study. On that profit, Wells Fargo actually received a $681 million tax benefit, resulting in an effective tax rate of negative 1.4 percent. Must be nice if you can get it! Oh to be a corporation!

3.) The corporation with the lowest Federal tax rate: The award for this honour goes to General Electric (remember, the CEO of GE is President Obama’s “job czar”, one Jeffrey R. Immelt). Over the three year period in question, GE’s United States profit was $7.722 billion, hardly chump change. However, the generosity of the current corporate tax system saw fit to reward GE with a $4.737 billion tax benefit. This resulted in a three year effective Federal tax rate of negative 61.3 percent! Note as well that General Electric also receives the honour for the largest Federal tax benefit as noted two sentences ago. Congratulations! Since Mr. Immelt heads a corporation that has achieved such illustrious awards under his tenure, I thought I’d throw in his photograph from the cover of Bloomberg Markets for the illumination of my readers:

Here’s a chart showing the pre-tax profits, Federal income taxes paid (or not) and effective Federal tax rate for all 12 corporations:

Note that all of the companies but two (poor sad IBM and United Technologies) enjoyed at least one tax-free year during the period from 2008 to 2010. In total, the 12 corporations made $171.021 billion in profits over the three year period and paid a grand total of, drum roll please, negative $2.5 billion in taxes for an effective overall Federal tax rate of minus 1.5 percent. According to CTJ, had these 12 corporations paid the full 35 percent corporate tax rate that CEO’s are prone to whinge about, they would have remitted $59.85 billion to the Federal coffers rather than collecting $2.5 billion in benefits. That would have raised total corporate taxes collected by Washington by 12 percent for the three year period.

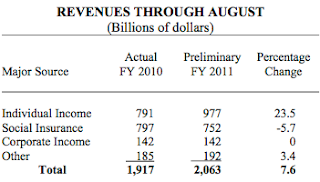

Let’s put the amount of corporate taxes that Washington receives into perspective. Here’s a screen capture from the Congressional Budget Office’s Monthly Budget Review for the first 11 months of fiscal 2011 released on September 8th, 2011 showing where the Federal government’s revenue is sourced:

Despite a nicely profitable year, corporate taxes have not grown from fiscal 2010 to fiscal 2011 and, at $142 billion, are only 14.5 percent of the revenue sourced from individual income taxes, down from 17.95 percent in fiscal 2010.

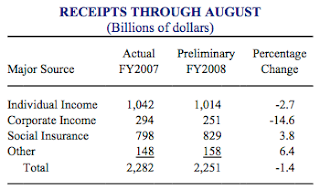

Now, let’s go back to the Monthly Budget Review from September 5th, 2008, just before the soft, glutinous material hit the rotating cooling device. Here is a screen capture showing the data:

Notice that corporate income taxes for the first 11 months of 2008 were $251 billion, over 75 percent higher than what they were in 2010 and 2011, despite the fact that the economy was starting to circle the white porcelain bowl, particularly in comparison to 2010 and 2011. At this point in fiscal 2008, corporate taxes were 24.75 percent of revenue sourced from individual income taxes, nearly twice as high as in fiscal 2011.

It is rather interesting to see how corporations seem to be quite adept at minimizing their tax burden. Oh the juggling that must go on. Perhaps their ability to purchase the services of tax lawyers and accountants allows them tax luxuries that the rest of us can only dream about. Maybe it’s time that Washington simplify the tax code to make it more transparent, eliminate some corporate tax loopholes and ensure that highly profitable American corporations pay their fair share. The CTJ study shows us that this is not currently happening and given the current talk on the street, it is unlikely to happen anytime soon.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment