Canada’s Parliamentary Budget Officer, Kevin Page, recently released a note entitled "Renewing the Canada Health Transfer: Implications for Federal and Provincial-Territorial Fiscal Sustainability". In this note, the PBO analyzes the Government of Canada’s (aka Harper Government’s) December 2011 announcment that the Canada Health Transfer (CHT) would continue to grow at 6 percent annualy until 2016 – 2017 and then starting in 2017 – 2018, the CHT would grow in line with the three year moving average of nominal GDP growth (the escalator), guaranteeing a minimum of 3 percent per year until the CHT is reviewed in 2024. While all of these dates seem very far in the future, this paper looks at how these changes will impact provincial-territorial budgets. Coincidentally (or not), these changes just happen to be taking place within the exact time frame that baby boomers will be availing themselves of more health care system resources.

Canada’s Parliamentary Budget Officer, Kevin Page, recently released a note entitled "Renewing the Canada Health Transfer: Implications for Federal and Provincial-Territorial Fiscal Sustainability". In this note, the PBO analyzes the Government of Canada’s (aka Harper Government’s) December 2011 announcment that the Canada Health Transfer (CHT) would continue to grow at 6 percent annualy until 2016 – 2017 and then starting in 2017 – 2018, the CHT would grow in line with the three year moving average of nominal GDP growth (the escalator), guaranteeing a minimum of 3 percent per year until the CHT is reviewed in 2024. While all of these dates seem very far in the future, this paper looks at how these changes will impact provincial-territorial budgets. Coincidentally (or not), these changes just happen to be taking place within the exact time frame that baby boomers will be availing themselves of more health care system resources.Let’s digress for a moment. The much-abused Canada Health Act (CHA) states that its primary objective is:

"…to protect, promote and restore the physical and mental well-being of residents of Canada and to facilitate reasonable access to health services without financial or other barriers."

The CHA establishes the criteria that Canada’s provinces and territories must fulfill in order to receive the full federal Canada Health Transfer, thereby ensuring that all eligible residents of Canada have "…reasonable access to insured health services on a prepaid basis, without direct charges at the point of service for such services". In other words, right across the country, Canadians are to have universal access to medical services and that these services are portable across provincial boundaries should residents move from one jurisdiction to another. Provincial health care plans are to cover all services offered by hospitals and physicians and that these services are to be offered without extra-billing or additional user charges. Should a jurisdiction allow extra billing, that amount will be deducted from the federal cash transfer. For example, from the passing of the CHA in April of 1984 to March 2010, a total of $9,159,619 has been deducted from federal cash contributions due to extra billing, an extremely small amount considering the size of transfers over the past 26 years. In 2011 – 2012, the Canada Health Transfer is projected to reach $27 billion, rising to over $30 billion in 2013 – 2014. Provinces also receive additional Canada Health Transfer support through tax transfers that amount to $13.6 billion in 2011 – 2012. In case you were interested, here is a history of Canada’s health care funding.

Back to the PBO’s note.

To put the following discussion into perspective, I’d like to take a brief look at the history of Canada’s annual GDP growth rate since 1980:

You will notice right away that Canada’s economy grew at an annual rate of 6 percent or greater for only very short periods of time over the last 32 years and averaged roughly 3 percent over the three decades. As shown here, over the past 10 years, Canada’s annual GDP growth only reached 4 percent on 2 occasions and then only briefly:

From this data, we can quite clearly see that it is highly unlikelythat, once 2017 – 2018 rolls around and the CHT transfers are linked to nominal GDP growth rate, the Feds will ever have to increase the transfers by more than 3 percent. Please keep these graphs in mind when reading the remainder of the PBO note.

As I noted above, once 2017 – 2018 rolls around, the size of the CHT transfers are linked to the rolling three year average of the growth level of Canada’s economy. The PBO rather optimistically predicts that nominal GDP will grow by an average of 3.7 percent over the period from 2017 to 2024 which corresponds to a 3.9 percent three year rolling average. This is quite a bit higher than the historical norm as I noted above. This means that the PBO projects that the CHT transfers will grow on average by 3.9 percent annually from 2017 – 2018 to 2024 – 2025. This is significantly lower than the PBO’s projected 5.1 percent growth rate in provincial health care spending over the same period. For the purposes of their simulation, the PBO also projects that the same CHT transfer growth rate will continue beyond 2024 – 2025 and that it will be maintained indefinitely at this level. Once again, this is significantly lower than the PBO’s projected 5.3 percent growth rate in provincial health care spending over the same time period.

Now, let’s look at two scenarios; first, the share of federal CHT funding as a percentage of total provincial health care funding under the current 6 percent escalator followed by the federal share of CHT funding as a percentage of total health care funding under the new, GDP-linked funding arrangement:

1.) Current 6 percent escalator: The federal CHT was projected to average 21.6 percent of provincial health care spending between 2011 – 2012 and 2035 – 2036, increasing to 26.8 percent over the next 25 years and increasing again to 38.1 percent of funding over the final 25 years as provincial spending on health care declined due to the "departure" of the beloved baby boomers.

2.) New GDP-linked escalator: The federal CHT is projected to decrease from its current level of 20.4 percent of provincial health care spending to an average of 18.6 percent between now and 2035 – 2036, decreasing further to 13.8 percent over the next 25 years and decreasing again to 11.9 percent over the final 25 years of the simulation.

Here is a graph showing how the two escalators impact the Federal share of provincial health care spending:

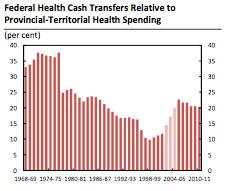

To put all of these numbers into context, over the period from 1968 – 1969 to 1976 – 1977, federal health transfers amount to an average of 36.1 percent of provincial health care spending as shown here:

These changes will have a marked impact on provincial treasuries since an increasing portion of the burden of providing health services will fall on their already overly-indebted shoulders. Provincial program spending (including health care), under the new scenario, is expected to increase from 17.3 percent of GDP to 23.9 percent of GDP by 2081 – 2082 as CHT transfers from the federal government decline.

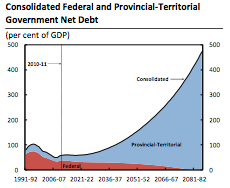

Here is a graph showing how the consolidated provincial-territorial debt (in blue) and federal debt (in red) will rise as a percentage of GDP to 2081 – 2082 under the new CHT transfer scenario:

Notice that the federal net debt-to-GDP ratio actually declines over the six decade period but, in sharp contrast, the provincial debt-to-GDP ratio rises from 20 percent in 2010 – 2011 to 125 percent in 2050 – 2051 and to an astronomic 480 percent by 2081 – 2082. As a result of the changes to the CHT transfers, growth in provincial debt is projected to be higher than economic growth, an unsustainable situation. While I realize that projections 60 years out have a very low chance of occurring, it is important to have someone like Mr. Page look well beyond the four year election cycle horizon that our politicians are most comfortable with. It is just that short sightedness that has gotten us into this mess.

Basically, the federal government is transferring its debt to the provinces. As a taxpayer, the most offensive part of this scheme is that the level of federal taxation will not drop to meet the lower level of CHT transfers. This means that, as provinces cope with rising debt levels, Canadian taxpayers will most likely suffer as provincial tax rates rise in concert with increased debt. No matter which level of government experiences increased debt levels, it is the individual tax payer that will bear the load, that is, unless Canada’s health care system suddenly becomes a great deal more efficient and is able to deliver more effective services for less money, a highly unlikely scenario. But, I guess as long as the Federal government’s books look good, that’s all that really matters…to them.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment